Answered step by step

Verified Expert Solution

Question

1 Approved Answer

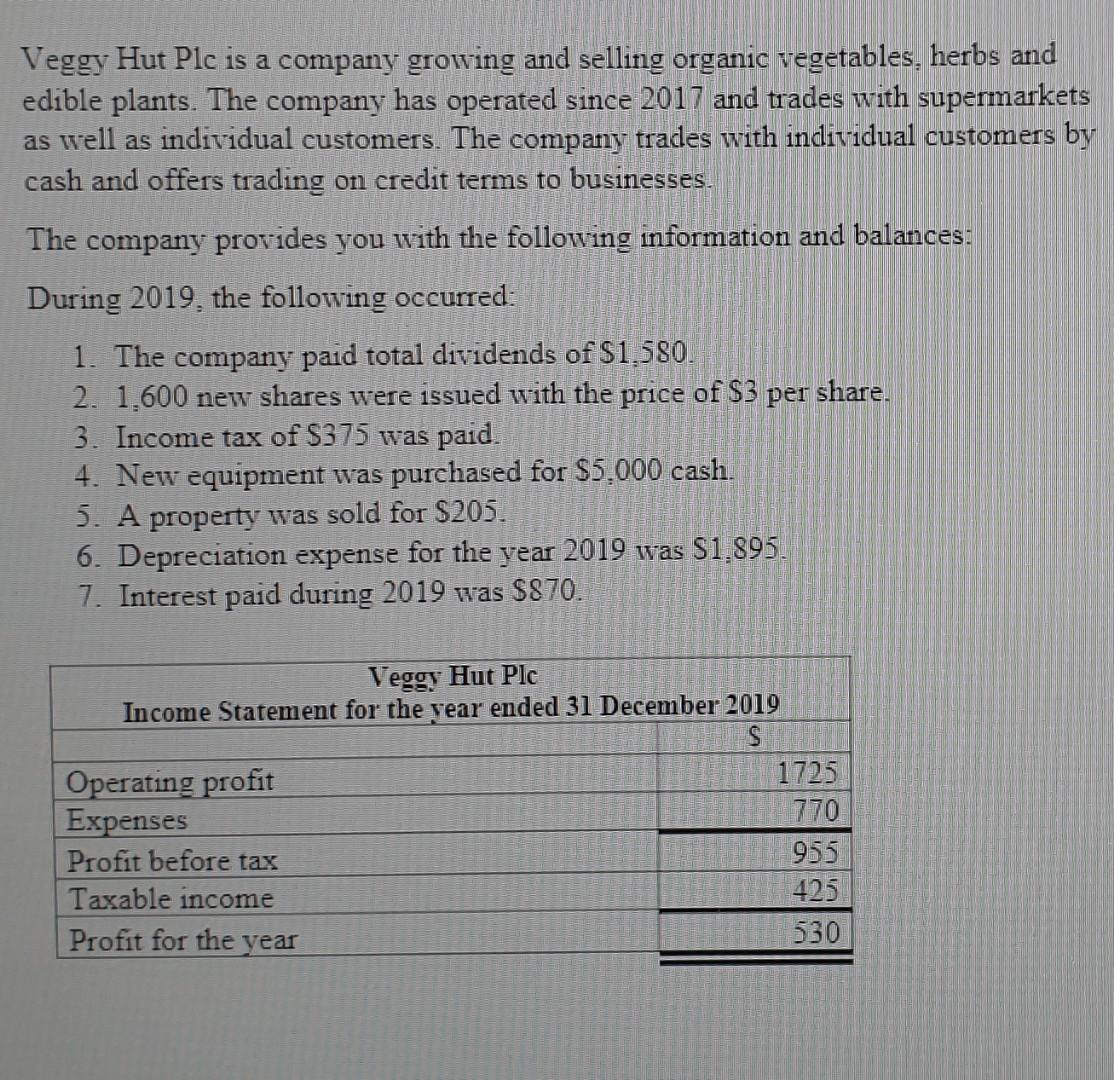

Veggy Hut Plc is a company growing and selling organic vegetables, herbs and edible plants. The company has operated since 2017 and trades with supermarkets

