Answered step by step

Verified Expert Solution

Question

1 Approved Answer

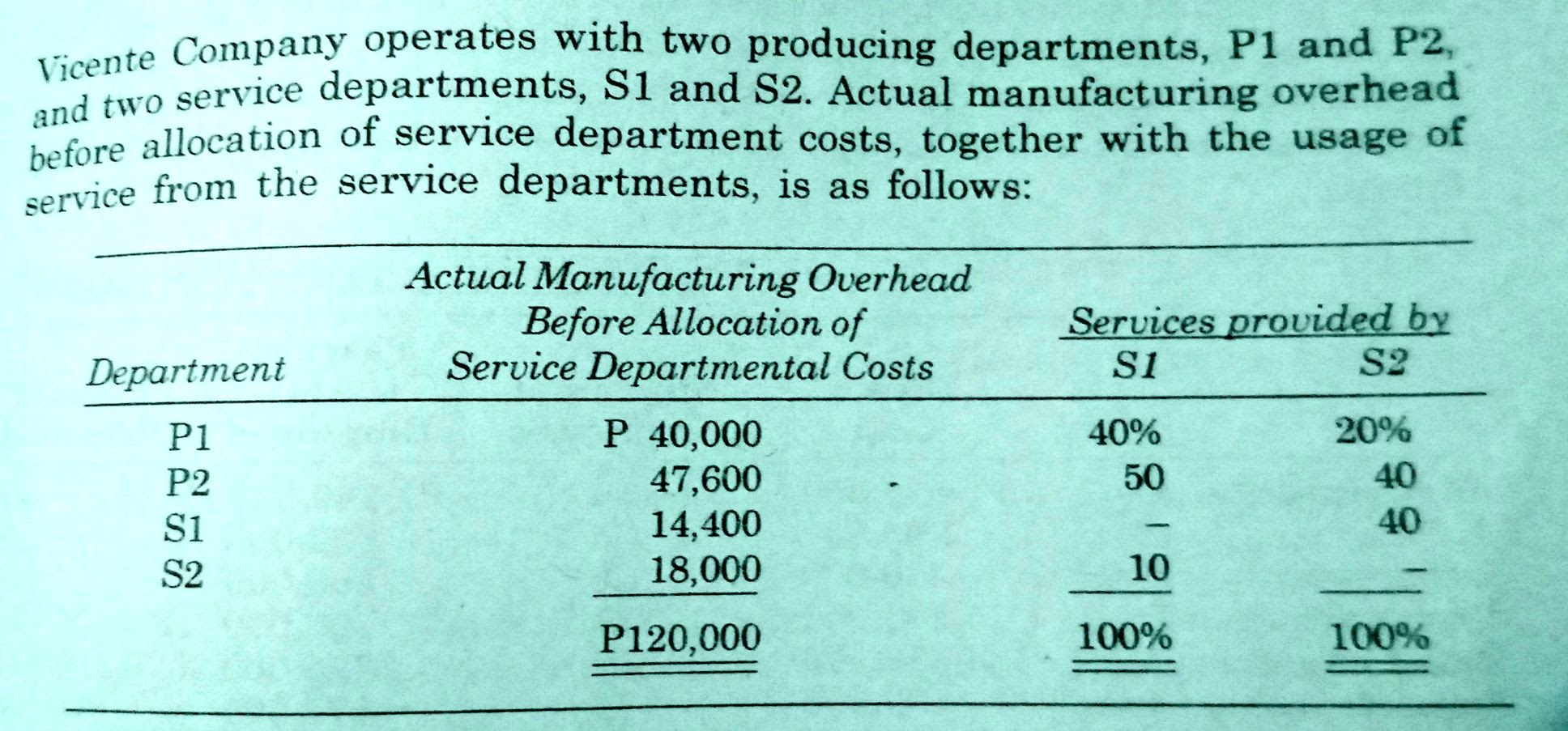

Vicente Company operates with two producing departments, P1 and P2, and two service departments, S1 and S2. Actual manufacturing overhead before allocation of service

