Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VAT rate for every transaction is %20. Economic life of every depreciable asset is 5 years. Record the transactions below in the journal and T-accounts.

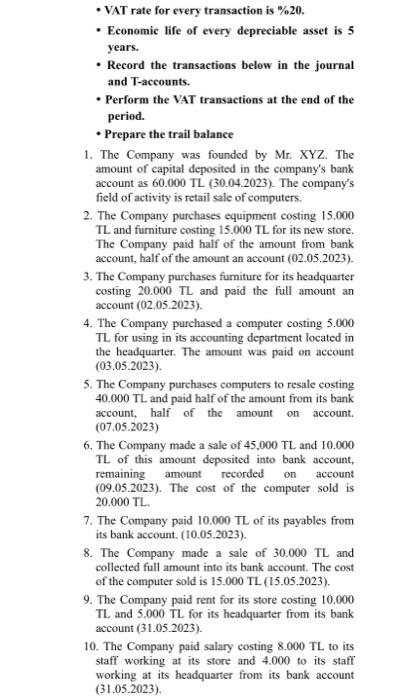

VAT rate for every transaction is %20. Economic life of every depreciable asset is 5 years. Record the transactions below in the journal and T-accounts. Perform the VAT transactions at the end of the period. Prepare the trail balance 1. The Company was founded by Mr. XYZ. The amount of capital deposited in the company's bank account as 60.000 TL (30.04.2023). The company's field of activity is retail sale of computers. 2. The Company purchases equipment costing 15.000 TL and furniture costing 15.000 TL for its new store. The Company paid half of the amount from bank account, half of the amount an account (02.05.2023). 3. The Company purchases furniture for its headquarter costing 20.000 TL and paid the full amount an account (02.05.2023). 4. The Company purchased a computer costing 5.000 TL for using in its accounting department located in the headquarter. The amount was paid on account (03.05.2023). 5. The Company purchases computers to resale costing 40.000 TL and paid half of the amount from its bank account, half of the amount on account. (07.05.2023) 6. The Company made a sale of 45,000 TL and 10.000 TL of this amount deposited into bank account, remaining amount recorded on (09.05.2023). The cost of the computer sold is 20.000 TL. account 7. The Company paid 10.000 TL of its payables from its bank account. (10.05.2023). 8. The Company made a sale of 30.000 TL and collected full amount into its bank account. The cost of the computer sold is 15.000 TL (15.05.2023). 9. The Company paid rent for its store costing 10.000 TL and 5.000 TL for its headquarter from its bank account (31.05.2023). 10. The Company paid salary costing 8.000 TL to its staff working at its store and 4.000 to its staff working at its headquarter from its bank account (31.05.2023).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started