Question

Veto Inc. purchased a vehicle for $28,000 on July 10, 2022. Additional information is as follows: Estimated useful life - 3 years Estimated residual

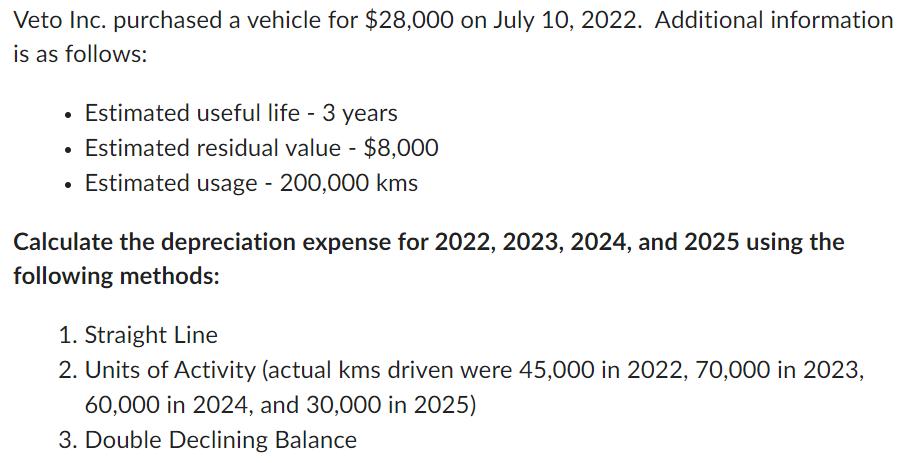

Veto Inc. purchased a vehicle for $28,000 on July 10, 2022. Additional information is as follows: Estimated useful life - 3 years Estimated residual value - $8,000 Estimated usage - 200,000 kms Calculate the depreciation expense for 2022, 2023, 2024, and 2025 using the following methods: 1. Straight Line 2. Units of Activity (actual kms driven were 45,000 in 2022, 70,000 in 2023, 60,000 in 2024, and 30,000 in 2025) 3. Double Declining Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the depreciation for each method 1 Straight Line textDepreciation fractextCost textRe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

13th Canadian Edition

1119740444, 9781119740445

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App