Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vegan life is a not-for-profit organization whose mission is to promote and raise awareness in regard to the Vegans. You are a vegan yourself

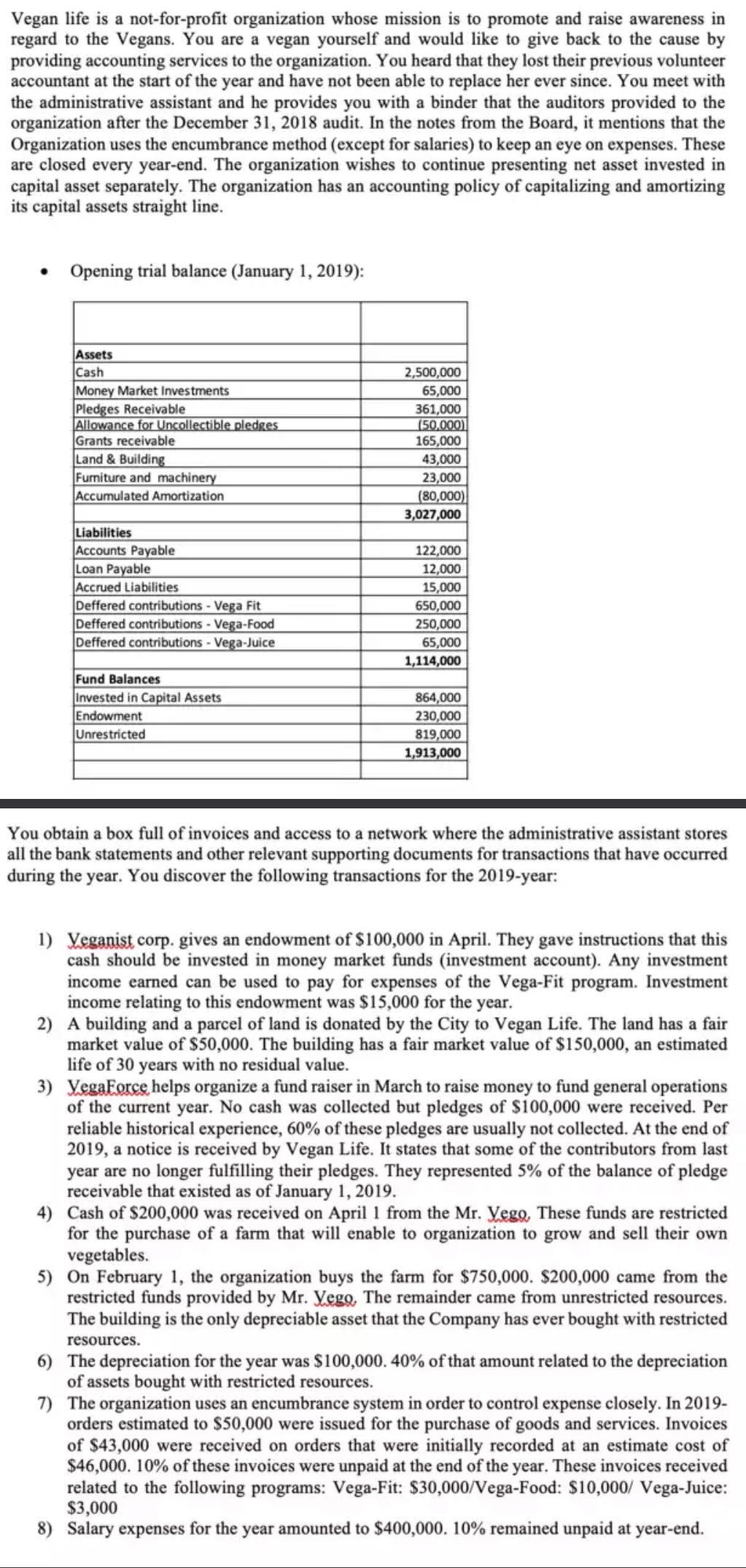

Vegan life is a not-for-profit organization whose mission is to promote and raise awareness in regard to the Vegans. You are a vegan yourself and would like to give back to the cause by providing accounting services to the organization. You heard that they lost their previous volunteer accountant at the start of the year and have not been able to replace her ever since. You meet with the administrative assistant and he provides you with a binder that the auditors provided to the organization after the December 31, 2018 audit. In the notes from the Board, it mentions that the Organization uses the encumbrance method (except for salaries) to keep an eye on expenses. These are closed every year-end. The organization wishes to continue presenting net asset invested in capital asset separately. The organization has an accounting policy of capitalizing and amortizing its capital assets straight line. Opening trial balance (January 1, 2019): Assets Cash Money Market Investments Pledges Receivable Allowance for Uncollectible pledges Grants receivable Land & Building Furniture and machinery Accumulated Amortization Liabilities Accounts Payable Loan Payable Accrued Liabilities Deffered contributions - Vega Fit Deffered contributions - Vega-Food Deffered contributions - Vega-Juice Fund Balances Invested in Capital Assets Endowment Unrestricted 2,500,000 65,000 361,000 (50.000) 165,000 43,000 23,000 (80,000) 3,027,000 122,000 12,000 15,000 650,000 250,000 65,000 1,114,000 864,000 230,000 819,000 1,913,000 You obtain a box full of invoices and access to a network where the administrative assistant stores all the bank statements and other relevant supporting documents for transactions that have occurred during the year. You discover the following transactions for the 2019-year: 1) Veganist corp. gives an endowment of $100,000 in April. They gave instructions that this cash should be invested in money market funds (investment account). Any investment income earned can be used to pay for expenses of the Vega-Fit program. Investment income relating to this endowment was $15,000 for the year. 2) A building and a parcel of land is donated by the City to Vegan Life. The land has a fair market value of $50,000. The building has a fair market value of $150,000, an estimated life of 30 years with no residual value. 3) VegaForce helps organize a fund raiser in March to raise money to fund general operations of the current year. No cash was collected but pledges of $100,000 were received. Per reliable historical experience, 60% of these pledges are usually not collected. At the end of 2019, a notice is received by Vegan Life. It states that some of the contributors from last year are no longer fulfilling their pledges. They represented 5% of the balance of pledge receivable that existed as of January 1, 2019. 4) Cash of $200,000 was received on April 1 from the Mr. Vego, These funds are restricted for the purchase of a farm that will enable to organization to grow and sell their own vegetables. 5) On February 1, the organization buys the farm for $750,000. $200,000 came from the restricted funds provided by Mr. Yego. The remainder came from unrestricted resources. The building is the only depreciable asset that the Company has ever bought with restricted resources. 6) The depreciation for the year was $100,000. 40% of that amount related to the depreciation of assets bought with restricted resources. 7) The organization uses an encumbrance system in order to control expense closely. In 2019- orders estimated to $50,000 were issued for the purchase of goods and services. Invoices of $43,000 were received on orders that were initially recorded at an estimate cost of $46,000. 10% of these invoices were unpaid at the end of the year. These invoices received related to the following programs: Vega-Fit: $30,000/Vega-Food: $10,000/ Vega-Juice: $3,000 8) Salary expenses for the year amounted to $400,000. 10% remained unpaid at year-end. QUESTION: Prepare the journal entries for the organization for the 2019 year under the deferral method and the restricted fund method.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 Opening Trial Balance January 1 2019 Assets Cash 2500000 Money Market Investments 65000 Pledges Receivable 361000 Allowance for Uncollect...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started