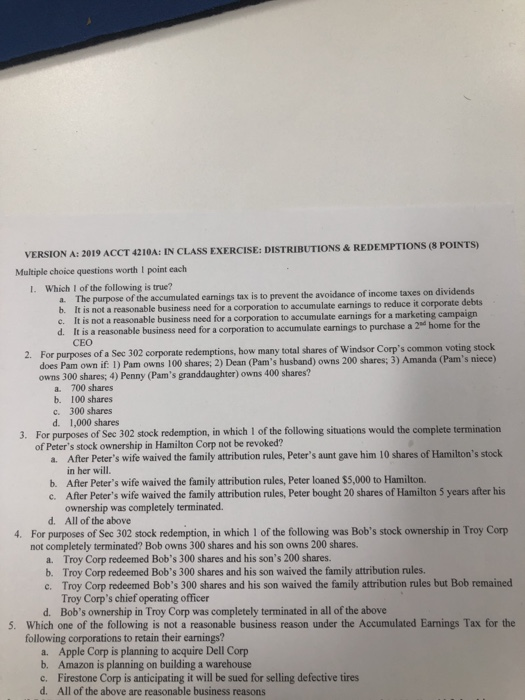

VERSION A 2019 ACCT 4210AI IN CLASS EXERCISE: DISTRIBUTIONS & REDEMPTIONS (8 POINTS) Multiple choice questions worth I point each 1. Which I of the following is true? a. The purpose of the accumulated earnings tax is to prevent the avoidance of income taxes on dividends b. It is not a reasonable business need for a corporation to accumulate earnings to reduce it corporate debts c. It is not a reasonable business need for a corporation to accumulate earnings for a marketing campaign d. It is a reasonable business need for a corporation to accumulate earnings to purchase a 2 home for the CEO 2. For purposes of a Sec 302 corporate redemptions, how many total shares of Windsor Corp's common voting stock does Pam own if: 1) Pam owns 100 shares; 2) Dean (Pam's husband) owns 200 shares; 3) Amanda (Pam's niece) owns 300 shares; 4) Penny (Pam's granddaughter) owns 400 shares? a 700 shares b. 100 shares c. 300 shares d. 1,000 shares 3. For purposes of Sec 302 stock redemption, in which I of the following situations would the complete termination of Peter's stock ownership in Hamilton Corp not be revoked? After Peter's wife waived the family attribution rules, Peter's aunt gave him 10 shares of Hamilton's stock in her will b. After Peter's wife waived the family attribution rules, Peter loaned $5,000 to Hamilton c. After Peter's wife waived the family attribution rules, Peter bought 20 shares of Hamilton 5 years after his ownership was completely terminated. d. All of the above 4. For purposes of Sec 302 stock redemption, in which I of the following was Bob's stock ownership in Troy Corp not completely terminated? Bob owns 300 shares and his son owns 200 shares a. Troy Corp redeemed Bob's 300 shares and his son's 200 shares. b. Troy Corp redeemed Bob's 300 shares and his son waived the family attribution rules. c. Troy Corp redeemed Bob's 300 shares and his son waived the family attribution rules but Bob remained Troy Corp's chief operating officer d. Bob's ownership in Troy Corp was completely terminated in all of the above 5. Which one of the following is not a reasonable business reason under the Accumulated Earnings Tax for the following corporations to retain their earnings? a. Apple Corp is planning to acquire Dell Corp b. Amazon is planning on building a warehouse c. Firestone Corp is anticipating it will be sued for selling defective tires d. All of the above are reasonable business reasons VERSION A 2019 ACCT 4210AI IN CLASS EXERCISE: DISTRIBUTIONS & REDEMPTIONS (8 POINTS) Multiple choice questions worth I point each 1. Which I of the following is true? a. The purpose of the accumulated earnings tax is to prevent the avoidance of income taxes on dividends b. It is not a reasonable business need for a corporation to accumulate earnings to reduce it corporate debts c. It is not a reasonable business need for a corporation to accumulate earnings for a marketing campaign d. It is a reasonable business need for a corporation to accumulate earnings to purchase a 2 home for the CEO 2. For purposes of a Sec 302 corporate redemptions, how many total shares of Windsor Corp's common voting stock does Pam own if: 1) Pam owns 100 shares; 2) Dean (Pam's husband) owns 200 shares; 3) Amanda (Pam's niece) owns 300 shares; 4) Penny (Pam's granddaughter) owns 400 shares? a 700 shares b. 100 shares c. 300 shares d. 1,000 shares 3. For purposes of Sec 302 stock redemption, in which I of the following situations would the complete termination of Peter's stock ownership in Hamilton Corp not be revoked? After Peter's wife waived the family attribution rules, Peter's aunt gave him 10 shares of Hamilton's stock in her will b. After Peter's wife waived the family attribution rules, Peter loaned $5,000 to Hamilton c. After Peter's wife waived the family attribution rules, Peter bought 20 shares of Hamilton 5 years after his ownership was completely terminated. d. All of the above 4. For purposes of Sec 302 stock redemption, in which I of the following was Bob's stock ownership in Troy Corp not completely terminated? Bob owns 300 shares and his son owns 200 shares a. Troy Corp redeemed Bob's 300 shares and his son's 200 shares. b. Troy Corp redeemed Bob's 300 shares and his son waived the family attribution rules. c. Troy Corp redeemed Bob's 300 shares and his son waived the family attribution rules but Bob remained Troy Corp's chief operating officer d. Bob's ownership in Troy Corp was completely terminated in all of the above 5. Which one of the following is not a reasonable business reason under the Accumulated Earnings Tax for the following corporations to retain their earnings? a. Apple Corp is planning to acquire Dell Corp b. Amazon is planning on building a warehouse c. Firestone Corp is anticipating it will be sued for selling defective tires d. All of the above are reasonable business reasons