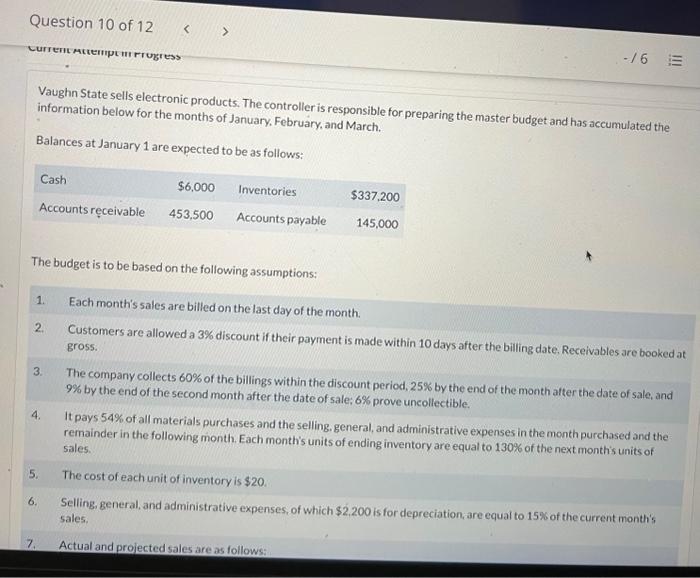

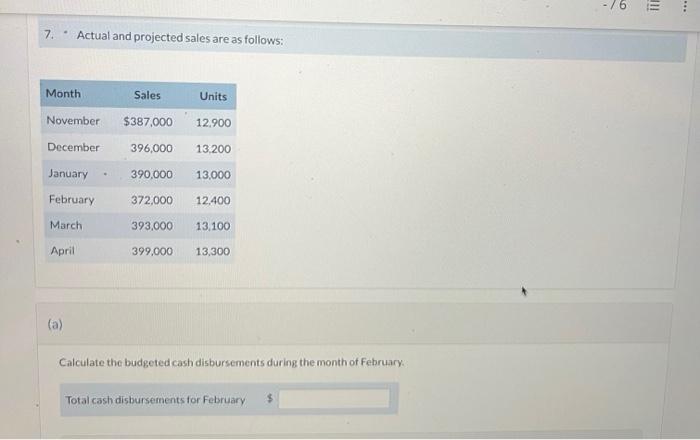

Vaughn State sells electronic products. The controller is responsible for preparing the master budget and has accumulated the information below for the months of January. February, and March. Balances at January 1 are expected to be as follows: The budget is to be based on the following assumptions: 1. Each month's sales are billed on the last day of the month. 2. Customers are allowed a 3% discount if their payment is made within 10 days after the billing date. Receivables are booked at gross. 3. The company collects 60% of the billings within the discount period, 25% by the end of the month atter the date of sale, and 9% by the end of the second month after the date of sale; 6% prove uncollectible. 4. It pays 54% of all materials purchases and the selling. general, and administrative expenses in the month purchased and the remainder in the following month. Each month's units of ending inventory are equal to 130% of the next month's units of sales. 5. The cost of each unit of inventory is $20. 6. Selling, general, and administrative expenses, of which $2,200 is for depreciation, are equal to 15% of the current month's, sales. 7. Actual and projected sales are as follows: 7. Actual and projected sales are as follows: (a) Calculate the budgeted cash disbursements during the month of February. Vaughn State sells electronic products. The controller is responsible for preparing the master budget and has accumulated the information below for the months of January. February, and March. Balances at January 1 are expected to be as follows: The budget is to be based on the following assumptions: 1. Each month's sales are billed on the last day of the month. 2. Customers are allowed a 3% discount if their payment is made within 10 days after the billing date. Receivables are booked at gross. 3. The company collects 60% of the billings within the discount period, 25% by the end of the month atter the date of sale, and 9% by the end of the second month after the date of sale; 6% prove uncollectible. 4. It pays 54% of all materials purchases and the selling. general, and administrative expenses in the month purchased and the remainder in the following month. Each month's units of ending inventory are equal to 130% of the next month's units of sales. 5. The cost of each unit of inventory is $20. 6. Selling, general, and administrative expenses, of which $2,200 is for depreciation, are equal to 15% of the current month's, sales. 7. Actual and projected sales are as follows: 7. Actual and projected sales are as follows: (a) Calculate the budgeted cash disbursements during the month of February