Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Veat he tamactions. Forat herequements. Transactions On Seplember 1 of the prior year, Kimer Consuling purchased sereral peces of otion furritiure for the rented allice

Veat he tamactions.

Forat herequements.

Transactions

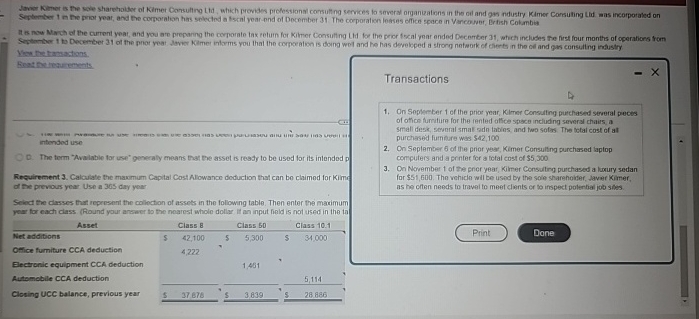

On Seplember of the prior year, Kimer Consuling purchased sereral peces of otion furritiure for the rented allice space including several chairs a small desk, seumral small radn tabies and two sotos The cotal cost of at purchased fumbire wes $

On Seplember of the prior yeas, Kimer Consulting purchased laptop computers and a pernfer for a tetat cosi of $

On Norember of the pnor year, Kimer Consuling purchased a laxury sedan for $ Gi The vehicle will be used by the sole sharehoiber, Javer Kimer, as he often needs to traveit to meet clents or to irspect polential job shes.

Requirement Calcuiate the maxmum Capital Cost Allowance deduction that can bo chimed for Kims d the previous year. Use a day year

Seinct the classes that repersent the colloction of assets in the following table. Then enter the maximum year for each class Round your answer to the noarest whole dollyr if an input field is not used in the ta

tableAssetClass Class lass Net additions,$Office furniture CCA deduction,,Bectronic equipment CCA deduction,,,,Automobile CCA deduction,,,,,,Closing UCC balance, previous year, B BS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started