Question

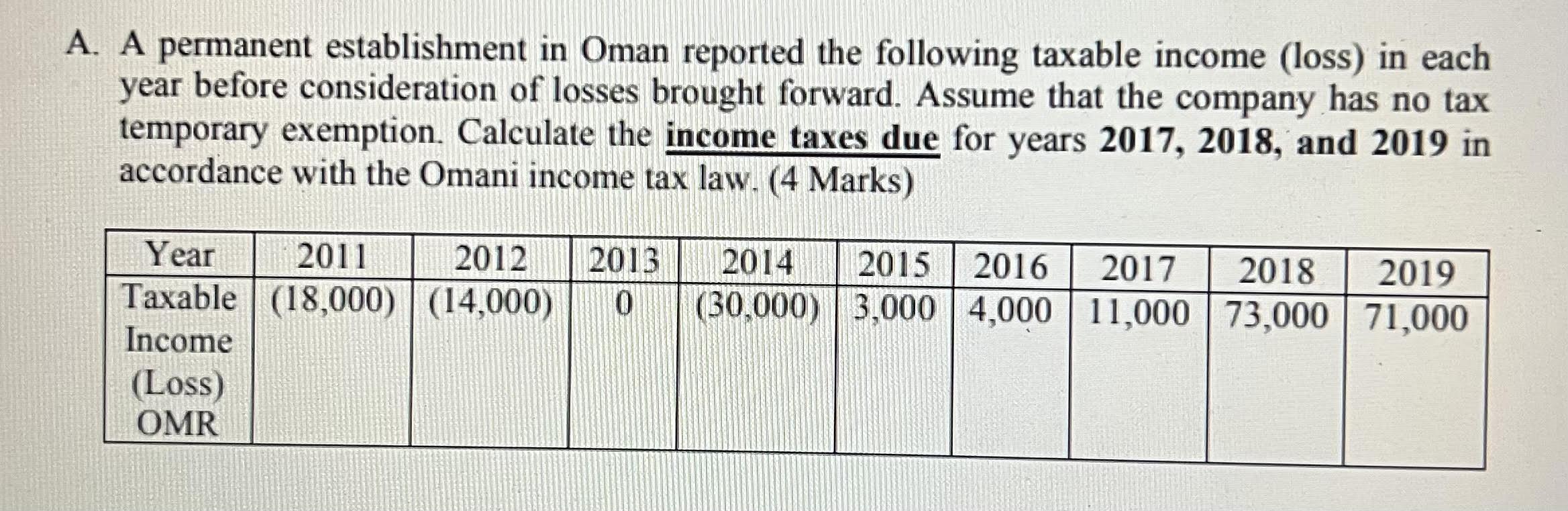

A. A permanent establishment in Oman reported the following taxable income (loss) in each year before consideration of losses brought forward. Assume that the

A. A permanent establishment in Oman reported the following taxable income (loss) in each year before consideration of losses brought forward. Assume that the company has no tax temporary exemption. Calculate the income taxes due for years 2017, 2018, and 2019 in accordance with the Omani income tax law. (4 Marks) Year 2011 2012 2013 2014 Taxable (18,000) (14,000) 0 (30,000) Income (Loss) OMR 2015 2016 3,000 4,000 2017 2018 2019 11,000 73,000 71,000

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Using a corporate income tax rate of 15 lets calculate the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: kieso, weygandt and warfield.

14th Edition

9780470587232, 470587288, 470587237, 978-0470587287

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App