Veryclear Glassware is a new business owned by Skyler Peoples, the company president. Skyler's first year of operation commenced on January 1, 2022. EIN:

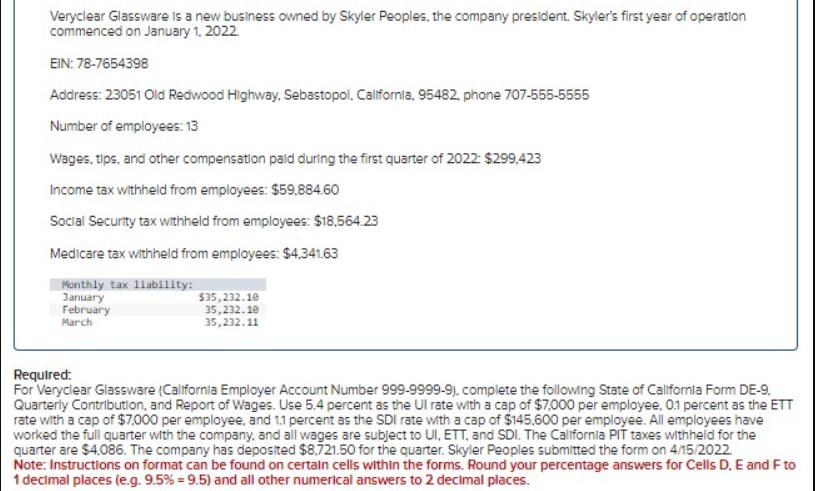

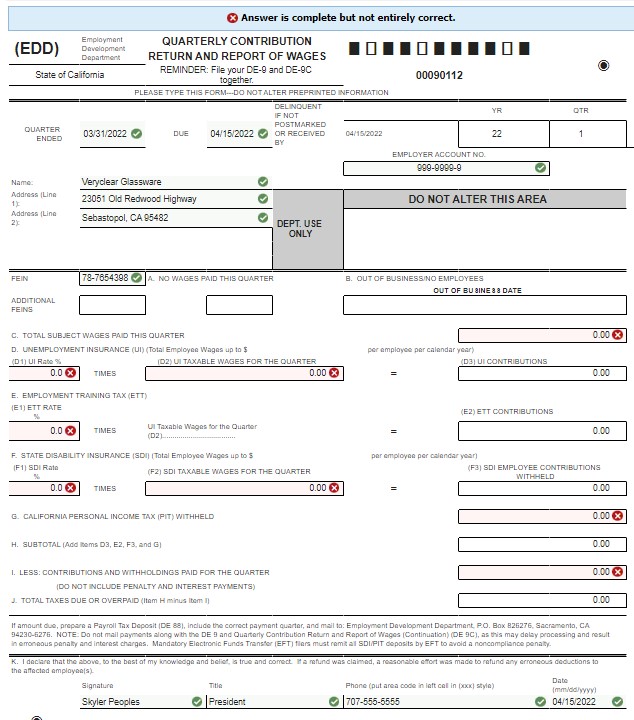

Veryclear Glassware is a new business owned by Skyler Peoples, the company president. Skyler's first year of operation commenced on January 1, 2022. EIN: 78-7654398 Address: 23051 Old Redwood Highway, Sebastopol, California, 95482, phone 707-555-5555 Number of employees: 13 Wages, tips, and other compensation paid during the first quarter of 2022: $299,423 Income tax withheld from employees: $59,884.60 Social Security tax withheld from employees: $18,564.23 Medicare tax withheld from employees: $4,341.63 Monthly tax liability: January February March $35,232.10 35,232.10 35,232.11 Required: For Veryclear Glassware (California Employer Account Number 999-9999-9), complete the following State of California Form DE-9. Quarterly Contribution, and Report of Wages. Use 5.4 percent as the UI rate with a cap of $7,000 per employee, 0.1 percent as the ETT rate with a cap of $7,000 per employee, and 1.1 percent as the SDI rate with a cap of $145.600 per employee. All employees have worked the full quarter with the company, and all wages are subject to UI, ETT, and SDI. The California PIT taxes withheld for the quarter are $4.086. The company has deposited $8,721.50 for the quarter. Skyler Peoples submitted the form on 4/15/2022 Note: Instructions on format can be found on certain cells within the forms. Round your percentage answers for Cells D, E and F to 1 decimal places (e.g. 9.5% = 9.5) and all other numerical answers to 2 decimal places. Employment (EDD) Development Department State of California QUARTER ENDED Name: Address (Line 1) Address (Line 2x FEIN ADDITIONAL FEINS 03/31/2022 78-7654398 Veryclear Glassware 23051 Old Redwood Highway Sebastopol, CA 95482 0.0 X TIMES QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES REMINDER: File your DE-9 and DE-9C together. PLEASE TYPE THIS FORM---DO NOT ALTER PREPRINTED INFORMATION TIMES E. EMPLOYMENT TRAINING TAX (ETT) (E1) ETT RATE % 0.0 x DUE C. TOTAL SUBJECT WAGES PAID THIS QUARTER D. UNEMPLOYMENT INSURANCE (UI) (Total Employee Wages up to $ (D1) UI Rate % A. NO WAGES PAID THIS QUARTER Answer is complete but not entirely correct. 