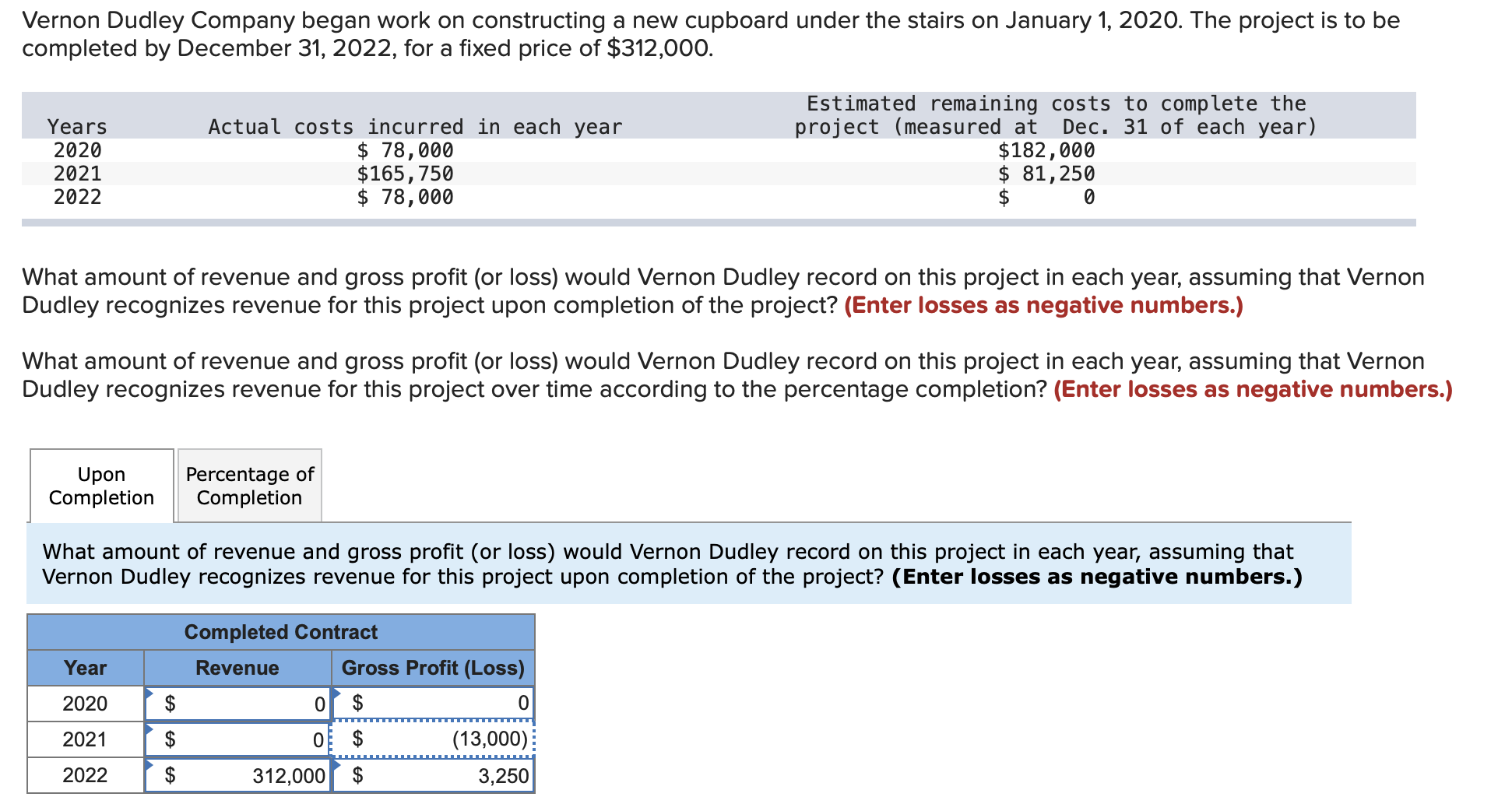

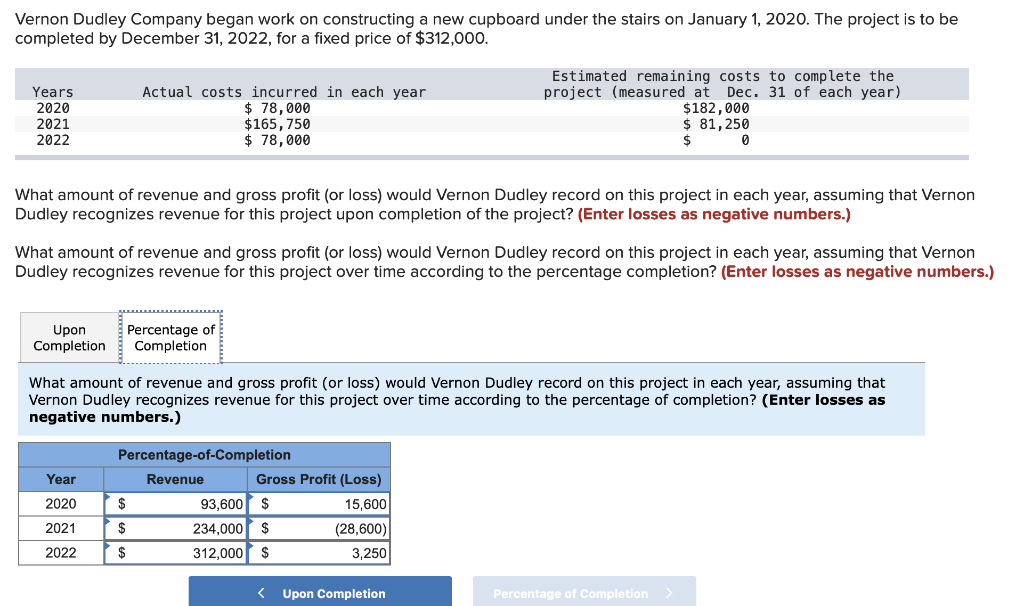

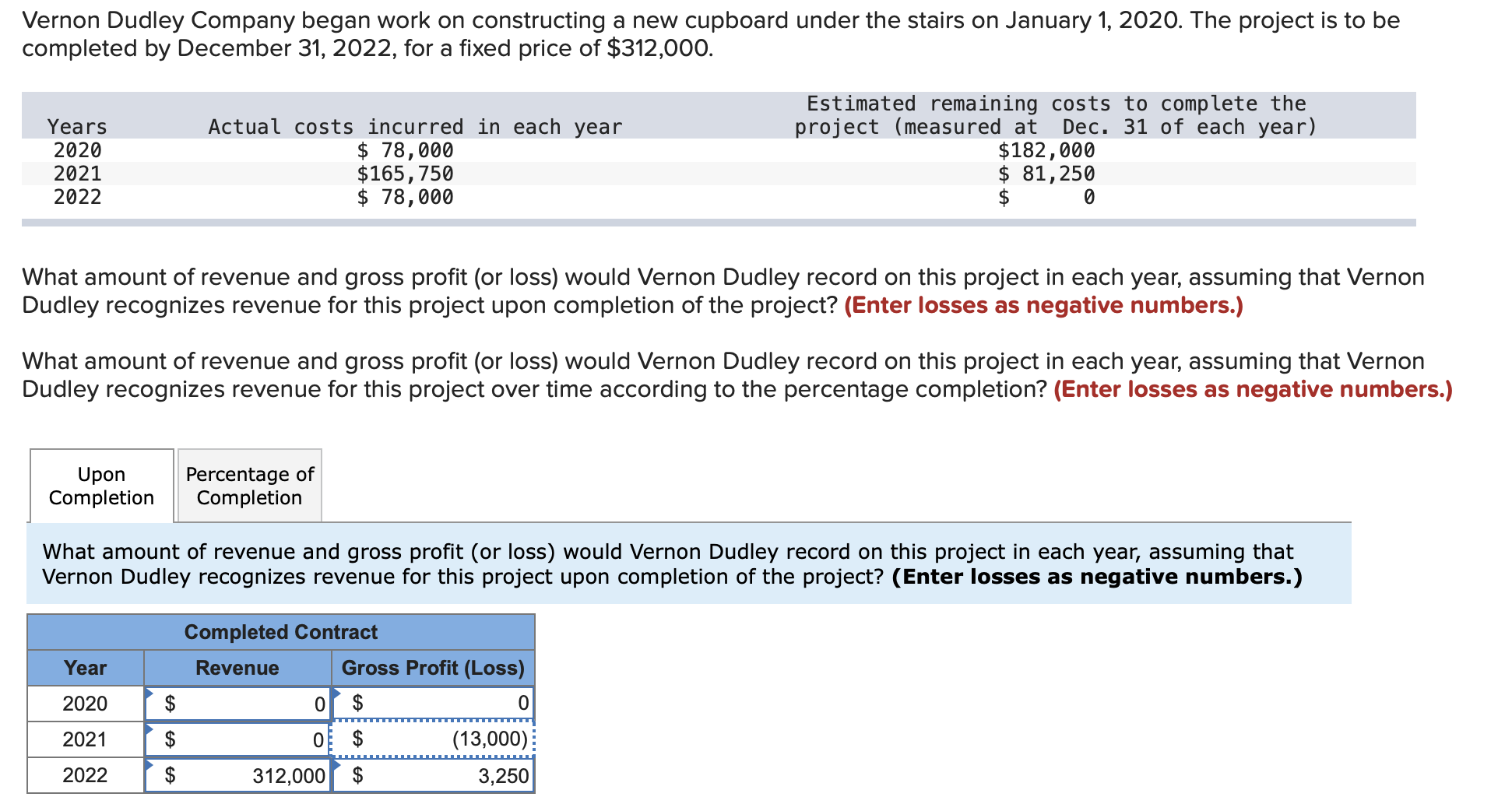

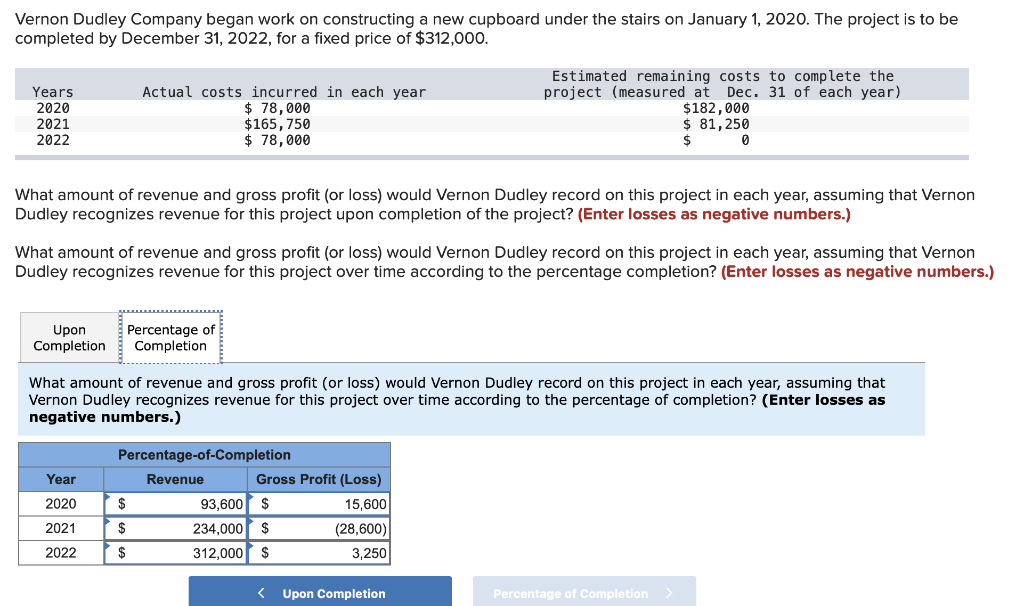

Vernon Dudley Company began work on constructing a new cupboard under the stairs on January 1, 2020. The project is to be completed by December 31, 2022, for a fixed price of $312,000. Years 2020 2021 2022 Actual costs incurred in each year $ 78,000 $165,750 $ 78,000 Estimated remaining costs to complete the project (measured at Dec. 31 of each year) $182,000 $ 81,250 $ What amount of revenue and gross profit (or loss) would Vernon Dudley record on this project in each year, assuming that Vernon Dudley recognizes revenue for this project upon completion of the project? (Enter losses as negative numbers.) What amount of revenue and gross profit (or loss) would Vernon Dudley record on this project in each year, assuming that Vernon