Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Venture Capital FirmEarly-stage venture capital firm shortly after its formation with initial investments. There is a single general partner with an extensive network of tech

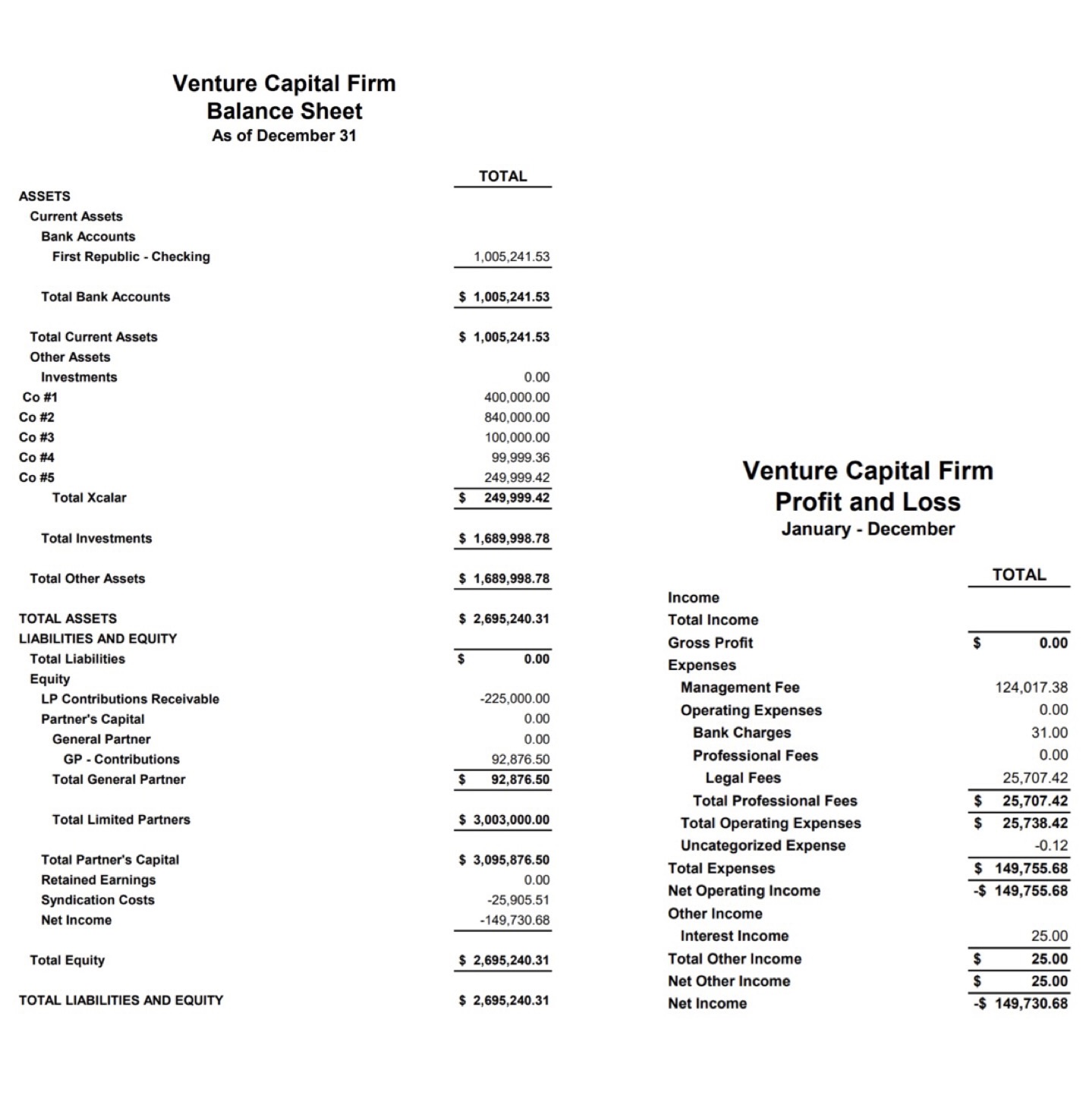

Venture Capital FirmEarly-stage venture capital firm shortly after its formation with initial investments. There is a single general partner with an extensive network of tech friends who can provide deal flow.The fund is looking for more limited partners.Question: would you invest in this early Venture capital firm based on the balanace sheet given? why or why not analyze carefully and explain in detail please.

Venture Capital Firm Balance Sheet As of December 31 TOTAL ASSETS Current Assets Bank Accounts First Republic - Checking Total Bank Accounts 1,005,241.53 $ 1,005,241.53 $ 1,005,241.53 Total Current Assets Other Assets Investments Co #1 Co #2 Co #3 Co #4 Co #5 Total Xcalar 0.00 400,000.00 840,000.00 100,000.00 99,999.36 249,999.42 $ 249,999.42 Venture Capital Firm Profit and Loss January - December Total Investments Total Other Assets TOTAL ASSETS LIABILITIES AND EQUITY Total Liabilities Equity LP Contributions Receivable Partner's Capital General Partner GP- Contributions Total General Partner $ 1,689,998.78 $ 1,689,998.78 $ 2,695,240.31 $ 0.00 -225,000.00 0.00 0.00 92,876.50 $ 92,876.50 Total Limited Partners $ 3,003,000.00 Income Total Income Gross Profit Expenses Management Fee Operating Expenses Bank Charges Total Operating Expenses TOTAL $ 0.00 124,017.38 0.00 Professional Fees Legal Fees 31.00 0.00 25,707.42 Total Professional Fees $ 25,707.42 $ 25,738.42 Uncategorized Expense -0.12 Total Partner's Capital Retained Earnings Syndication Costs Net Income $ 3,095,876.50 -25,905.51 -149,730.68 Total Expenses $ 149,755.68 0.00 Net Operating Income -$ 149,755.68 Other Income Interest Income 25.00 Total Equity $ 2,695,240.31 Total Other Income $ 25.00 Net Other Income $ 25.00 TOTAL LIABILITIES AND EQUITY $ 2,695,240.31 Net Income -$ 149,730.68

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate whether to invest in the earlystage venture capital firm based on the balance sheet provided we need to consider several factors Current A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dbec62f431_962739.pdf

180 KBs PDF File

663dbec62f431_962739.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started