04/15/2022 UITaxable Wages for the Quarter (D2) F. STATE DISABILITY INSURANCE (SDI) (Total Employee Wages up to $ (F1) SDI Rate 0.0 x TIMES H. SUBTOTAL (Add Items D3, E2, F3, and G) Signature Skyler Peoples (D2) UITAXABLE WAGES FOR THE QUARTER G. CALIFORNIA PERSONAL INCOME TAX (PIT) WITHHELD 1. LESS: CONTRIBUTIONS AND WITHHOLDINGS PAID FOR THE QUARTER (DO NOT INCLUDE PENALTY AND INTEREST PAYMENTS) J. TOTAL TAXES DUE OR OVERPAID (Itam H minus Item 1) (F2) SDI TAXABLE WAGES FOR THE QUARTER DELINQUENT IF NOT POSTMARKED OR RECEIVED BY DEPT. USE ONLY Title 0.00 x President 0.00 x 04/15/2022 00090112 EMPLOYER ACCOUNT NO. 999-9999-9 B. OUT OF BUSINESS/NO EMPLOYEES DO NOT ALTER THIS AREA YR per employee per calendar year) 22 OUT OF BUSINE 8 8 DATE (D3) UI CONTRIBUTIONS per employee per calendar year) (E2) ETT CONTRIBUTIONS OTR 1 0.00 X Phone (put area code in left call in (xxx) style) 707-555-5555 0.00 0.00 (F3) SDI EMPLOYEE CONTRIBUTIONS WITHHELD 0.00 0.00 X If amount due, prepare a Payroll Tax Deposit (DE 88), include the correct payment quarter, and mail to: Employment Development Department, P.O. Box 826276, Sacramento, CA 94230-6276. NOTE: Do not mail payments along with the DE 9 and Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C), as this may delay processing and result in erroneous penalty and interest charges. Mandatory Electronic Funds Transfer (EFT) filers must remit all SDI/PIT deposits by EFT to avoid a noncompliance penalty. 0.00 K. I declare that the above, to the best of my knowledge and belief, is true and comect. It a refund was claimed, a reasonable effort was made to refund any erroneous deductions to the affected employee(s) 0.00 x 0.00 Date (mm/dd/yyyy) 04/15/2022 Veryclear Glassware is a new business owned by Skyler Peoples, the company president. Skyler's first year of operation commenced on January 1, 2022. EIN: 78-7654398 Address: 23051 Old Redwood Highway, Sebastopol, California, 95482, phone 707-555-5555 Number of employees: 13 Wages, tips, and other compensation paid during the first quarter of 2022: $299,423 Income tax withheld from employees: $59,884.60 Social Security tax withheld from employees: $18,564.23 Medicare tax withheld from employees: $4,341.63 Monthly tax liability: January February March $35,232.10 35,232.10 35,232.11 Required: For Veryclear Glassware (California Employer Account Number 999-9999-9), complete the following State of California Form DE-9. Quarterly Contribution, and Report of Wages. Use 5.4 percent as the UI rate with a cap of $7,000 per employee, 0.1 percent as the ETT rate with a cap of $7,000 per employee, and 1.1 percent as the SDI rate with a cap of $145.600 per employee. All employees have worked the full quarter with the company, and all wages are subject to UI, ETT, and SDI. The California PIT taxes withheld for the quarter are $4.086. The company has deposited $8,721.50 for the quarter. Skyler Peoples submitted the form on 4/15/2022 Note: Instructions on format can be found on certain cells within the forms. Round your percentage