Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(vi) An entity borrowed Ksh 500,000 in December and will make its only payment for interest when the loan comes due six months later.

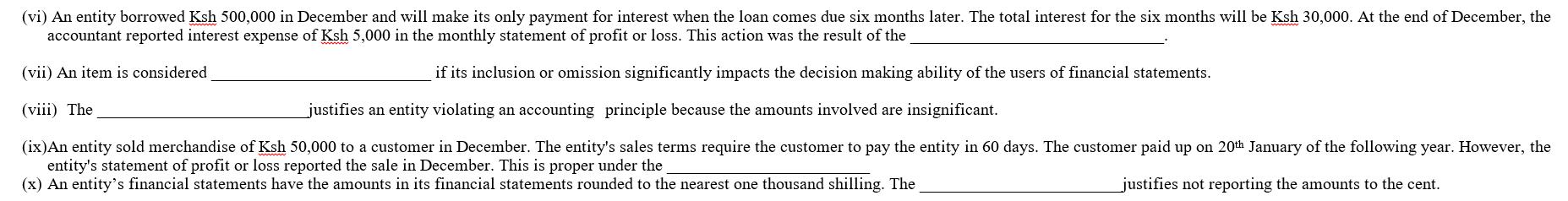

(vi) An entity borrowed Ksh 500,000 in December and will make its only payment for interest when the loan comes due six months later. The total interest for the six months will be Ksh 30,000. At the end of December, the accountant reported interest expense of Ksh 5,000 in the monthly statement of profit or loss. This action was the result of the (vii) An item is considered (viii) The if its inclusion or omission significantly impacts the decision making ability of the users of financial statements. justifies an entity violating an accounting principle because the amounts involved are insignificant. (ix) An entity sold merchandise of Ksh 50,000 to a customer in December. The entity's sales terms require the customer to pay the entity in 60 days. The customer paid up on 20th January of the following year. However, the entity's statement of profit or loss reported the sale in December. This is proper under the (x) An entity's financial statements have the amounts in its financial statements rounded to the nearest one thousand shilling. The justifies not reporting the amounts to the cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started