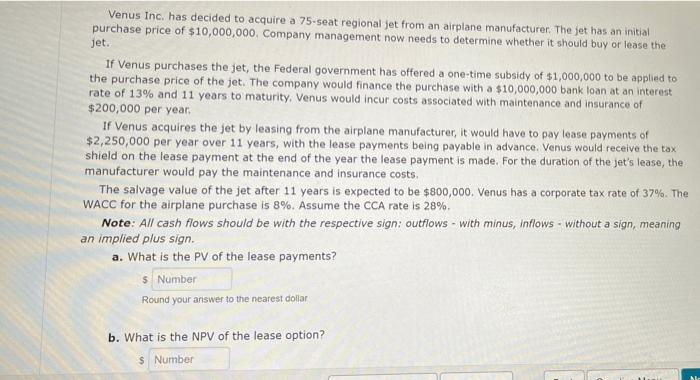

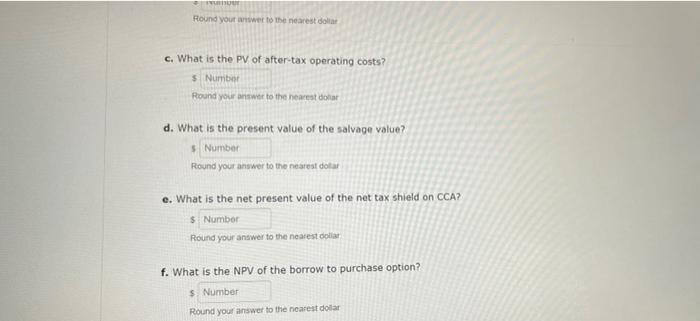

Venus Inc. has decided to acquire a 75-seat regional jet from an airplane manufacturer. The jet has an initial purchase price of $10,000,000. Company management now needs to determine whether it should buy or lease the jet. If Venus purchases the jet, the Federal government has offered a one-time subsidy of $1,000,000 to be applied to the purchase price of the jet. The company would finance the purchase with a $10,000,000 bank loan at an interest rate of 13% and 11 years to maturity. Venus would incur costs associated with maintenance and insurance of $200,000 per year. If Venus acquires the jet by leasing from the airplane manufacturer, it would have to pay lease payments of $2,250,000 per year over 11 years, with the lease payments being payable in advance. Venus would receive the tax shield on the lease payment at the end of the year the lease payment is made. For the duration of the jet's lease, the manufacturer would pay the maintenance and insurance costs. The salvage value of the jet after 11 years is expected to be $800,000. Venus has a corporate tax rate of 37%. The WACC for the airplane purchase is 8%. Assume the CCA rate is 28%. Note: All cash flows should be with the respective sign: outflows with minus, inflows - without a sign, meaning an implied plus sign. a. What is the PV of the lease payments? s Number Round your answer to the nearest dollar b. What is the NPV of the lease option? $ Number Me our Round your answer to the nearest dollar c. What is the PV of after-tax operating costs? s Number Round your answer to the nearest dollar d. What is the present value of the salvage value? $ Number Round your answer to the nearest dollar e. What is the net present value of the net tax shield on CCA? $ Number Round your answer to the nearest dollar f. What is the NPV of the borrow to purchase option? $ Number Round your answer to the nearest dollar Venus Inc. has decided to acquire a 75-seat regional jet from an airplane manufacturer. The jet has an initial purchase price of $10,000,000. Company management now needs to determine whether it should buy or lease the jet. If Venus purchases the jet, the Federal government has offered a one-time subsidy of $1,000,000 to be applied to the purchase price of the jet. The company would finance the purchase with a $10,000,000 bank loan at an interest rate of 13% and 11 years to maturity. Venus would incur costs associated with maintenance and insurance of $200,000 per year. If Venus acquires the jet by leasing from the airplane manufacturer, it would have to pay lease payments of $2,250,000 per year over 11 years, with the lease payments being payable in advance. Venus would receive the tax shield on the lease payment at the end of the year the lease payment is made. For the duration of the jet's lease, the manufacturer would pay the maintenance and insurance costs. The salvage value of the jet after 11 years is expected to be $800,000. Venus has a corporate tax rate of 37%. The WACC for the airplane purchase is 8%. Assume the CCA rate is 28%. Note: All cash flows should be with the respective sign: outflows with minus, inflows - without a sign, meaning an implied plus sign. a. What is the PV of the lease payments? s Number Round your answer to the nearest dollar b. What is the NPV of the lease option? $ Number Me our Round your answer to the nearest dollar c. What is the PV of after-tax operating costs? s Number Round your answer to the nearest dollar d. What is the present value of the salvage value? $ Number Round your answer to the nearest dollar e. What is the net present value of the net tax shield on CCA? $ Number Round your answer to the nearest dollar f. What is the NPV of the borrow to purchase option? $ Number Round your answer to the nearest dollar