Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vaughn is a Canadian company that conducts many transactions in $US. Because the price of $US fluctuates daily, Vaughn often enters into futures contracts

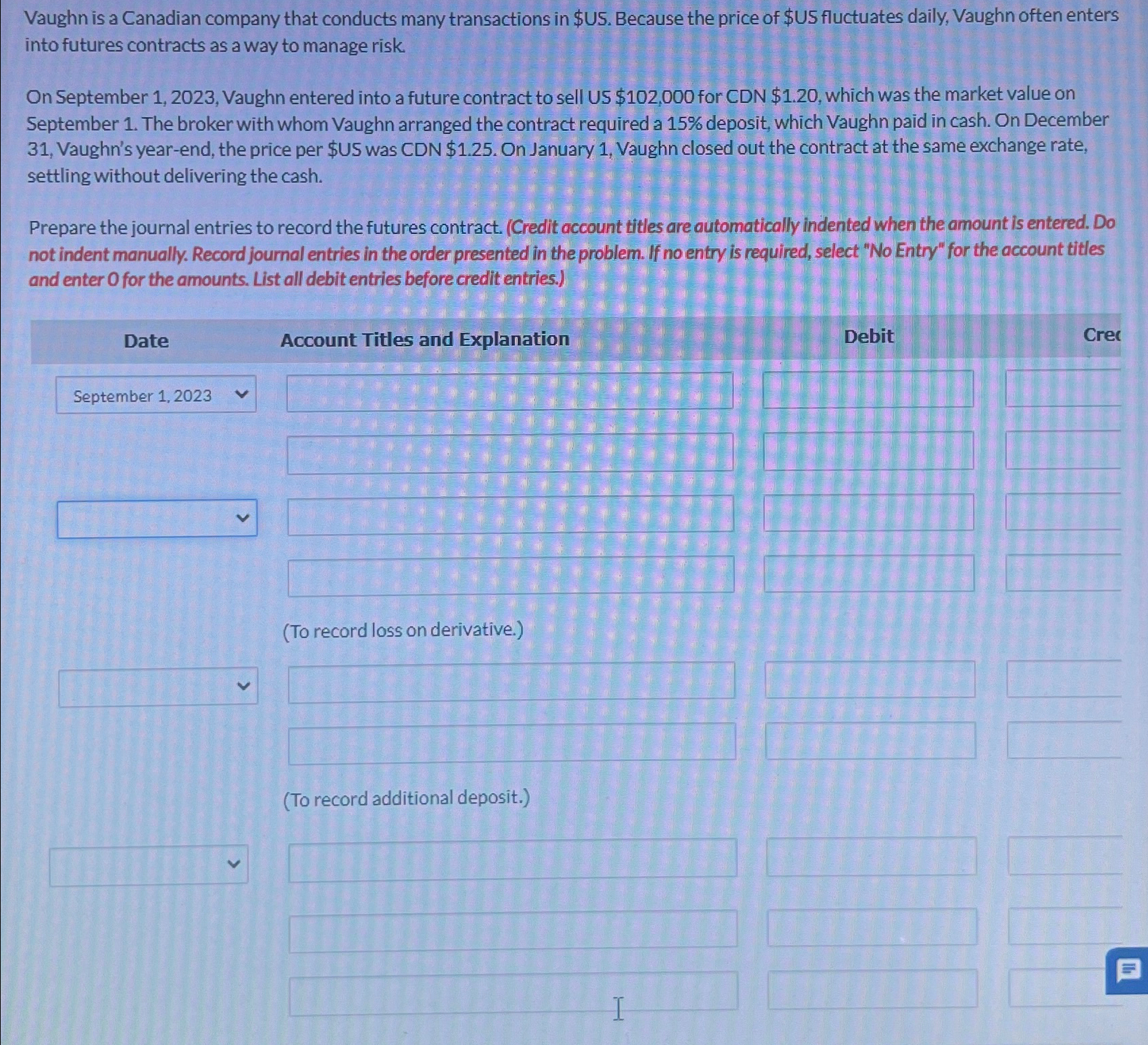

Vaughn is a Canadian company that conducts many transactions in $US. Because the price of $US fluctuates daily, Vaughn often enters into futures contracts as a way to manage risk. On September 1, 2023, Vaughn entered into a future contract to sell US $102,000 for CDN $1.20, which was the market value on September 1. The broker with whom Vaughn arranged the contract required a 15% deposit, which Vaughn paid in cash. On December 31, Vaughn's year-end, the price per $US was CDN $1.25. On January 1, Vaughn closed out the contract at the same exchange rate, settling without delivering the cash. Prepare the journal entries to record the futures contract. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date September 1, 2023 Account Titles and Explanation > > (To record loss on derivative.) > (To record additional deposit.) Debit Cre = I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries and explanations for each transaction 1 September 1 2023 Debit Loss on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started