Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Viatris Company currently has a capital structure of 70 percent debt and 30 percent equity, but is considering a new product that will be

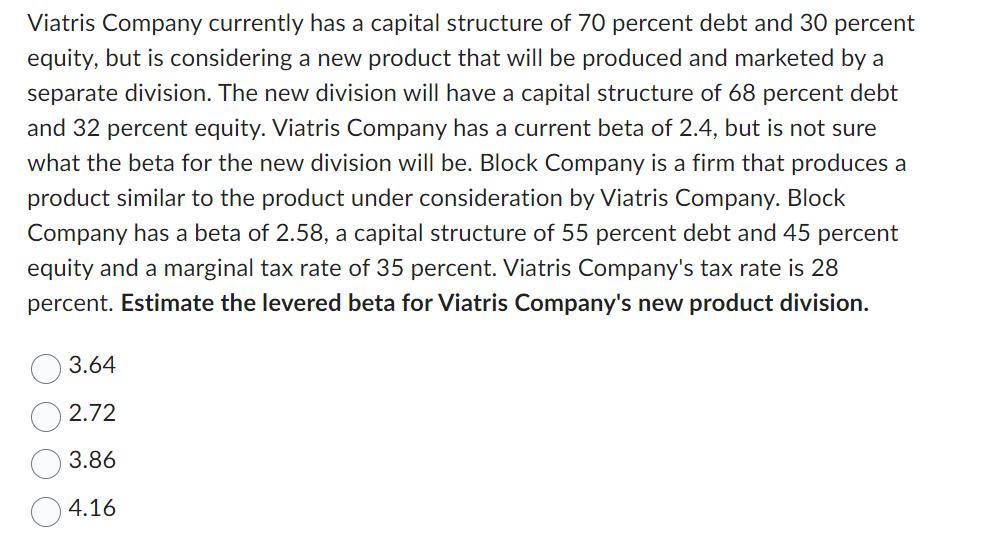

Viatris Company currently has a capital structure of 70 percent debt and 30 percent equity, but is considering a new product that will be produced and marketed by a separate division. The new division will have a capital structure of 68 percent debt and 32 percent equity. Viatris Company has a current beta of 2.4, but is not sure what the beta for the new division will be. Block Company is a firm that produces a product similar to the product under consideration by Viatris Company. Block Company has a beta of 2.58, a capital structure of 55 percent debt and 45 percent equity and a marginal tax rate of 35 percent. Viatris Company's tax rate is 28 percent. Estimate the levered beta for Viatris Company's new product division. 3.64 2.72 3.86 4.16

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The levered beta for Viatris Companys new product division can be estimated using the formula Levere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started