Answered step by step

Verified Expert Solution

Question

1 Approved Answer

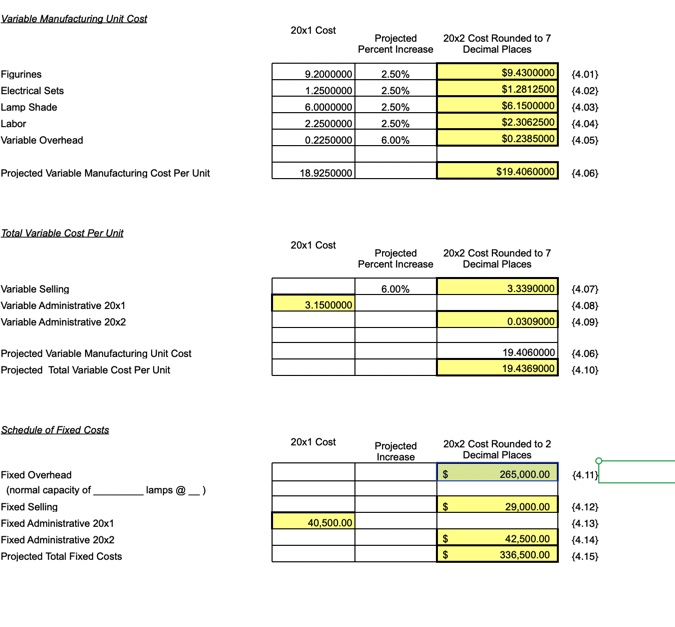

Variable Manufacturing Unit Cost Figurines Electrical Sets 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 7 Decimal Places 9.2000000 2.50% $9.4300000 (4.01) 1.2500000

