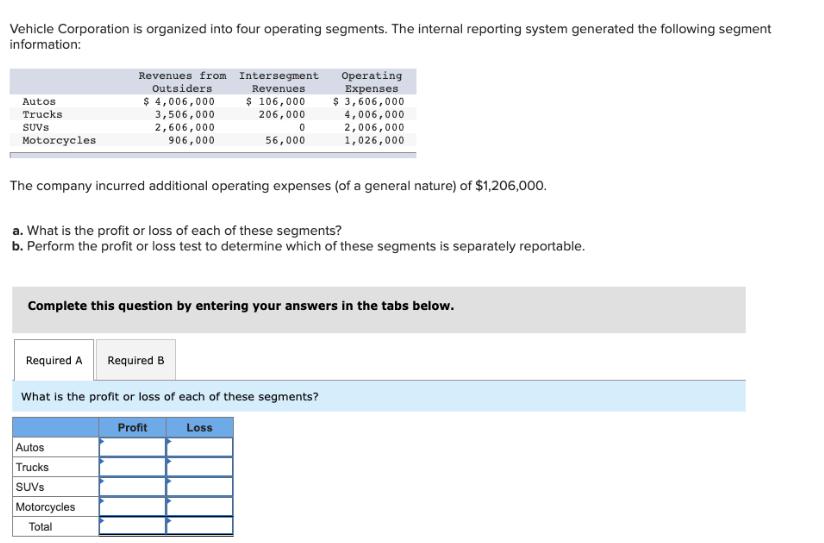

Vehicle Corporation is organized into four operating segments. The internal reporting system generated the following segment information: Autos Trucks SUVS Motorcycles Revenues from Intersegment

Vehicle Corporation is organized into four operating segments. The internal reporting system generated the following segment information: Autos Trucks SUVS Motorcycles Revenues from Intersegment Revenues $ 106,000 206,000 Outsiders $ 4,006,000 3,506,000 2,606,000 906,000 The company incurred additional operating expenses (of a general nature) of $1,206,000. 0 56,000 a. What is the profit or loss of each of these segments? b. Perform the profit or loss test to determine which of these segments is separately reportable. Required A Required B Autos Trucks SUVS Complete this question by entering your answers in the tabs below. Motorcycles Total Operating Expenses $ 3,606,000 4,006,000 2,006,000 1,026,000 What is the profit or loss of each of these segments? Profit Loss

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the profit or loss for each of the segments we need to consider the following informati...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started