Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vettori Manufacturing Company (VMC) is a Canadian private company in the manufactory industry. VMC has a September 30 year-end and applies ASPE. It is

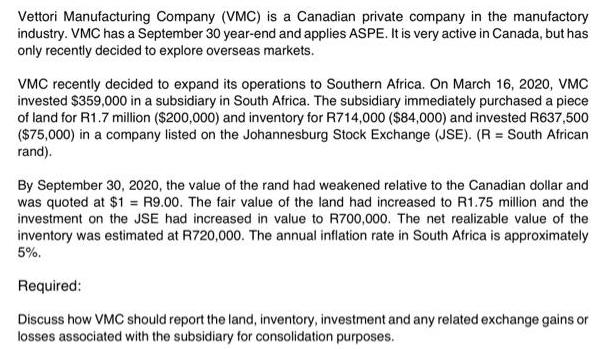

Vettori Manufacturing Company (VMC) is a Canadian private company in the manufactory industry. VMC has a September 30 year-end and applies ASPE. It is very active in Canada, but has only recently decided to explore overseas markets. VMC recently decided to expand its operations to Southern Africa. On March 16, 2020, VMC invested $359,000 in a subsidiary in South Africa. The subsidiary immediately purchased a piece of land for R1.7 million ($200,000) and inventory for R714,000 ($84,000) and invested R637,500 ($75,000) in a company listed on the Johannesburg Stock Exchange (JSE). (R = South African rand). By September 30, 2020, the value of the rand had weakened relative to the Canadian dollar and was quoted at $1 = R9.00. The fair value of the land had increased to R1.75 million and the investment on the JSE had increased in value to R700,000. The net realizable value of the inventory was estimated at R720,000. The annual inflation rate in South Africa is approximately 5%. Required: Discuss how VMC should report the land, inventory, investment and any related exchange gains or losses associated with the subsidiary for consolidation purposes.

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

When Vettori Manufacturing Company VMC expands its operations to Southern Africa and acquires a subsidiary there it needs to consider the accounting t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started