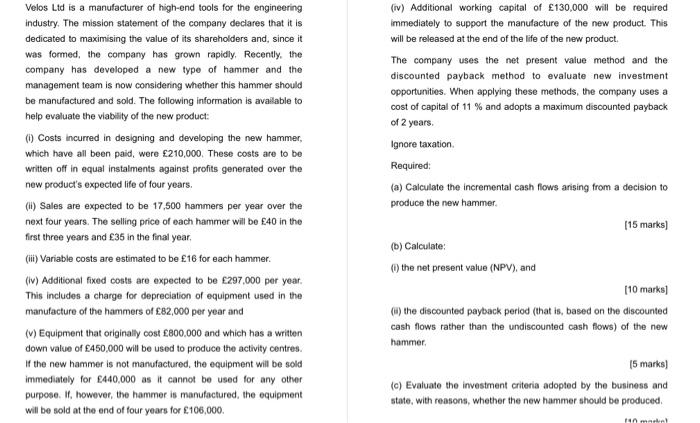

Velos Ltd is a manufacturer of high-end tools for the engineering industry. The mission statement of the company declares that it is dedicated to maximising the value of its shareholders and, since it was formed, the company has grown rapidly. Recently, the company has developed a new type of hammer and the management team is now considering whether this hammer should be manufactured and sold. The following information is available to help evaluate the viability of the new product: (1) Costs incurred in designing and developing the new hammer, which have all been paid, were 210,000. These costs are to be written off in equal instalments against profits generated over the new product's expected life of four years. (1) Sales are expected to be 17,500 hammers per year over the next four years. The selling price of each hammer will be 40 in the first three years and 35 in the final year, (ii) Variable costs are estimated to be 16 for each hammer. (1) Additional fixed costs are expected to be 297,000 per year. This includes a charge for depreciation of equipment used in the manufacture of the hammers of 82,000 per year and () Equipment that originally cost 800,000 and which has a written down value of 450,000 will be used to produce the activity centres. If the new hammer is not manufactured, the equipment will be sold immediately for 440,000 as it cannot be used for any other purpose. If however, the hammer is manufactured, the equipment will be sold at the end of four years for 106,000. (iv) Additional working capital of 130,000 will be required immediately to support the manufacture of the new product. This will be released at the end of the life of the new product The company uses the net present value method and the discounted payback method to evaluate new investment opportunities. When applying these methods, the company uses a cost of capital of 11 % and adopts a maximum discounted payback of 2 years Ignore taxation Required: (a) Calculate the incremental cash flows arising from a decision to produce the new hammer [15 marks) (b) Calculate: the net present value (NPV), and [10 marks] c) the discounted payback period (that is, based on the discounted cash flows rather than the undiscounted cash flows) of the new hammer (5 marks) (c) Evaluate the investment criteria adopted by the business and state, with reasons, whether the new hammer should be produced, anmak