Answered step by step

Verified Expert Solution

Question

1 Approved Answer

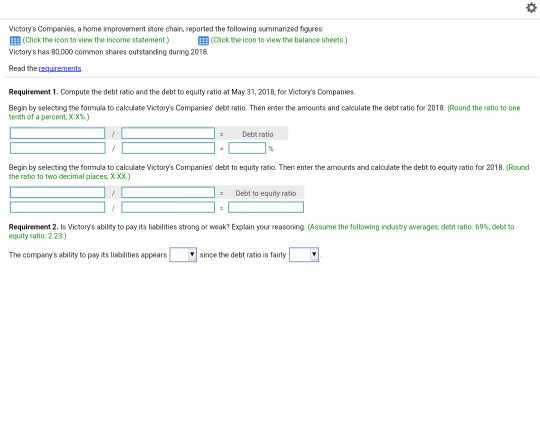

Victory's Companies, a home improvement store chains, reported the fellowing summarized fgures EEB (Click the ioon to view the income statement.) Victory's has 80000 common

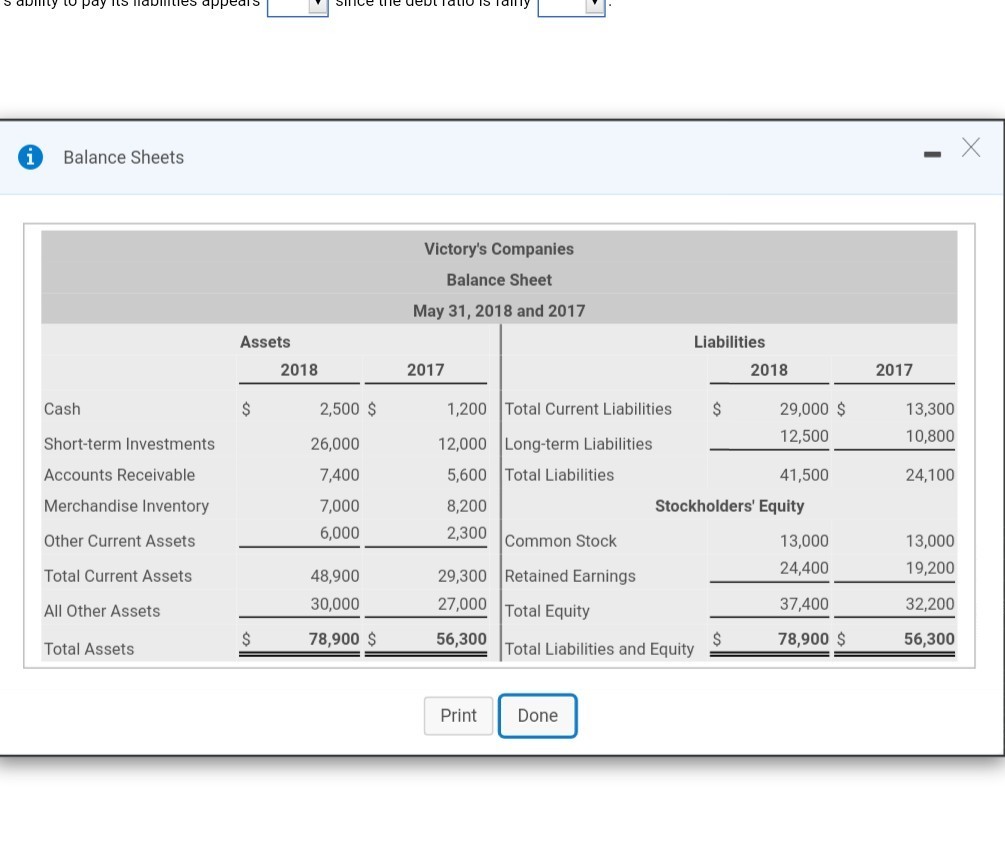

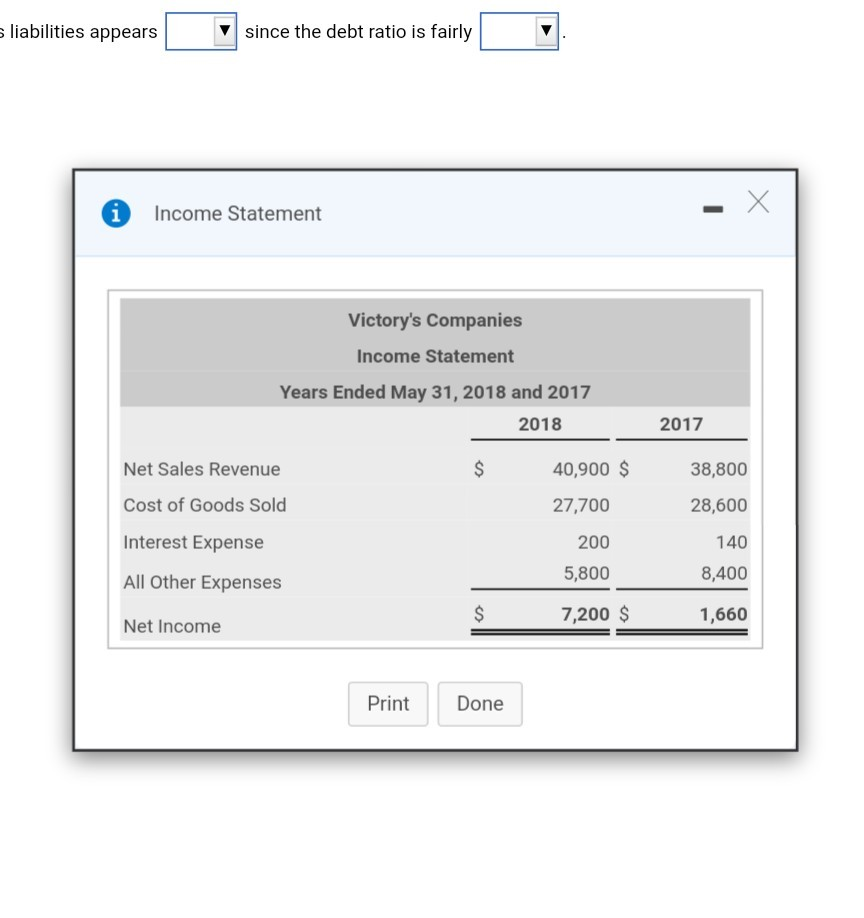

Victory's Companies, a home improvement store chains, reported the fellowing summarized fgures EEB (Click the ioon to view the income statement.) Victory's has 80000 common shares outstandng during 2018 Read the tequr ments (Cick the icon to view the balance sheets ) Requirement 1, Compute the debt ratio and the debt to equity ratio at May 31, 2018 for Victory's Companies Begin by selecting the formula to calculate Victory's Companies' debt ratio. Then ener the amounts and calculate the debt ratio for 201 8 IRound 1he ratio to one tenth of a percent. X X%) : Debt ratio Begin by selecting the formula to caloulate Victory's Companies' debt to equity ratio. Then enter the amounts and calculate the debt to equity ratio for 2018. (Round the ratio to two decimal places, XXx) Debt to equity ratio Requirement 2 Is Victory's ability to pay