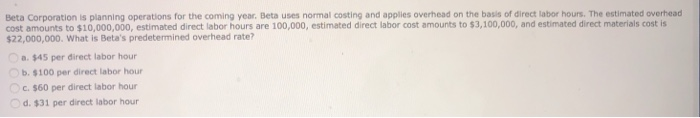

?? Beta Corporation is planning operations for the coming year. Beta uses normal costing and applies overhead on the basis of direct labor hours. The

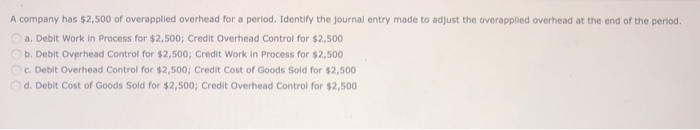

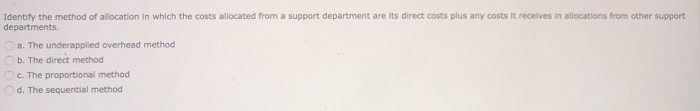

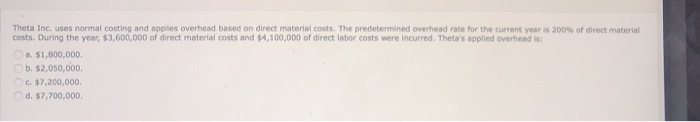

Beta Corporation is planning operations for the coming year. Beta uses normal costing and applies overhead on the basis of direct labor hours. The estimated overhead cost amounts to $10,000,000, estimated direct labor hours are 100,000, estimated direct labor cost amounts to $3,100,000, and estimated direct materials cost is $22,000,000. What is Beta's predetermined overhead rate? a. $45 per direct labor hour b. $100 per direct labor hour c. $60 per direct labor hour Od. $31 per direct labor hour A company has $2,500 of overapplied overhead for a period. Identify the journal entry made to adjust the overapplied overhead at the end of the period. a. Debit Work in Process for $2,500; Credit Overhead Control for $2,500 b. Debit Overhead Control for $2,500; Credit Work in Process for $2,500 c. Debit Overhead Control for $2,500; Credit Cost of Goods Sold for $2,500 d. Debit Cost of Goods Sold for $2,500; Credit Overhead Control for $2,500 Identify the method of allocation in which the costs allocated from a support department are its direct costs plus any costs it receives in allocations from other support departments. a. The underapplied overhead method b. The direct method c. The proportional method d. The sequential method Theta Inc. uses normal costing and applies overhead based on direct material costs. The predetermined overhead rate for the current year is 200% of direct material costs. During the year, $3,600,000 of direct material costs and $4,100,000 of direct labor costs were incurred. Theta's applied overhead is: a. $1,800,000. b. $2,050,000. c. $7,200,000. Od. $7,700,000.

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1st image Predetermined OH rate Estimated OH cost Direct Labor Hours 10000000 100000 10000 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d8ca52436a_176652.pdf

180 KBs PDF File

635d8ca52436a_176652.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started