Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VI. Accounting Principles and Assumptions. Answer the following questions. Identify the accounting principles or assumptions that are applied, and briefly explain. (6%) 1) On

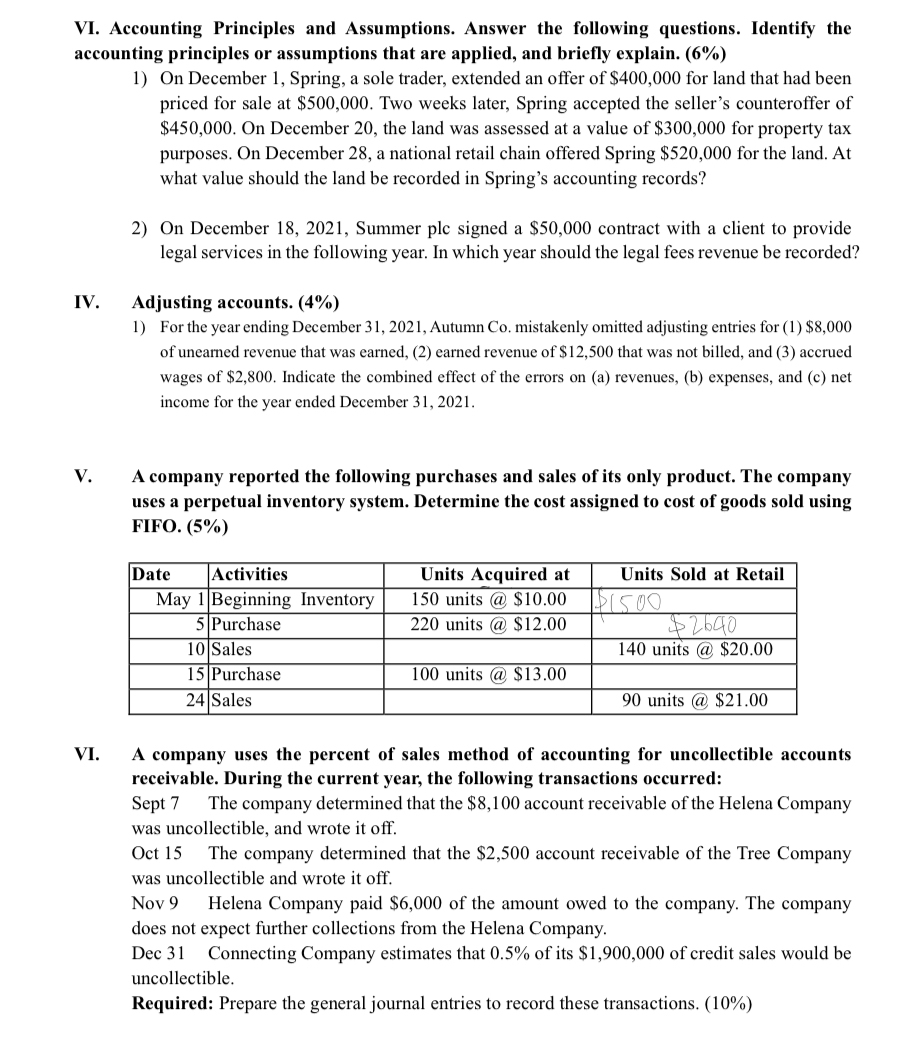

VI. Accounting Principles and Assumptions. Answer the following questions. Identify the accounting principles or assumptions that are applied, and briefly explain. (6%) 1) On December 1, Spring, a sole trader, extended an offer of $400,000 for land that had been priced for sale at $500,000. Two weeks later, Spring accepted the seller's counteroffer of $450,000. On December 20, the land was assessed at a value of $300,000 for property tax purposes. On December 28, a national retail chain offered Spring $520,000 for the land. At what value should the land be recorded in Spring's accounting records? IV. V. VI. 2) On December 18, 2021, Summer plc signed a $50,000 contract with a client to provide legal services in the following year. In which year should the legal fees revenue be recorded? Adjusting accounts. (4%) 1) For the year ending December 31, 2021, Autumn Co. mistakenly omitted adjusting entries for (1) $8,000 of unearned revenue that was earned, (2) earned revenue of $12,500 that was not billed, and (3) accrued wages of $2,800. Indicate the combined effect of the errors on (a) revenues, (b) expenses, and (c) net income for the year ended December 31, 2021. A company reported the following purchases and sales of its only product. The company uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using FIFO. (5%) Date Activities May 1 Beginning Inventory 5 Purchase 10 Sales 15 Purchase 24 Sales Units Acquired at 150 units @ $10.00 220 units @ $12.00 100 units @ $13.00 Units Sold at Retail $1500 $2640 140 units @ $20.00 90 units @ $21.00 A company uses the percent of sales method of accounting for uncollectible accounts. receivable. During the current year, the following transactions occurred: Sept 7 The company determined that the $8,100 account receivable of the Helena Company was uncollectible, and wrote it off. Oct 15 The company determined that the $2,500 account receivable of the Tree Company was uncollectible and wrote it off. Nov 9 Helena Company paid $6,000 of the amount owed to the company. The company does not expect further collections from the Helena Company. Dec 31 Connecting Company estimates that 0.5% of its $1,900,000 of credit sales would be uncollectible. Required: Prepare the general journal entries to record these transactions. (10%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image provided shows a set of questions related to accounting concepts such as accounting principles and assumptions adjusting accounts FIFO inventory valuation and accounting for uncollectible ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started