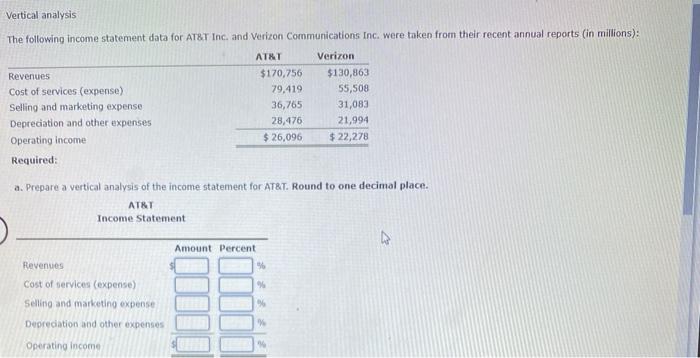

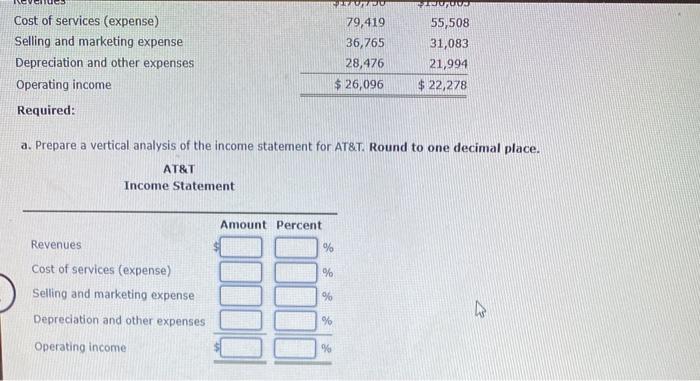

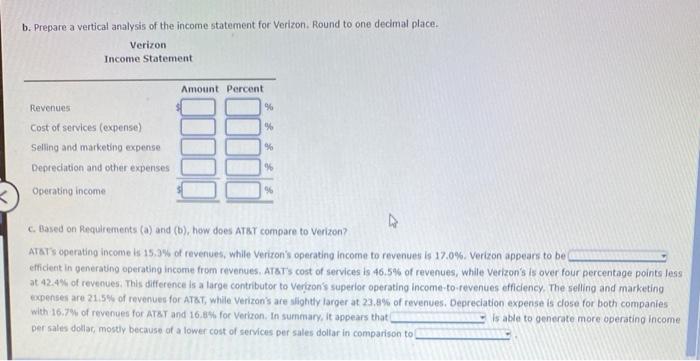

Vertical analysis The following income statement data for AT&T Inc. and Verizon Communications Inc. were taken from their recent annual reports (in millions): ATAT Verizon Revenues $170,756 $130,863 Cost of services (expense) 79,419 55,508 Selling and marketing expense 36,765 31,083 Depreciation and other expenses 28,476 21,994 Operating income $ 26,096 $ 22,278 Required: a. Prepare a vertical analysis of the income statement for AT&T. Round to one decimal place. ATAT Income Statement Amount Percent Revenues 56 Cost of services (expense) Selling and marketing expense % Depreciation and other expenses Operating income Cost of services (expense) Selling and marketing expense Depreciation and other expenses Operating income 79,419 36,765 28,476 $ 26,096 YOU 55,508 31,083 21,994 $ 22,278 Required: a. Prepare a vertical analysis of the income statement for AT&T. Round to one decimal place. AT&T Income Statement Amount Percent % % Revenues Cost of services (expense) Selling and marketing expense Depreciation and other expenses % % Operating income % b. Prepare a vertical analysis of the income statement for Verizon. Round to one decimal place. Verizon Income Statement Amount Percent Revenues 96 % 96 Cost of services (expense) Selling and marketing expense Depreciation and other expenses Operating income 96 c. Based on Requirements (a) and (b), how does ATAT compare to Verizon? AT&T's operating income is 15.3% of revenues, while Veriton's operating Income to revenues is 17.0%. Verizon appears to be efficient in generating operating income from revenues. ATT's cost of services is 46.5% of revenues, while Verizon's is over four percentage points less at 42.4% of revenues. This difference is a large contributor to Verizon's superior operating Income to revenues efficiency. The selling and marketing expenses are 21.5% of revenues for AT&T, while Verizon's are slightly farger at 23.8% of revenues. Depreciation expense is close for both companies with 16.7% of revenues for AT&T and 16.8% for Verizon. In summary, it appears that Is able to generate more operating income per sales dollat mostly because of a lower cost of services per sales dollar in comparison to