Answered step by step

Verified Expert Solution

Question

1 Approved Answer

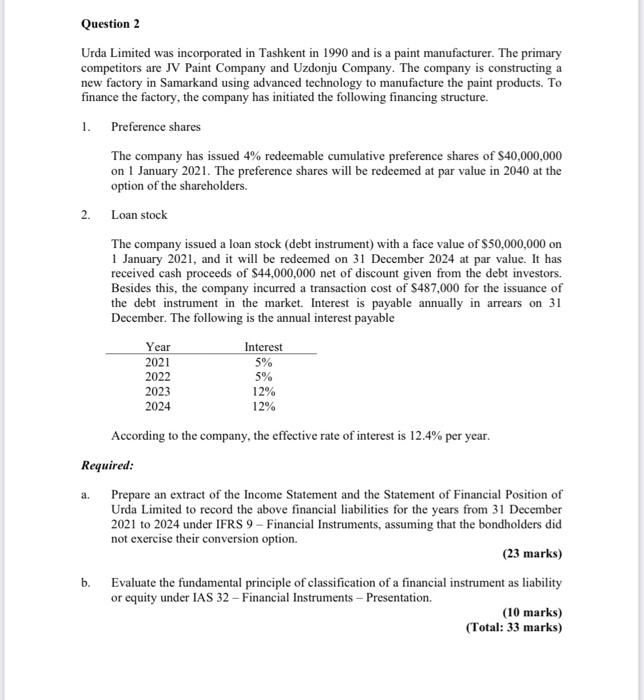

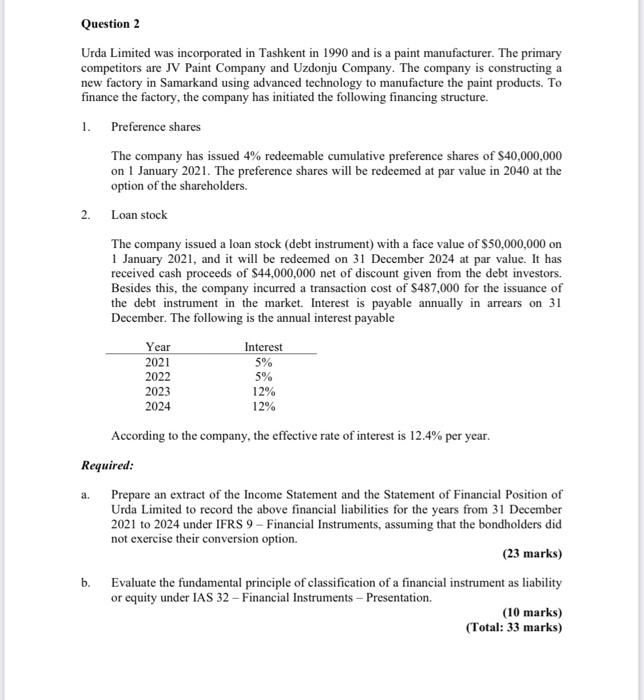

very urgant Question 2 Urda Limited was incorporated in Tashkent in 1990 and is a paint manufacturer. The primary competitors are JV Paint Company and

very urgant

Question 2 Urda Limited was incorporated in Tashkent in 1990 and is a paint manufacturer. The primary competitors are JV Paint Company and Uzdonju Company. The company is constructing a new factory in Samarkand using advanced technology to manufacture the paint products. To finance the factory, the company has initiated the following financing structure. 1. Preference shares The company has issued 4% redeemable cumulative preference shares of $40,000,000 on 1 January 2021. The preference shares will be redeemed at par value in 2040 at the option of the shareholders. 2. Loan stock The company issued a loan stock (debt instrument) with a face value of $50,000,000 on 1 January 2021, and it will be redeemed on 31 December 2024 at par value. It has received cash proceeds of $44,000,000 net of discount given from the debt investors. Besides this, the company incurred a transaction cost of $487,000 for the issuance of the debt instrument in the market. Interest is payable annually in arrears on 31 December. The following is the annual interest payable Year Interest 2021 5% 2022 5% 2023 12% 2024 12% According to the company, the effective rate of interest is 12.4% per year. Required: a. Prepare an extract of the Income Statement and the Statement of Financial Position of Urda Limited to record the above financial liabilities for the years from 31 December 2021 to 2024 under IFRS 9 - Financial Instruments, assuming that the bondholders did not exercise their conversion option. (23 marks) b. Evaluate the fundamental principle of classification of a financial instrument as liability or equity under IAS 32 - Financial Instruments - Presentation. (10 marks) (Total: 33 marks) Question 2 Urda Limited was incorporated in Tashkent in 1990 and is a paint manufacturer. The primary competitors are JV Paint Company and Uzdonju Company. The company is constructing a new factory in Samarkand using advanced technology to manufacture the paint products. To finance the factory, the company has initiated the following financing structure. 1. Preference shares The company has issued 4% redeemable cumulative preference shares of $40,000,000 on 1 January 2021. The preference shares will be redeemed at par value in 2040 at the option of the shareholders. 2. Loan stock The company issued a loan stock (debt instrument) with a face value of $50,000,000 on 1 January 2021, and it will be redeemed on 31 December 2024 at par value. It has received cash proceeds of $44,000,000 net of discount given from the debt investors. Besides this, the company incurred a transaction cost of $487,000 for the issuance of the debt instrument in the market. Interest is payable annually in arrears on 31 December. The following is the annual interest payable Year Interest 2021 5% 2022 5% 2023 12% 2024 12% According to the company, the effective rate of interest is 12.4% per year. Required: a. Prepare an extract of the Income Statement and the Statement of Financial Position of Urda Limited to record the above financial liabilities for the years from 31 December 2021 to 2024 under IFRS 9 - Financial Instruments, assuming that the bondholders did not exercise their conversion option. (23 marks) b. Evaluate the fundamental principle of classification of a financial instrument as liability or equity under IAS 32 - Financial Instruments - Presentation. (10 marks) (Total: 33 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started