answers for Cells D, E and F to 1 decimal places (e.g. 9.5% = 9.5) and all other numerical answers to 2 decimal places. Employment (EDD) Development Department State of California QUARTER ENDED Name: Address (Line 1) Address (Line 2x FEIN ADDITIONAL FEINS 03/31/2022 78-7654398 Veryclear Glassware 23051 Old Redwood Highway Sebastopol, CA 95482 0.0 X TIMES QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES REMINDER: File your DE-9 and DE-9C together. PLEASE TYPE THIS FORM---DO NOT ALTER PREPRINTED INFORMATION TIMES E. EMPLOYMENT TRAINING TAX (ETT) (E1) ETT RATE % 0.0 x DUE C. TOTAL SUBJECT WAGES PAID THIS QUARTER D. UNEMPLOYMENT INSURANCE (UI) (Total Employee Wages up to $ (D1) UI Rate % A. NO WAGES PAID THIS QUARTER Answer is complete but not entirely correct. 04/15/2022 UITaxable Wages for the Quarter (D2) F. STATE DISABILITY INSURANCE (SDI) (Total Employee Wages up to $ (F1) SDI Rate 0.0 x TIMES H. SUBTOTAL (Add Items D3, E2, F3, and G) Signature Skyler Peoples (D2) UI TAXABLE WAGES FOR THE QUARTER G. CALIFORNIA PERSONAL INCOME TAX (PIT) WITHHELD 1. LESS: CONTRIBUTIONS AND WITHHOLDINGS PAID FOR THE QUARTER (DO NOT INCLUDE PENALTY AND INTEREST PAYMENTS) J. TOTAL TAXES DUE OR OVERPAID (Itam H minus Item 1) (F2) SDI TAXABLE WAGES FOR THE QUARTER DELINQUENT IF NOT POSTMARKED OR RECEIVED BY DEPT. USE ONLY Title 0.00 x President 0.00 x 04/15/2022 00090112 EMPLOYER ACCOUNT NO. 999-9999-9 B. OUT OF BUSINESS/NO EMPLOYEES DO NOT ALTER THIS AREA YR per employee per calendar year) 22 OUT OF BUSINE 8 8 DATE (D3) UI CONTRIBUTIONS per employee per calendar year) (E2) ETT CONTRIBUTIONS OTR 1 0.00 X Phone (put area code in left call in (xxx) style) 707-555-5555 0.00 0.00 (F3) SDI EMPLOYEE CONTRIBUTIONS WITHHELD 0.00 0.00 X If amount due, prepare a Payroll Tax Deposit (DE 88), include the correct payment quarter, and mail to: Employment Development Department, P.O. Box 826276, Sacramento, CA 94230-6276. NOTE: Do not mail payments along with the DE 9 and Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C), as this may delay processing and result in erroneous penalty and interest charges. Mandatory Electronic Funds Transfer (EFT) filers must remit all SDI/PIT deposits by EFT to avoid a noncompliance penalty. 0.00 K. I declare that the above, to the best of my knowledge and belief, is true and comect. It a refund was claimed, a reasonable effort was made to refund any erroneous deductions to the affected employee(s) 0.00 x 0.00 Date (mm/dd/yyyy) 04/15/2022

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Lets use the given values to answer the questions To complete the State of California Form DE9 well ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started