Answered step by step

Verified Expert Solution

Question

1 Approved Answer

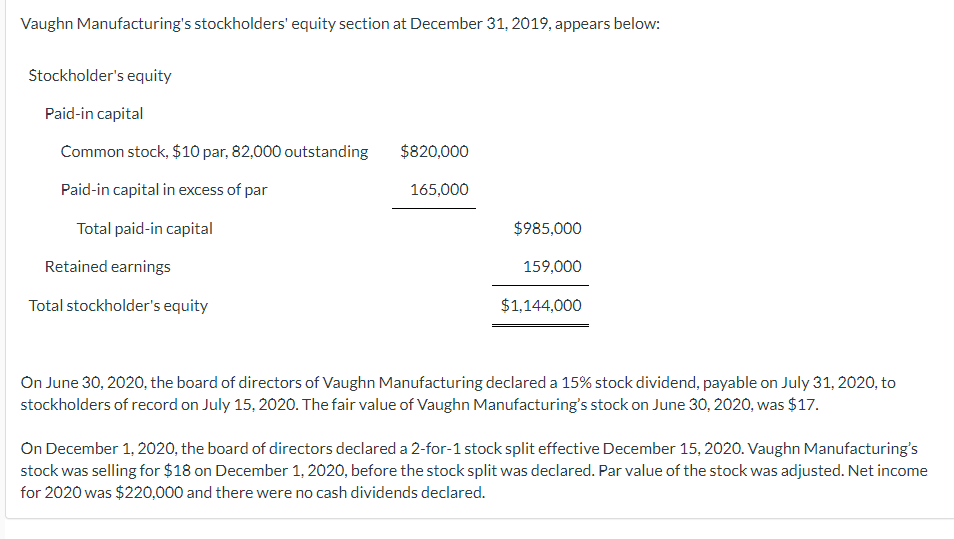

Vaughn Manufacturing's stockholders' equity section at December 31, 2019, appears below: Stockholder's equity Paid-in capital Common stock, $10 par, 82,000 outstanding $820,000 Paid-in capital

Vaughn Manufacturing's stockholders' equity section at December 31, 2019, appears below: Stockholder's equity Paid-in capital Common stock, $10 par, 82,000 outstanding $820,000 Paid-in capital in excess of par 165,000 Total paid-in capital $985,000 Retained earnings 159,000 Total stockholder's equity $1,144,000 On June 30, 2020, the board of directors of Vaughn Manufacturing declared a 15% stock dividend, payable on July 31, 2020, to stockholders of record on July 15, 2020. The fair value of Vaughn Manufacturing's stock on June 30, 2020, was $17. On December 1, 2020, the board of directors declared a 2-for-1 stock split effective December 15, 2020. Vaughn Manufacturing's stock was selling for $18 on December 1, 2020, before the stock split was declared. Par value of the stock was adjusted. Net income for 2020 was $220,000 and there were no cash dividends declared. Prepare the journal entries on the appropriate dates to record the stock dividend and the stock split. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order in which they must have occurred.) Date Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Account Titles and Explaination Debit Credit Date Stock Dividends 209100 J...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started