Answered step by step

Verified Expert Solution

Question

1 Approved Answer

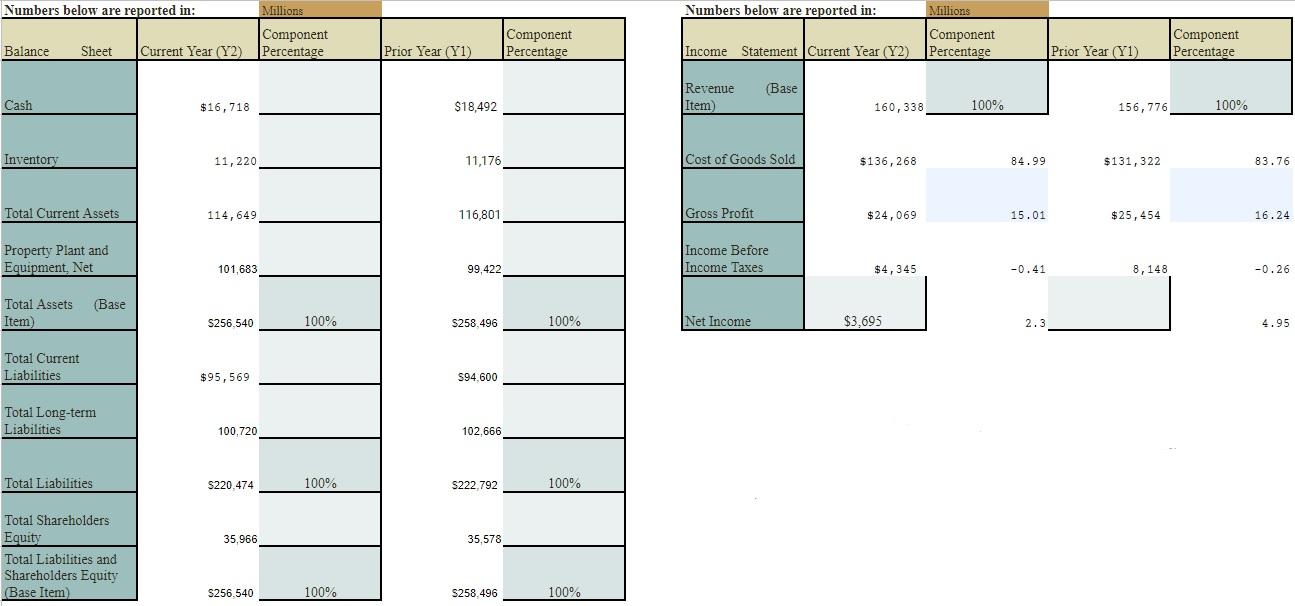

Vertical Ratio Analysis for 2018 and 2017 Ford Motor Co. Can someone verify my chart for accuracy and the blanks that need to be filled

Vertical Ratio Analysis for 2018 and 2017 Ford Motor Co. Can someone verify my chart for accuracy and the blanks that need to be filled in with the chart. Also if I can get some feedback on the below questions I would appreciate it. Thanks.

- On the vertical analysis of the Balance Sheet in Year 1, which item has the greatest component percentage in relation to Total Assets? Total Liabilities? Total Liabilities and Shareholders Equity? Did your answers change for Year 2? If so, name two factors that may have caused the shift in component percentages.

- On the vertical analysis of the Income Statement in Year 1, which item has the greatest component percentage in relation to Revenue? Did your answer change for Year 2? If so, name two factors that may have caused the shift in the component percentages.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started