Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vera Loewenhaupt and Sons (VL&H) is a corporation with a vast empire in the manufacturing and trading of wickerware products. The firm has 580.0

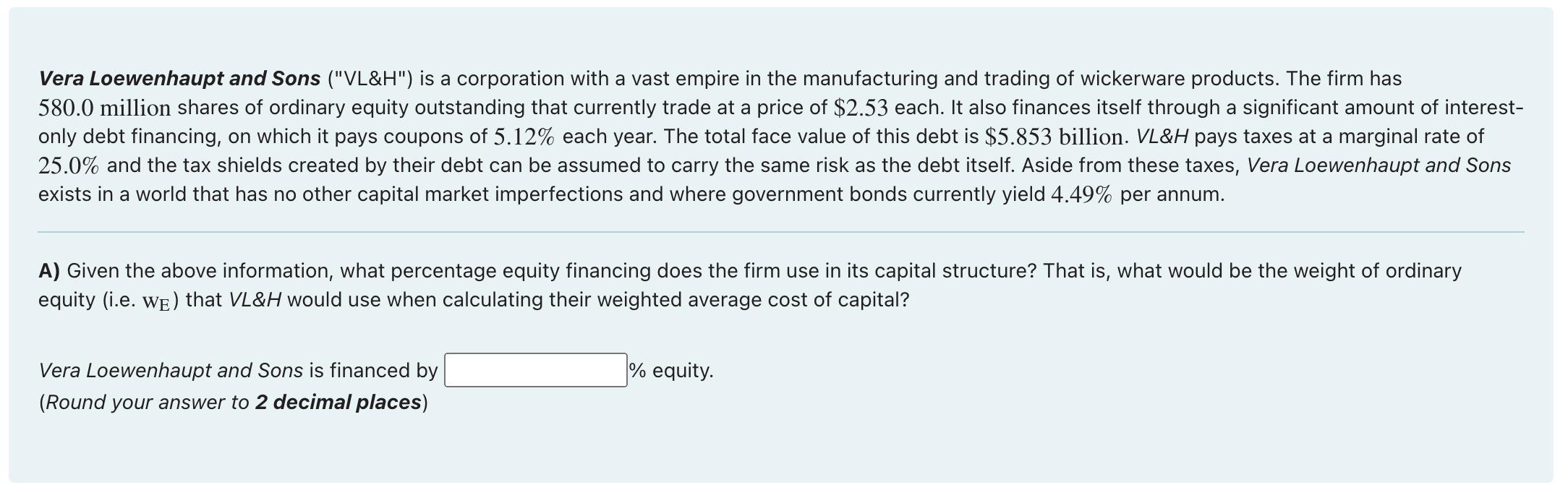

Vera Loewenhaupt and Sons ("VL&H") is a corporation with a vast empire in the manufacturing and trading of wickerware products. The firm has 580.0 million shares of ordinary equity outstanding that currently trade at a price of $2.53 each. It also finances itself through a significant amount of interest- only debt financing, on which it pays coupons of 5.12% each year. The total face value of this debt is $5.853 billion. VL&H pays taxes at a marginal rate of 25.0% and the tax shields created by their debt can be assumed to carry the same risk as the debt itself. Aside from these taxes, Vera Loewenhaupt and Sons exists in a world that has no other capital market imperfections and where government bonds currently yield 4.49% per annum. A) Given the above information, what percentage equity financing does the firm use in its capital structure? That is, what would be the weight of ordinary equity (i.e. WE) that VL&H would use when calculating their weighted average cost of capital? Vera Loewenhaupt and Sons is financed by (Round your answer to 2 decimal places) % equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the percentage of equity financing in Vera Loewenhaupt and Sons capital structure we ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d6150b8166_967562.pdf

180 KBs PDF File

663d6150b8166_967562.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started