Answered step by step

Verified Expert Solution

Question

1 Approved Answer

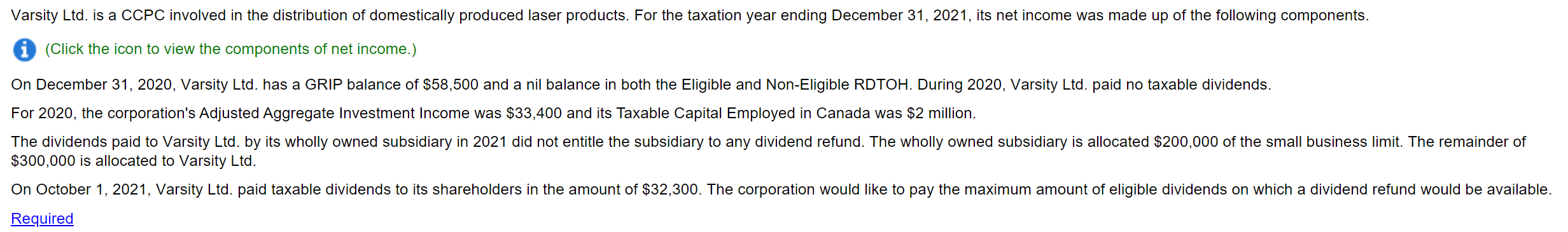

Varsity Ltd. is a CCPC involved in the distribution of domestically produced laser products. For the taxation year ending December 31, 2021, its net

