Answered step by step

Verified Expert Solution

Question

1 Approved Answer

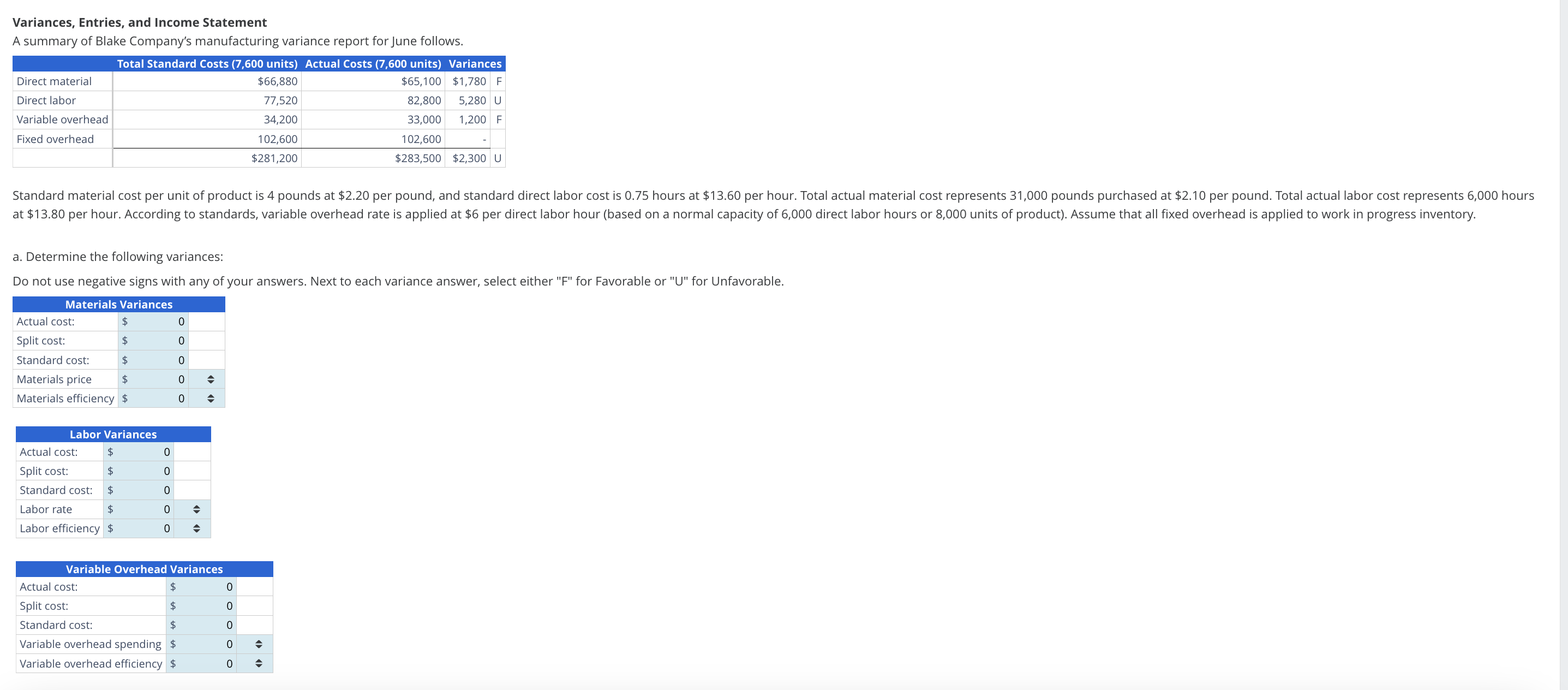

Variances, Entries, and Income Statement A summary of Blake Company's manufacturing variance report for June follows. Total Standard Costs (7,600 units) Actual Costs (7,600

Variances, Entries, and Income Statement A summary of Blake Company's manufacturing variance report for June follows. Total Standard Costs (7,600 units) Actual Costs (7,600 units) Variances Direct material Direct labor Variable overhead Fixed overhead $66,880 77,520 34,200 102,600 $281,200 $65,100 $1,780 F 82,800 5,280 U 33,000 102,600 1,200 F $283,500 $2,300 U Standard material cost per unit of product is 4 pounds at $2.20 per pound, and standard direct labor cost is 0.75 hours at $13.60 per hour. Total actual material cost represents 31,000 pounds purchased at $2.10 per pound. Total actual labor cost represents 6,000 hours at $13.80 per hour. According to standards, variable overhead rate is applied at $6 per direct labor hour (based on a normal capacity of 6,000 direct labor hours or 8,000 units of product). Assume that all fixed overhead is applied to work in progress inventory. a. Determine the following variances: Do not use negative signs with any of your answers. Next to each variance answer, select either "F" for Favorable or "U" for Unfavorable. Materials Variances Actual cost: $ 0 Split cost: $ 0 Standard cost: $ 0 Materials price $ 0 = Materials efficiency $ 0 Labor Variances Actual cost: $ Split cost: $ Standard cost: $ Labor rate $ Labor efficiency $ OOOOO 0 0 0 0 0 Variable Overhead Variances Actual cost: $ Split cost: $ Standard cost: $ Variable overhead spending $ Variable overhead efficiency $ ooooo 0 0 0 0 0 =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started