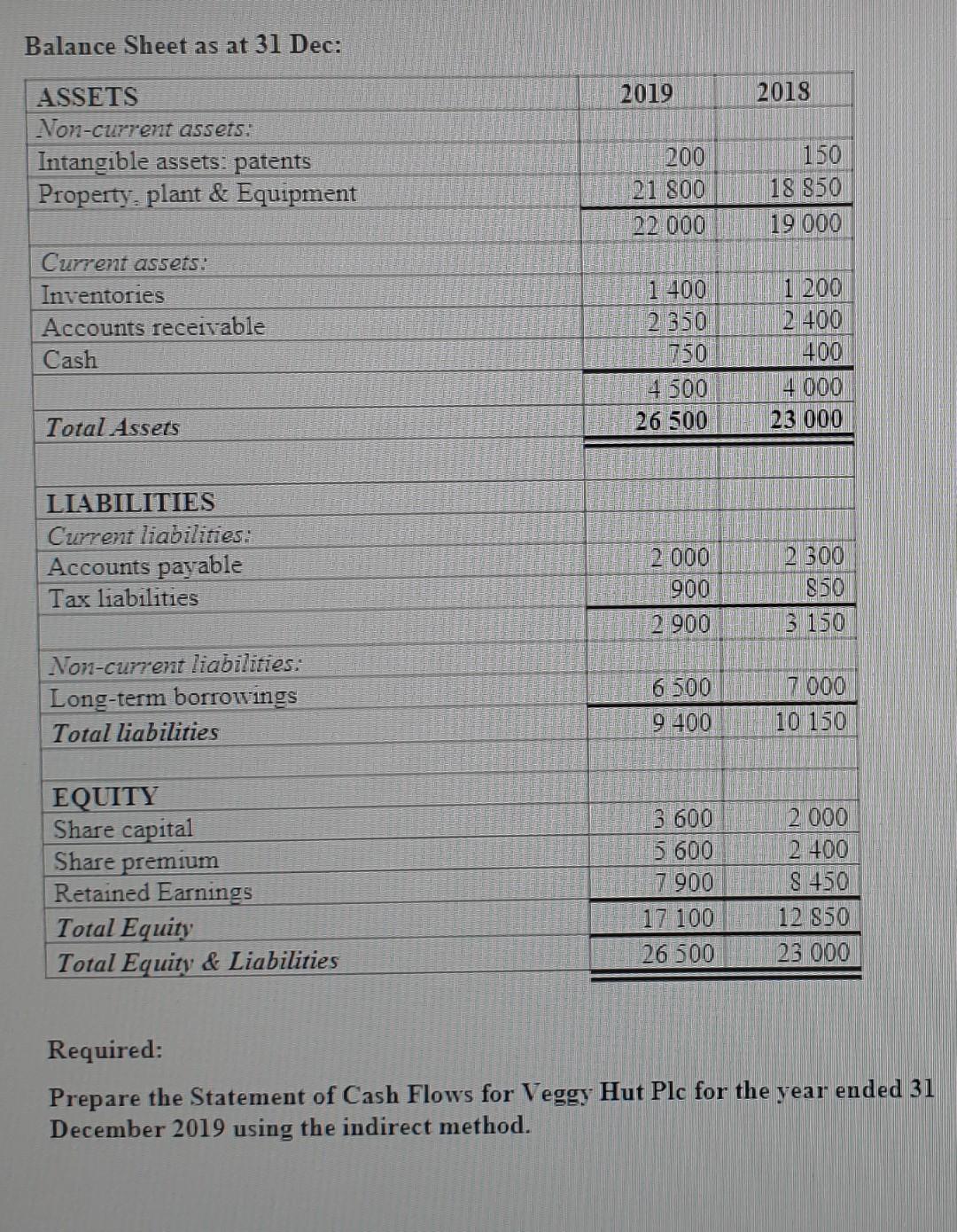

Veggy Hut Plc is a company growing and selling organic vegetables, herbs and edible plants. The company has operated since 2017 and trades with supermarkets as well as individual customers. The company trades with individual customers by cash and offers trading on credit terms to businesses. The company provides you with the following information and balances: During 2019, the following occurred: 1. The company paid total dividends of $1,580. 2. 1.600 new shares were issued with the price of $3 per share. 3. Income tax of S375 was paid. 4. New equipment was purchased for $5.000 cash. 5. A property was sold for $205. 6. Depreciation expense for the year 2019 was $1.895. 7. Interest paid during 2019 was $870. Veggy Hut Plc Income Statement for the year ended 31 December 2019 S Operating profit 1725 Expenses 770 Profit before tax 955 Taxable income 425 Profit for the year 530 Balance Sheet as at 31 Dec: 2019 2018 ASSETS Non-current assets: Intangible assets: patents Property, plant & Equipment 200 21 800 22 000 150 18 850 19 000 Current assets: Inventories Accounts receivable Cash 1 400 2 350 50 4 500 26 500 1 200 2.400 400 4 000 23 000 Total Assets LIABILITIES Current liabilities: Accounts payable Tax liabilities 2 000 900 2.900 2 300 850 3 150 Non-current liabilities: Long-term borrowings Total liabilities 6 500 9 400 17 000 10 150 EQUITY Share capital Share premium Retained Earnings Total Equity Total Equity & Liabilities 3 600 5 600 7 900 17 100 26 500 2.000 2. 400 8 +50 12 850 23 000 Required: Prepare the Statement of Cash Flows for Veggy Hut Plc for the year ended 31 December 2019 using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started