Question

Venture capital firm JD is trying to determine in which of 10 projects it should invest. It knows how much money is available for investment

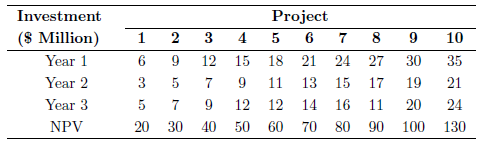

Venture capital firm JD is trying to determine in which of 10 projects it should invest. It knows how much money is available for investment in each of the next N years, the NPV of each project, and the cash required by each project in each of the next N years (see the table below).

During year 1, $86 million is available for investment. During year 2, $65 million is available for investment. During year 3, $74 million is available for investment.

Formulate an integer-linear program (ILP) to determine in which projects JD should invest in order to maximize its NPV. (Note: Each project must be completed at either a 100% or 0% level.)

Show how you would modify your model from part a in order to accommodate the following additional requirements.

A) If project 4 is selected, then product 1 must be selected.

B) If Project 4 can be selected only if product 1 is selected.

C) If project 4 is not selected, then product 1 must be selected.

D) If project 4 is not selected, then product 1 must not be selected.

E) Projects 1 and 4 cannot both be selected.

F) At most four projects can be selected.

E) If projects 1, 3, and 5 are all selected, then project 2 must be selected.

F) If projects 1 and 5 are both selected, then neither project 2 nor project 3 can be selected.

E) If either project 1 or 5 is selected, then project 2 must be selected.

F) If project 1 is selected, then either project 2 or project 3 must be selected.

Investment (8 Million) Year 1 Year 2 Year 3 NPV 1 6 3 5 20 2 9 5 7 30 3 12 7 9 40 4 15 9 12 50 Project 5 6 7 18 21 24 11 13 15 12 14 16 60 70 80 8 27 17 11 90 9 30 19 20 100 10 35 21 24 130 Investment (8 Million) Year 1 Year 2 Year 3 NPV 1 6 3 5 20 2 9 5 7 30 3 12 7 9 40 4 15 9 12 50 Project 5 6 7 18 21 24 11 13 15 12 14 16 60 70 80 8 27 17 11 90 9 30 19 20 100 10 35 21 24 130Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started