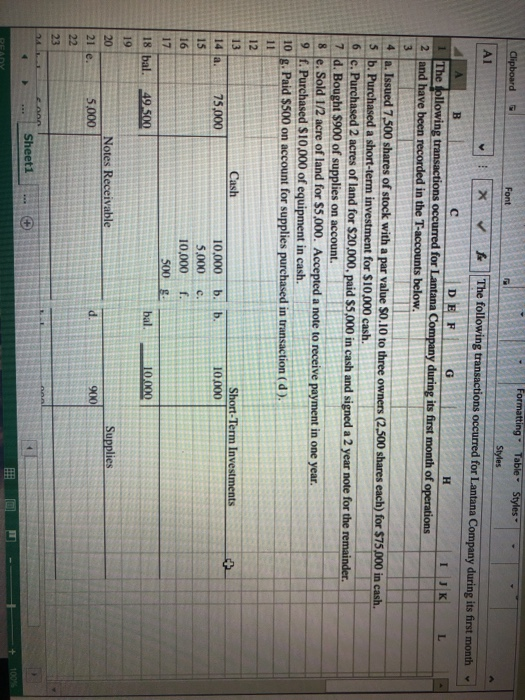

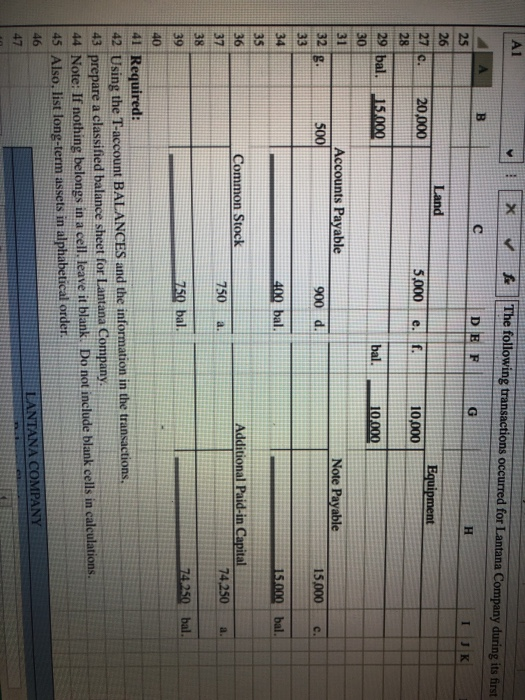

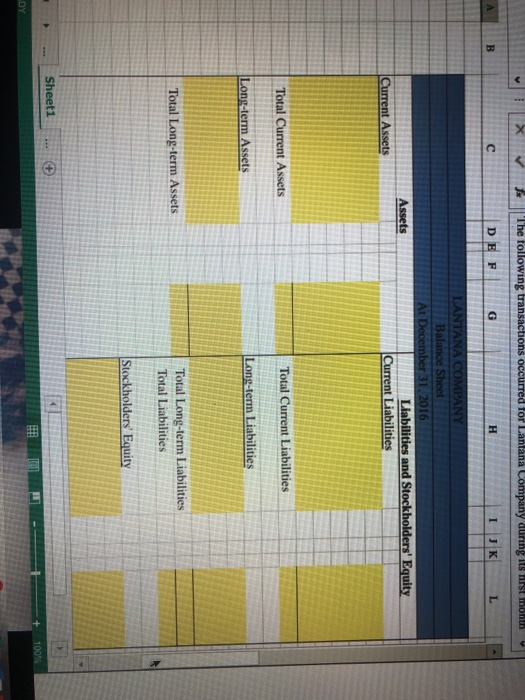

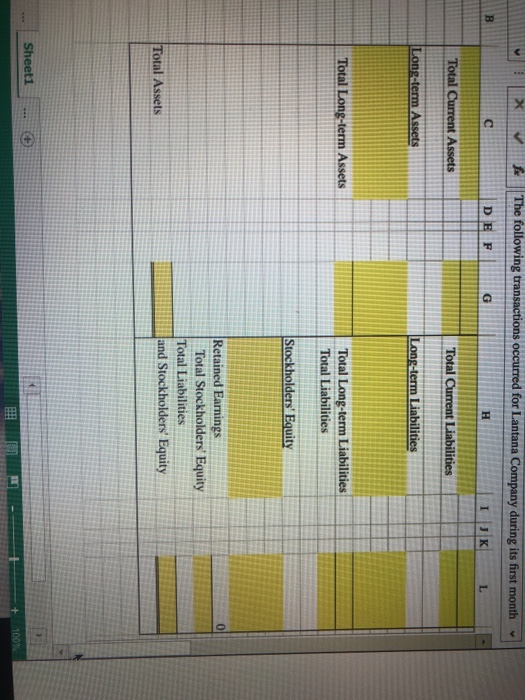

velue 100.00 polnts Preparing a Classifled Balance Sheet using Excel's SUM Function and Cell Referencing Lantana Company has opened its company and has recorded its first month of transactions in T-accounts. The Controller has asked you to prepare the companys classified balance sheet at the month end based on those transactions. Use the information included in the Excel Simulation and the Excel functions described below to complete the task. . Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, f in a blank cell, " 814 was enfered,the formula . Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add) would output the result from cell B14, or 75,000 in this example. minus sign to subtract asterisk sign to multiply and / (forward slash to di de Fro the Excel Sr ulation below if n a blank cell-c14-C15 as entered, he formula would add the values from those cells and output the result, or 15,000 in this example. If using the other math symbols the result would output an appropriate answer for its function. . SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. From the Excel -sUMC 14 15 16 was entered, the formula would output the result of adding those three separate cells, or 25,000 n this sm laton below if in a blank cell example. Similanly, If in a blank cel eSUM(C14 C16' was entered, the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 25,000 in this example | Formatting, Table"-Styles | A1 A | | The following transactions occurred for Lantana Company during its first month : x DEF: G IJKL The 2 and have been recorded in the T-accounts below. 6 c. Purchased 2 acres of land for $20,000, paid S5,000 in cash and signed a 2 year note for the remainder. 8 e. Sold 1/2 acre of land for $5,000. Accepted a note to receive payment in one year. 7 d. Bought $900 of supplies on account.E 9 f. Purchased $10,000 of equipment in cash. 10 g.Paid $500 on account for supplies purchased in transaction (d) 12 13 Cash 10,000 b. b 5,000 c. 10,000 f 500 10,000 15 18 bal. 49.500 19 bal. 0 Notes Receivable 5,000 90 Sheet1 x V The following mnnctions occumred for Lantana Company A1 DB F IJK 26 27- 20,000 5000 e. . 10,000 29 bal. 15,000 31 Accounts Payable Note Payable 32 g. 900 d. 15,000c 400 bal. 15.000 bal. 35 Common Stock Additional Paid-in Capital 750 a. 74,250 a. 37 38 39 250 bal. 74250 bal 41 Required: 42 Using the T-account BALANCES and the information in the transactions 43 prepare a classified balance sheet for Lantana Company 44 Note: If nothing belongs in a cell. leave it blank Do not include blank cells in calculations 45 Also, list long-term assets in alphabetical order LANTANA COMPANY Total Total Long-term Assets Total Liabilities DE F I JK and Stockholders Equity