its liabilities strong or weak, Explain your reasor ng equity ratio: 223) Assume lhe following i dustry averages; debt ratio 69%, debt to The company's ability to pay its liablities appears since the debt ratio is fairly Balance Sheets Victory's Companies Balance Sheet May 31, 2018 and 2017 Assets Liabilities 2017 2018 2017 Cash Short-term Investments Accounts Receivable Merchandise Inventory Other Current Assets Total Current Assets All Other Assets Total Assets 29,000 $ 12,500 2,500 $ 1,200 Total Current Liabilities$ 13,300 10,800 26,000 7,400 7,000 6,000 48,900 30,000 78,900 $ 12,000 Long-term Liabilities 41,500 24,100 5,600 Total Liabilities 8,200 2,300 Stockholders' Equity 13,000 24,400 37,400 78,900 $ 13,000 19,200 32,200 56,300 Common Stock 29,300 Retained Earnings 27,000 Total Equity 56,300 Total Liabilities and Equity Print Done liabilities appears since the debt ratio is fairly Income Statement Victory's Companies Income Statement Years Ended May 31, 2018 and 2017 2018 2017 40,900 $ Net Sales Revenue Cost of Goods Sold Interest Expense All Other Expenses Net Income 38,800 28,600 140 8,400 1,660 27,700 200 5,800 7,200 $ PrintDone

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started