Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Victory Mowers is a wholly-owned subsidiary of Venus Inc. and manufactures two different models of lawnmowers: the budget 'Lawnmaster' model and the environmentally-friendly and

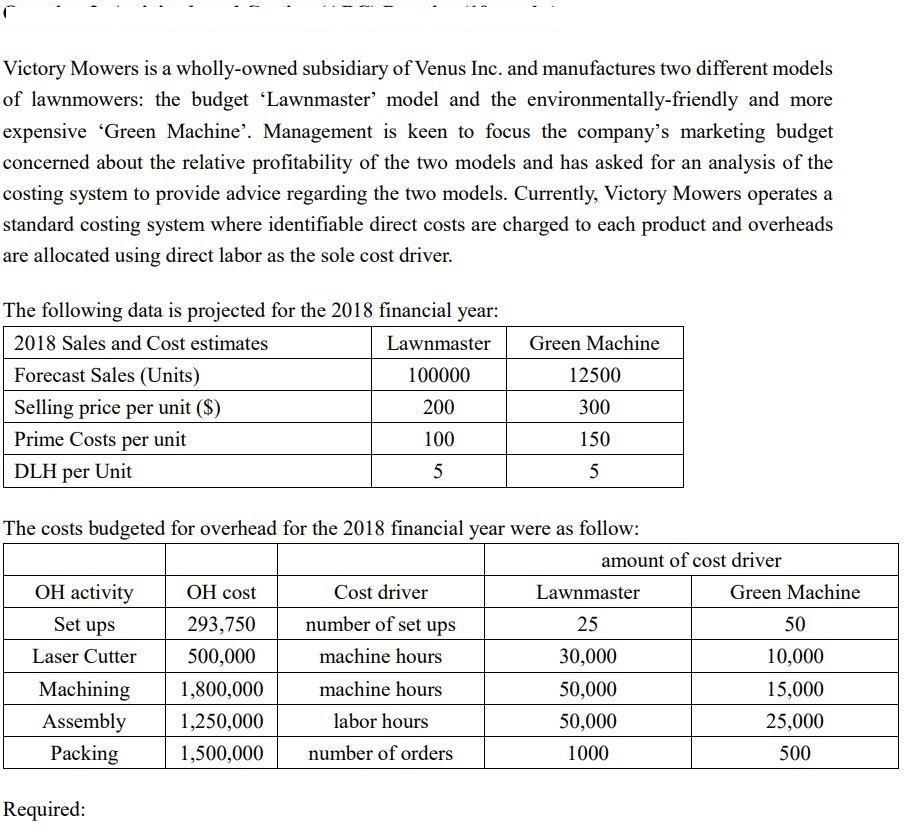

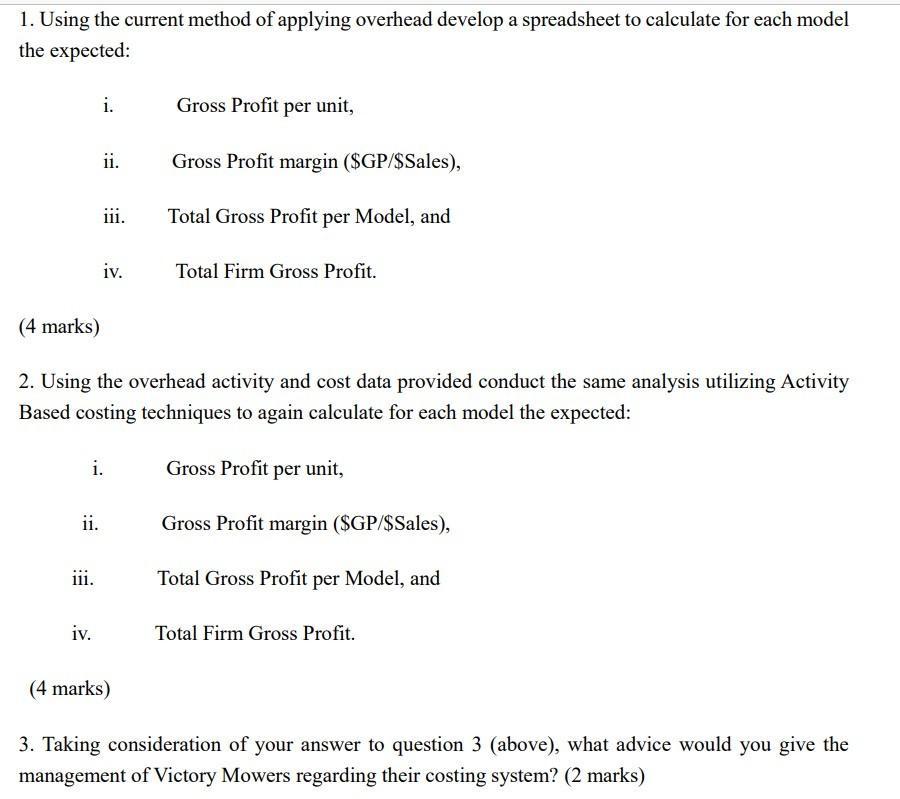

Victory Mowers is a wholly-owned subsidiary of Venus Inc. and manufactures two different models of lawnmowers: the budget 'Lawnmaster' model and the environmentally-friendly and more expensive 'Green Machine'. Management is keen to focus the company's marketing budget concerned about the relative profitability of the two models and has asked for an analysis of the costing system to provide advice regarding the two models. Currently, Victory Mowers operates a standard costing system where identifiable direct costs are charged to each product and overheads are allocated using direct labor as the sole cost driver. The following data is projected for the 2018 financial year: 2018 Sales and Cost estimates Forecast Sales (Units) Selling price per unit ($) Prime Costs per unit DLH per Unit OH activity Set ups Laser Cutter The costs budgeted for overhead for the 2018 financial year were as follow: OH cost 293,750 500,000 Machining 1,800,000 Assembly 1,250,000 Packing 1,500,000 Required: Lawnmaster 100000 200 100 5 Cost driver number of set ups machine hours Green Machine 12500 300 150 5 machine hours labor hours number of orders amount of cost driver Lawnmaster 25 30,000 50,000 50,000 1000 Green Machine 50 10,000 15,000 25,000 500 1. Using the current method of applying overhead develop a spreadsheet to calculate for each model the expected: (4 marks) ii. i. iii. ii. iv. iii. i. iv. 2. Using the overhead activity and cost data provided conduct the same analysis utilizing Activity Based costing techniques to again calculate for each model the expected: Gross Profit per unit, Gross Profit margin ($GP/$Sales), Total Gross Profit per Model, and Gross Profit per unit, Gross Profit margin ($GP/$Sales), (4 marks) Total Gross Profit per Model, and Total Firm Gross Profit. Total Firm Gross Profit. 3. Taking consideration of your answer to question 3 (above), what advice would you give the management of Victory Mowers regarding their costing system? (2 marks)

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started