Answered step by step

Verified Expert Solution

Question

1 Approved Answer

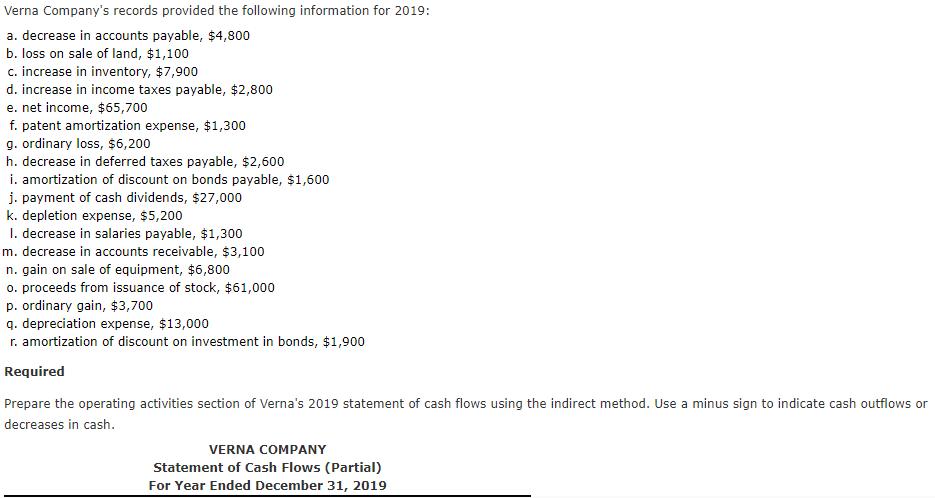

Verna Company's records provided the following information for 2019: a. decrease in accounts payable, $4,800 b. loss on sale of land, $1,100 c. increase

Verna Company's records provided the following information for 2019: a. decrease in accounts payable, $4,800 b. loss on sale of land, $1,100 c. increase in inventory, $7,900 d. increase in income taxes payable, $2,800 e. net income, $65,700 f. patent amortization expense, $1,300 g. ordinary loss, $6,200 h. decrease in deferred taxes payable, $2,600 i. amortization of discount on bonds payable, $1,600 j. payment of cash dividends, $27,000 k. depletion expense, $5,200 I. decrease in salaries payable, $1,300 m. decrease in accounts receivable, $3,100 n. gain on sale of equipment, $6,800 o. proceeds from issuance of stock, $61,000 p. ordinary gain, $3,700 q. depreciation expense, $13,000 r. amortization of discount on investment in bonds, $1,900 Required Prepare the operating activities section of Verna's 2019 statement of cash flows using the indirect method. Use a minus sign to indicate cash outflows or decreases in cash. VERNA COMPANY Statement of Cash Flows (Partial) For Year Ended December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started