Answered step by step

Verified Expert Solution

Question

1 Approved Answer

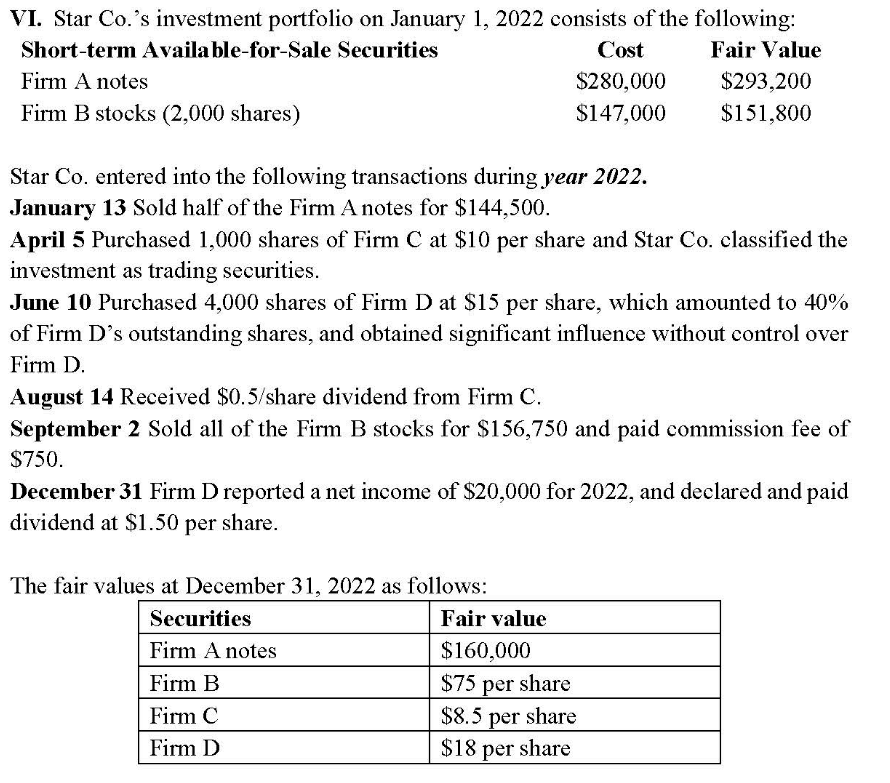

VI. Star Co.'s investment portfolio on January 1, 2022 consists of the following: Short-term Available-for-Sale Securities Fair Value Firm A notes Firm B stocks

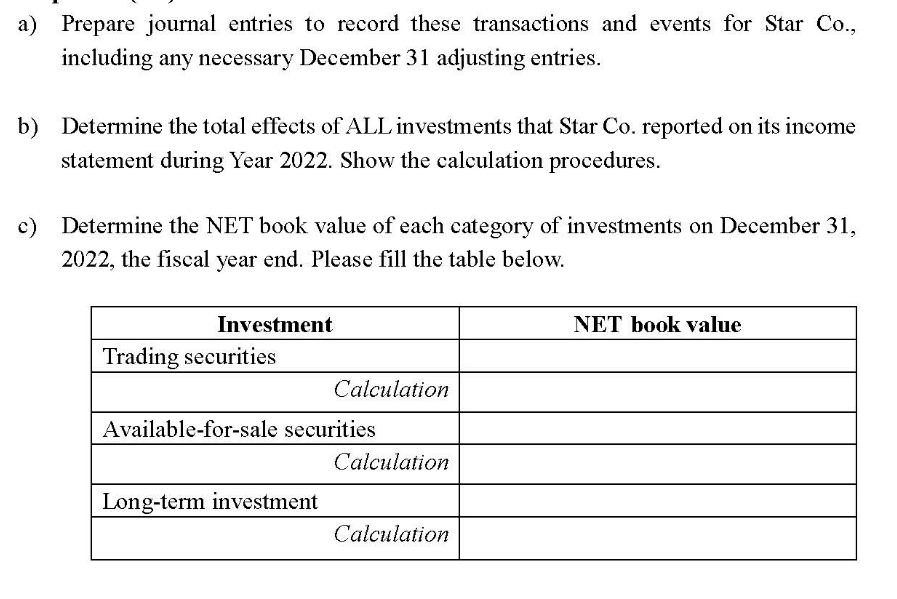

VI. Star Co.'s investment portfolio on January 1, 2022 consists of the following: Short-term Available-for-Sale Securities Fair Value Firm A notes Firm B stocks (2,000 shares) Star Co. entered into the following transactions during year 2022. January 13 Sold half of the Firm A notes for $144,500. Cost $280,000 $147,000 April 5 Purchased 1,000 shares of Firm C at $10 per share and Star Co. classified the investment as trading securities. June 10 Purchased 4,000 shares of Firm D at $15 per share, which amounted to 40% of Firm D's outstanding shares, and obtained significant influence without control over Firm D. The fair values at December 31, 2022 as follows: $293,200 $151,800 August 14 Received $0.5/share dividend from Firm C. September 2 Sold all of the Firm B stocks for $156,750 and paid commission fee of $750. December 31 Firm D reported a net income of $20,000 for 2022, and declared and paid dividend at $1.50 per share. Securities Firm A notes Firm B Firm C Firm D Fair value $160,000 $75 per share $8.5 per share $18 per share a) Prepare journal entries to record these transactions and events for Star Co., including any necessary December 31 adjusting entries. b) Determine the total effects of ALL investments that Star Co. reported on its income statement during Year 2022. Show the calculation procedures. c) Determine the NET book value of each category of investments on December 31, 2022, the fiscal year end. Please fill the table below. Investment Trading securities Calculation Available-for-sale securities Long-term investment Calculation Calculation NET book value

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entries January 13 Cash 144500 Availableforsale securities 140000 Gain on sale of securiti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started