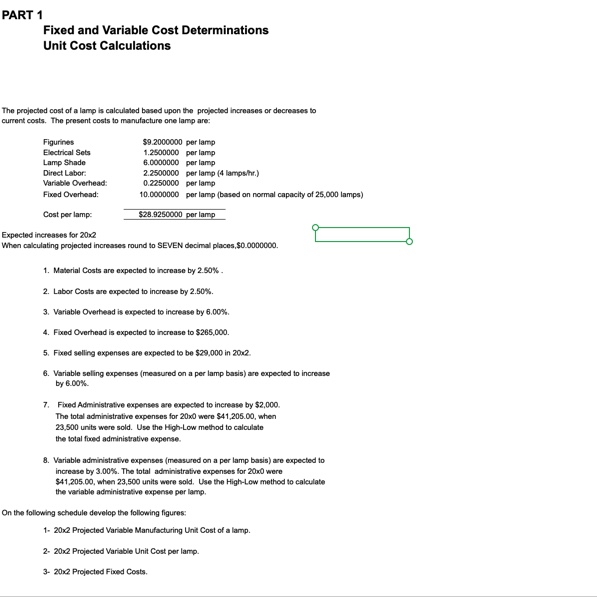

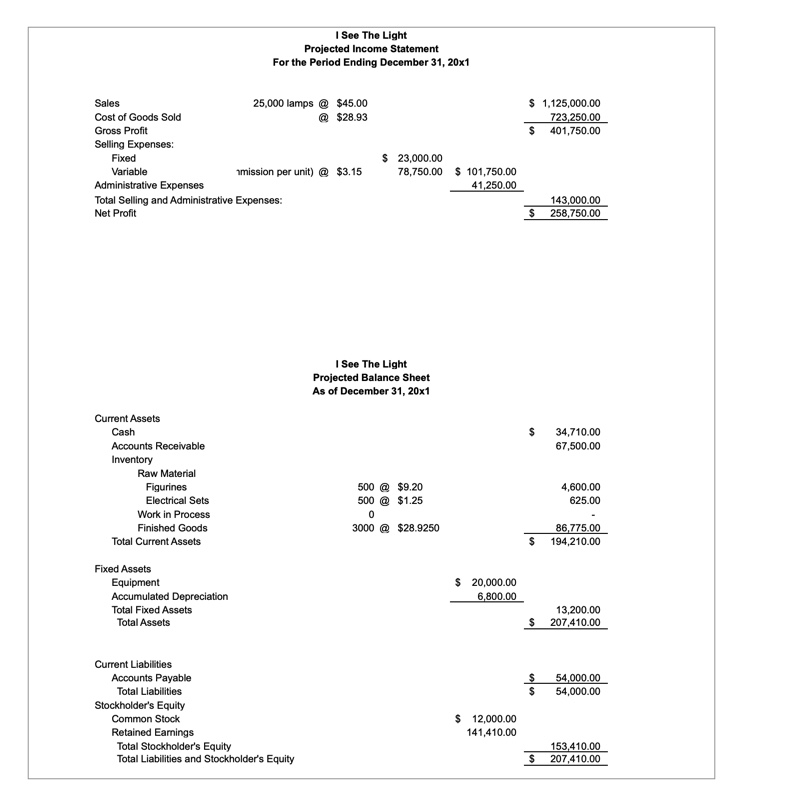

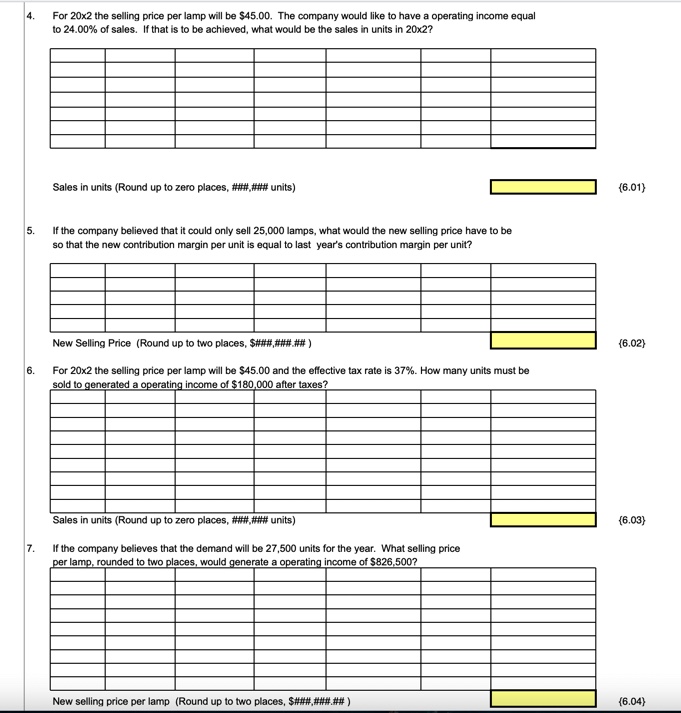

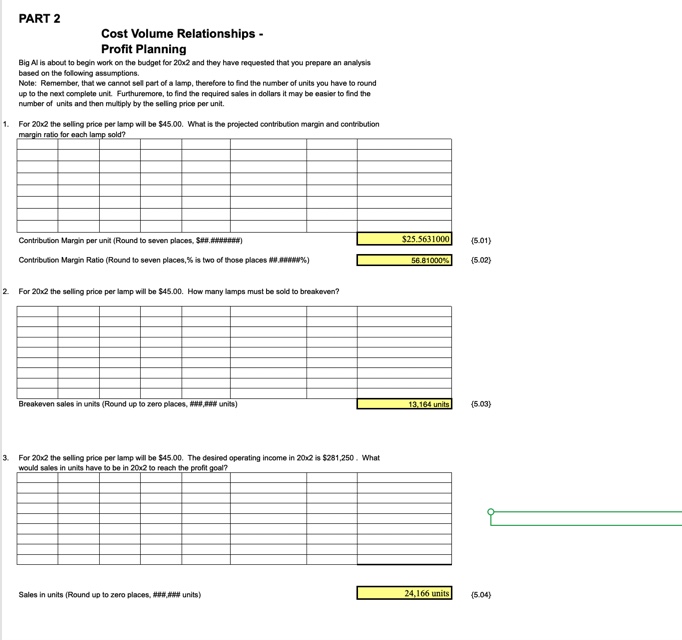

Variable Manufacturing Unit Cost Figurines Electrical Sets 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 7 Decimal Places 9.2000000 2.50% $9.4300000 (4.01) 1.2500000 2.50% $1.2812500 (4.02) 6.0000000 2.50% $6.1500000 (4.03) 2.2500000 2.50% $2.3062500 {4.04) 0.2250000 6.00% $0.2385000 (4.05) $19.4060000 (4.06) Lamp Shade Labor Variable Overhead Projected Variable Manufacturing Cost Per Unit 18.9250000 Total Variable Cost Per Unit Variable Selling Variable Administrative 20x1 Variable Administrative 20x2 Projected Variable Manufacturing Unit Cost Projected Total Variable Cost Per Unit Schedule of Fixed Costs Fixed Overhead (normal capacity of lamps @ Fixed Selling Fixed Administrative 20x1 Fixed Administrative 20x2 Projected Total Fixed Costs 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 7 Decimal Places 6.00% 3.3390000 (4.07) 3.1500000 (4.08) 0.0309000 {4.09} 19.4060000 (4.06) 19.4369000 (4.10) 20x1 Cost Projected Increase 20x2 Cost Rounded to 2 Decimal Places $ 265,000.00 (4.11) $ 29,000.00 {4.12} 40,500.00 (4.13) $ 42,500.00 {4.14} $ 336,500.00 (4.15} PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Figurines Electrical Sets Lamp Shade Direct Labor: Variable Overhead: Fixed Overhead: Cost per lamp: Expected increases for 20x2 $9.2000000 per lamp 1.2500000 per lamp 6.0000000 per lamp 2.2500000 per lamp (4 lamps/hr.) 0.2250000 per lamp 10.0000000 per lamp (based on normal capacity of 25,000 lamps) $28.9250000 per lamp When calculating projected increases round to SEVEN decimal places, $0.0000000. 1. Material Costs are expected to increase by 2.50%. 2. Labor Costs are expected to increase by 2.50%. 3. Variable Overhead is expected to increase by 6.00%. 4. Fixed Overhead is expected to increase to $265,000. 5. Fixed selling expenses are expected to be $29,000 in 20x2. 6. Variable seling expenses (measured on a per lamp basis) are expected to increase by 6.00% 7. Fixed Administrative expenses are expected to increase by $2,000. The total administrative expenses for 20x0 were $41,205.00, when 23,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.00%. The total administrative expenses for 20x0 were $41,205.00, when 23,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs. Sales Cost of Goods Sold Gross Profit Selling Expenses: Fixed Variable Administrative Expenses I See The Light Projected Income Statement For the Period Ending December 31, 20x1 25,000 lamps @$45.00 @ $28.93 $ 1,125,000.00 723,250.00 $ 401,750.00 $ 23,000.00 mission per unit) @ $3.15 78,750.00 $101,750.00 41,250.00 143,000.00 $ 258,750.00 Total Selling and Administrative