Answered step by step

Verified Expert Solution

Question

1 Approved Answer

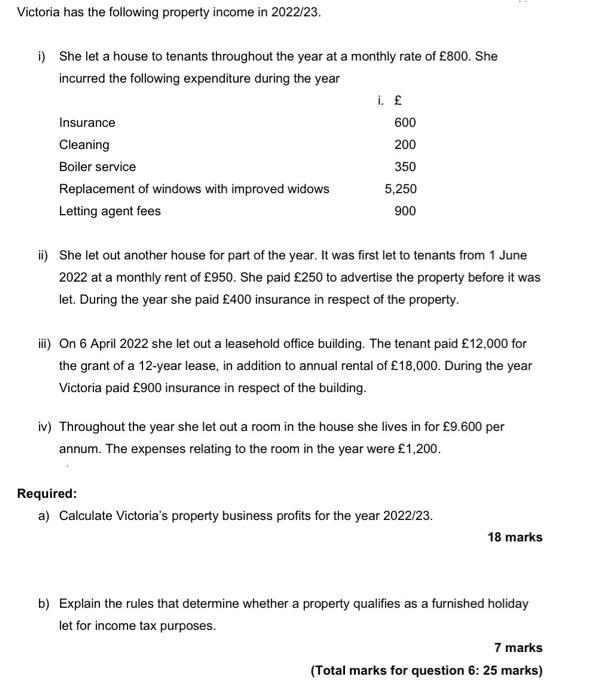

Victoria has the following property income in 2022/23. i) She let a house to tenants throughout the year at a monthly rate of 800.

Victoria has the following property income in 2022/23. i) She let a house to tenants throughout the year at a monthly rate of 800. She incurred the following expenditure during the year Insurance Cleaning Boiler service Replacement of windows with improved widows Letting agent fees i. 600 200 350 5,250 900 ii) She let out another house for part of the year. It was first let to tenants from 1 June 2022 at a monthly rent of 950. She paid 250 to advertise the property before it was let. During the year she paid 400 insurance in respect of the property. iii) On 6 April 2022 she let out a leasehold office building. The tenant paid 12,000 for the grant of a 12-year lease, in addition to annual rental of 18,000. During the year Victoria paid 900 insurance in respect of the building. iv) Throughout the year she let out a room in the house she lives in for 9.600 per annum. The expenses relating to the room in the year were 1,200. Required: a) Calculate Victoria's property business profits for the year 2022/23. 18 marks b) Explain the rules that determine whether a property qualifies as a furnished holiday let for income tax purposes. 7 marks (Total marks for question 6: 25 marks)

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Tenant or rental income can be a great way to make safe business profits However various expenses come along in due course of time Its essential to ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started