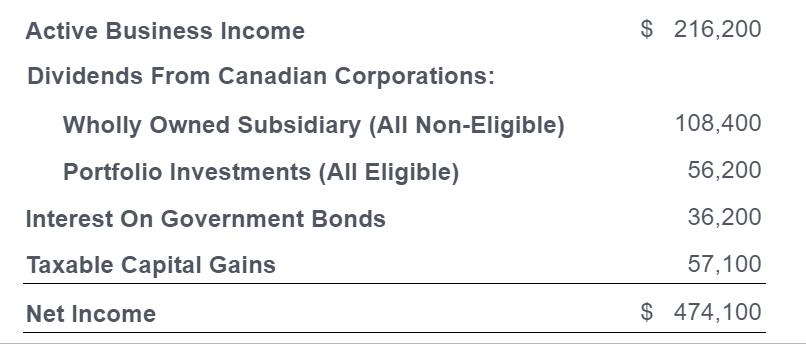

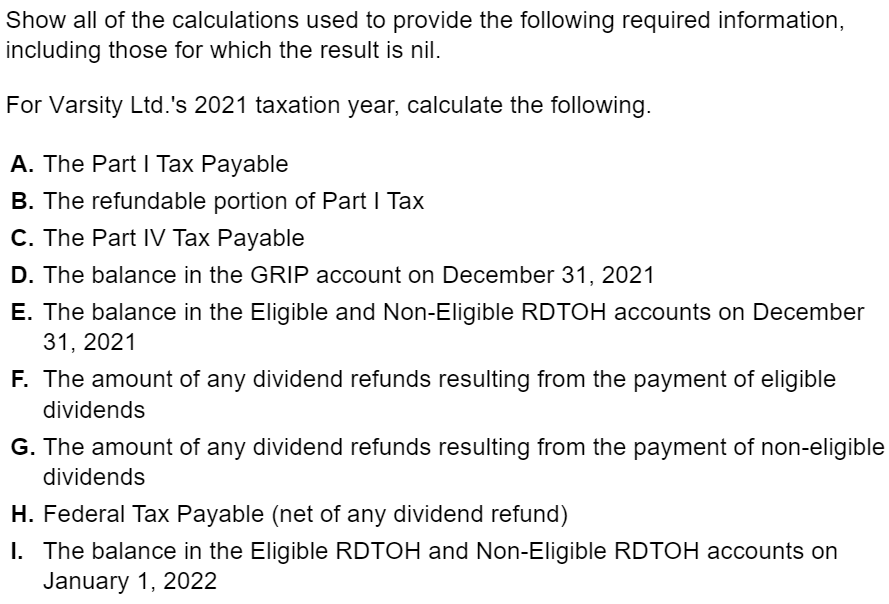

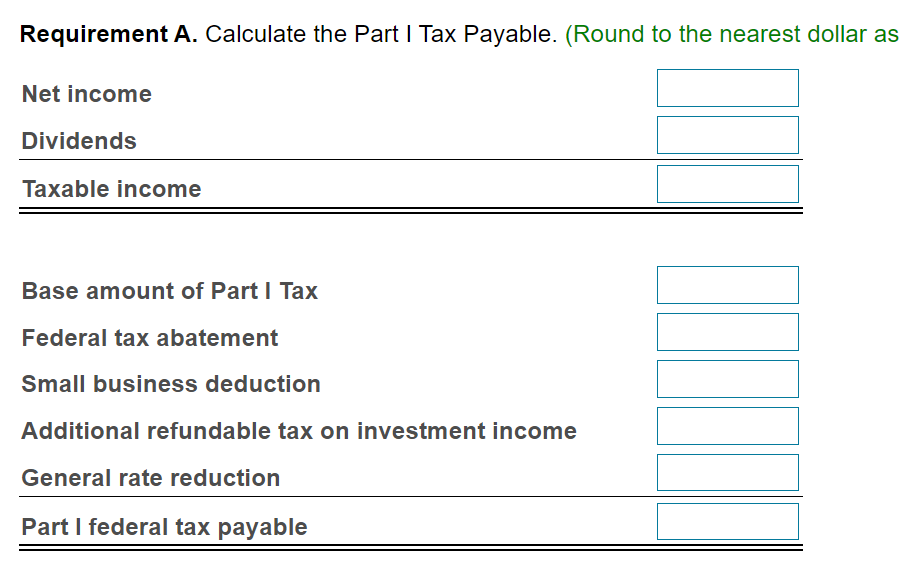

Varsity Ltd. is a CCPC involved in the distribution of domestically produced laser products. For the taxation year ending December 31, 2021, its net income was made up of the following components. i (Click the icon to view the components of net income.) On December 31, 2020, Varsity Ltd. has a GRIP balance of $58,500 and a nil balance in both the Eligible and Non-Eligible RDTOH. During 2020, Varsity Ltd. paid no taxable dividends. For 2020, the corporation's Adjusted Aggregate Investment Income was $33,400 and its Taxable Capital Employed in Canada was $2 million. The dividends paid to Varsity Ltd. by its wholly owned subsidiary in 2021 did not entitle the subsidiary to any dividend refund. The wholly owned subsidiary is allocated $200,000 of the small business limit. The remainder of $300,000 is allocated to Varsity Ltd. On October 1, 2021, Varsity Ltd. paid taxable dividends to its shareholders in the amount of $32,300. The corporation would like to pay the maximum amount of eligible dividends on which a dividend refund would be available. Required Active Business Income Dividends From Canadian Corporations: Wholly Owned Subsidiary (All Non-Eligible) Portfolio Investments (All Eligible) Interest On Government Bonds Taxable Capital Gains Net Income $ 216,200 108,400 56,200 36,200 57,100 $ 474,100 Show all of the calculations used to provide the following required information, including those for which the result is nil. For Varsity Ltd.'s 2021 taxation year, calculate the following. A. The Part I Tax Payable B. The refundable portion of Part I Tax C. The Part IV Tax Payable D. The balance in the GRIP account on December 31, 2021 E. The balance in the Eligible and Non-Eligible RDTOH accounts on December 31, 2021 F. The amount of any dividend refunds resulting from the payment of eligible dividends G. The amount of any dividend refunds resulting from the payment of non-eligible dividends H. Federal Tax Payable (net of any dividend refund) I. The balance in the Eligible RDTOH and Non-Eligible RDTOH accounts on January 1, 2022 Requirement A. Calculate the Part I Tax Payable. (Round to the nearest dollar as Net income Dividends Taxable income Base amount of Part I Tax Federal tax abatement Small business deduction Additional refundable tax on investment income General rate reduction Part I federal tax payable 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started