Expenses: Net Profit I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Total Current Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 500 @ $9.20 500 @ $1.25 0 3000 @ $28.9250 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $ 20,000.00 6,800.00 $ 12,000.00 141,410.00 $ 34,710.00 67,500.00 4,600.00 625.00 86,775.00 $ 194,210.00 $ 13,200.00 207,410.00 $ $ 54,000.00 54,000.00 $ 153,410.00 207,410.00 4. For 20x2 the selling price per lamp will be $45.00. The company would like to have a operating income equal 5. to 24.00% of sales. If that is to be achieved, what would be the sales in units in 20x2? Sales in units (Round up to zero places, ######### units) If the company believed that it could only sell 25,000 lamps, what would the new selling price have to be so that the new contribution margin per unit is equal to last year's contribution margin per unit? {6.01) New Selling Price (Round up to two places, $###,###.###) {6.02} 6. For 20x2 the selling price per lamp will be $45.00 and the effective tax rate is 37%. How many units must be sold to generated a operating income of $180,000 after taxes? Sales in units (Round up to zero places, ###,### units) {6.03) 7. If the company believes that the demand will be 27,500 units for the year. What selling price per lamp, rounded to two places, would generate a operating income of $826,500? New selling price per lamp (Round up to two places, $###.###.##) {6.04} PART 2 Cost Volume Relationships - Profit Planning Big Al is about to begin work on the budget for 20x2 and they have requested that you prepare an analysis based on the following assumptions. Note: Remember, that we cannot sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required sales in dollars it may be easier to find the number of units and then multiply by the selling price per unit. 1. For 20x2 the selling price per lamp will be $45.00. What is the projected contribution margin and contribution margin ratio for each lamp sold? Contribution Margin per unit (Round to seven places, $##.####***) Contribution Margin Ratio (Round to seven places, % is two of those places ##.####%) 2. For 20x2 the selling price per lamp will be $45.00. How many lamps must be sold to breakeven? Breakeven sales in units (Round up to zero places, ###### units) 3. For 20x2 the selling price per lamp will be $45.00. The desired operating income in 20x2 is $281,250. What would sales in units have to be in 20x2 to reach the profit goal? $25.5631000 (5.01) 56.81000% (5.02) 13,164 units (5.03) Sales in units (Round up to zero places, ###### units) 24,166 units (5.04)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for the variable and fixed manufacturing costs Figurines 20x1 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started