Dudley recognizes revenue for this project over time according to the percentage completion? (Enter losses as negative numbers.) Upon Completion Percentage of Completion What amount of revenue and gross profit (or loss) would Vernon Dudley record on this project in each year, assuming that Vernon Dudley recognizes revenue for this project upon completion of the project? (Enter losses as negative numbers.) Year 2020 Completed Contract Revenue Gross Profit (Loss) $ 0 $ 0 $ 0 $ (13,000): $ 312,000 $ 3,250 2021 2022 Vernon Dudley Company began work on constructing a new cupboard under the stairs on January 1, 2020. The project is to be completed by December 31, 2022, for a fixed price of $312,000. Years 2020 2021 2022 Actual costs incurred in each year $ 78,000 $165, 750 $ 78,000 Estimated remaining costs to complete the project (measured at Dec. 31 of each year) $182,000 $ 81,250 $ 0 What amount of revenue and gross profit (or loss) would Vernon Dudley record on this project in each year, assuming that Vernon Dudley recognizes revenue for this project upon completion of the project? (Enter losses as negative numbers.) What amount of revenue and gross profit (or loss) would Vernon Dudley record on this project in each year, assuming that Vernon Dudley recognizes revenue for this project over time according to the percentage completion? (Enter losses as negative numbers.) Upon Completion Percentage of Completion What amount of revenue and gross profit (or loss) would Vernon Dudley record on this project in each year, assuming that Vernon Dudley recognizes revenue for this project over time according to the percentage of completion? (Enter losses as negative numbers.) Year 2020 Percentage-of-Completion Revenue Gross Profit (Loss) $ 93,600 $ 15,600 $ 234,000 $ (28,600) $ 312,000 $ 3,250 2021 2022