Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Venture capitalists (VCs) receive money from investors and use it to fund entrepreneurs by investing in equity in start up businesses and, after a

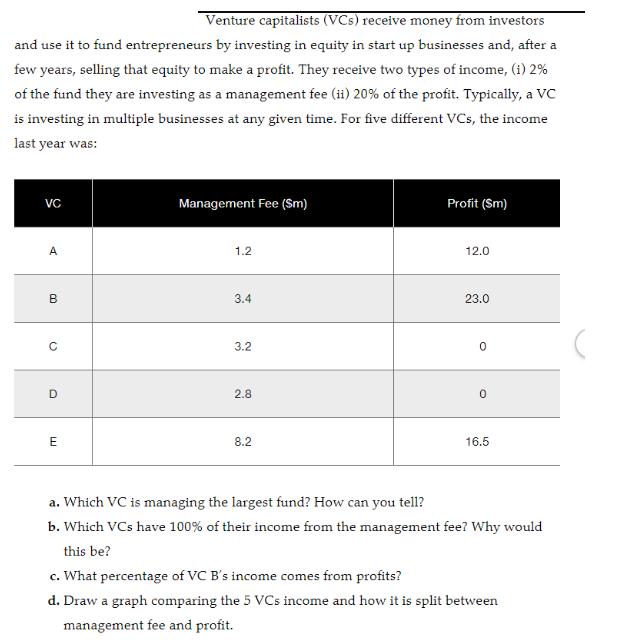

Venture capitalists (VCs) receive money from investors and use it to fund entrepreneurs by investing in equity in start up businesses and, after a few years, selling that equity to make a profit. They receive two types of income, (i) 2% of the fund they are investing as a management fee (ii) 20% of the profit. Typically, a VC is investing in multiple businesses at any given time. For five different VCs, the income last year was: VC Management Fee (Sm) Profit (Sm) A 1.2 12.0 B 3.4 23.0 C 3.2 2.8 8.2 16.5 a. Which VC is managing the largest fund? How can you tell? b. Which VCs have 100% of their income from the management fee? Why would this be? c. What percentage of VC B's income comes from profits? d. Draw a graph comparing the 5 VCs income and how it is split between management fee and profit.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started