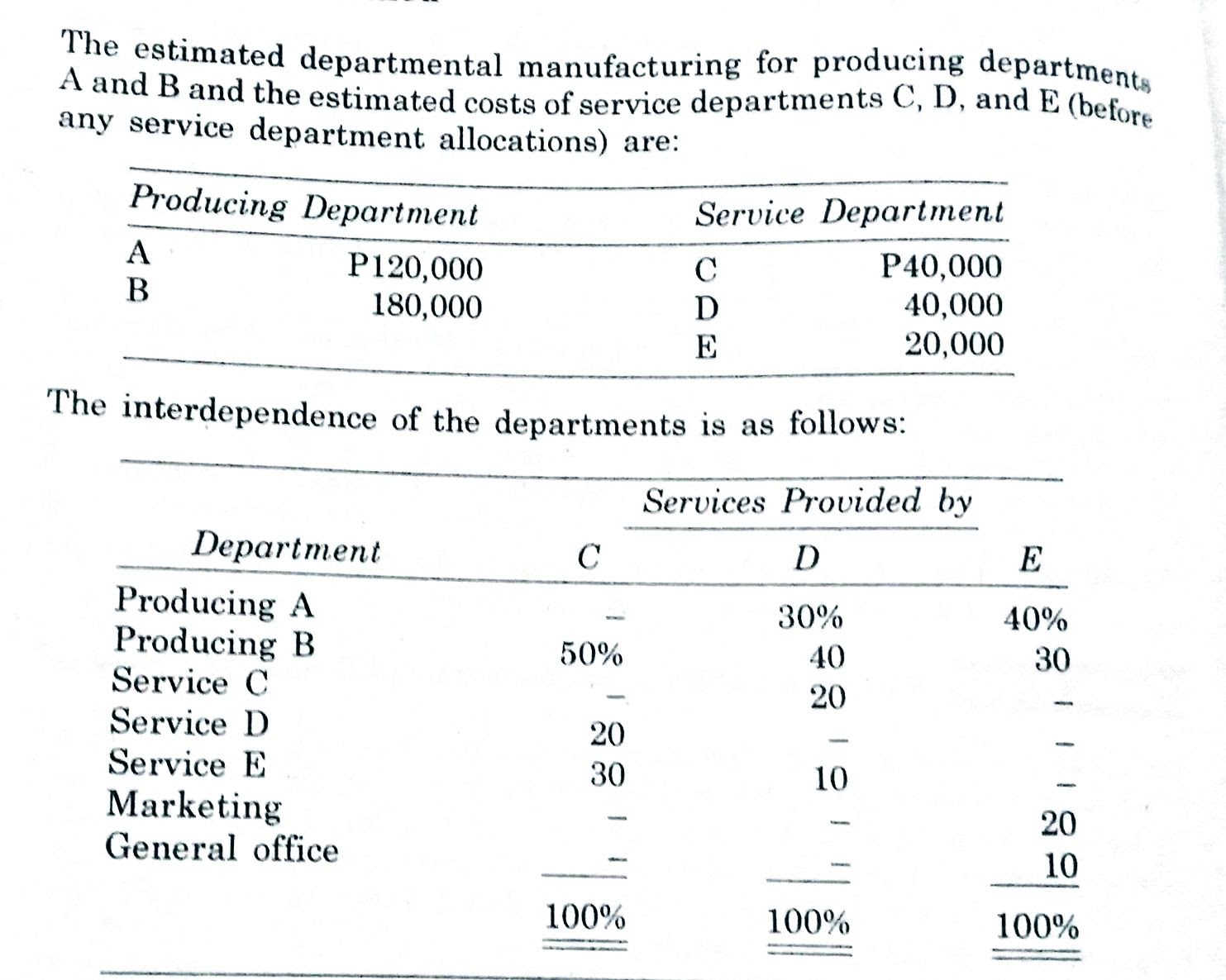

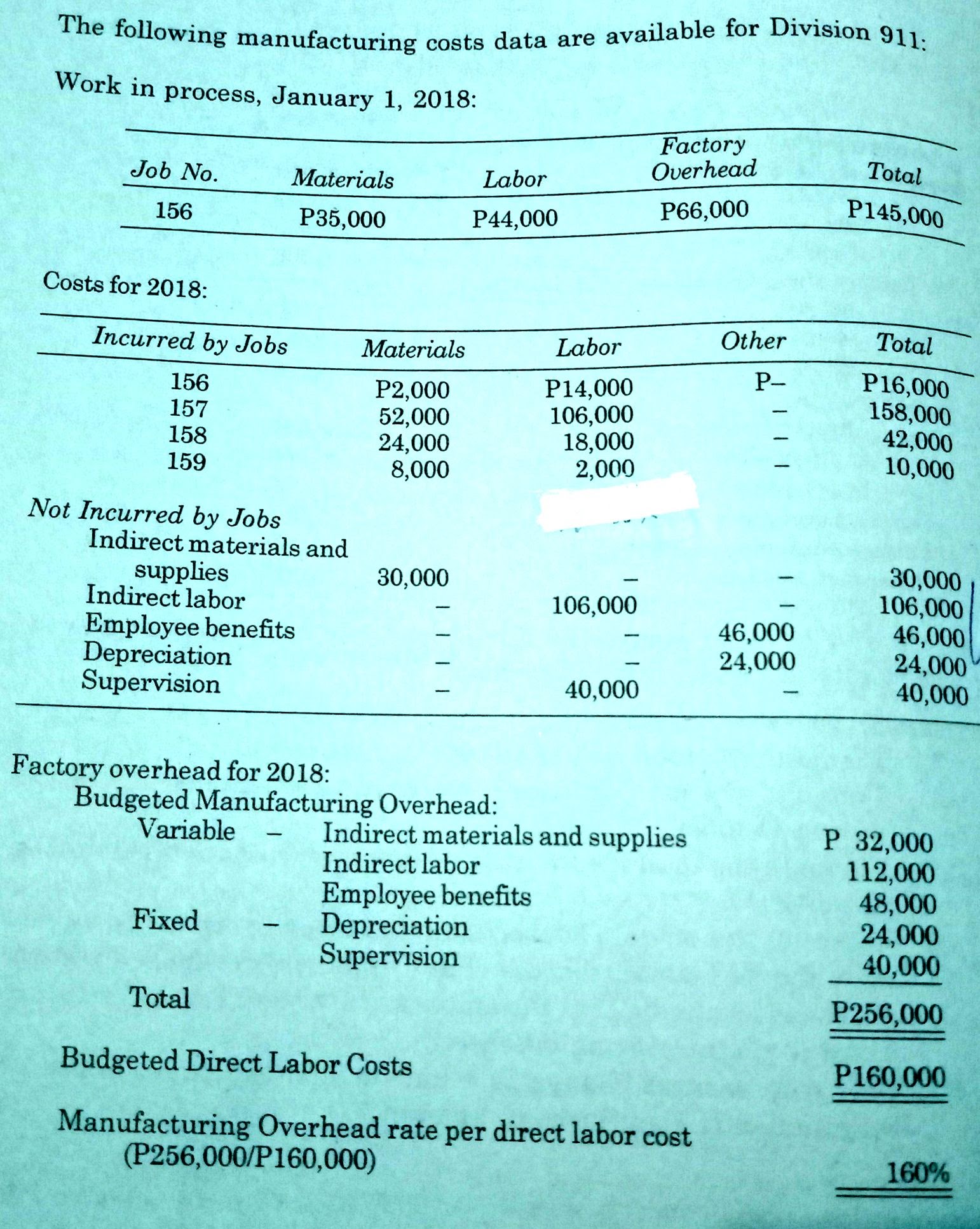

Vicente Company operates with two producing departments, P1 and P2, and two service departments, S1 and S2. Actual manufacturing overhead before allocation of service department costs, together with the usage of service from the service departments, is as follows: Actual Manufacturing Overhead Before Allocation of Service Departmental Costs P 40,000 Services provided by Department S1 S2 P1 40% 20% P2 47,600 50 40 S1 14,400 40 S2 18,000 10 P120,000 100% 100% The estimated departmental manufacturing for producing departments A and B and the estimated costs of service departments C, D, and E (before any service department allocations) are: Producing Department A B P120,000 180,000 Service Department C P40,000 D E 40,000 20,000 The interdependence of the departments is as follows: Services Provided by Department C D E Producing A 30% 40% Producing B 50% 40 30 Service C 20 Service D 20 Service E 30 10 Marketing 20 General office 10 100% 100% 100% The following manufacturing costs data are available for Division 911: Work in process, January 1, 2018: Job No. 156 Materials Labor Factory Overhead P66,000 P35,000 P44,000 Total P145,000 Costs for 2018: Incurred by Jobs Materials Labor Other Total 156 P2,000 P14,000 P- P16,000 157 52,000 106,000 158,000 158 24,000 18,000 42,000 159 8,000 2,000 10,000 Not Incurred by Jobs Indirect materials and supplies Indirect labor Employee benefits Depreciation Supervision 30,000 30,000 106,000 106,000 46,000 46,000 24,000 24,000 40,000 40,000 Factory overhead for 2018: Budgeted Manufacturing Overhead: Variable - Indirect materials and supplies Indirect labor P 32,000 112,000 Employee benefits 48,000 Fixed - Total Depreciation 24,000 Supervision 40,000 P256,000 P160,000 Budgeted Direct Labor Costs Manufacturing Overhead rate per direct labor cost (P256,000/P160,000) 160%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets tackle this stepbystep 1 Allocating the service department costs to the producing departme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started