Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Videos-to-Go signed a lease for a vehicle that had an expected economic life of eight years and a fair value of $12,700. The lessor

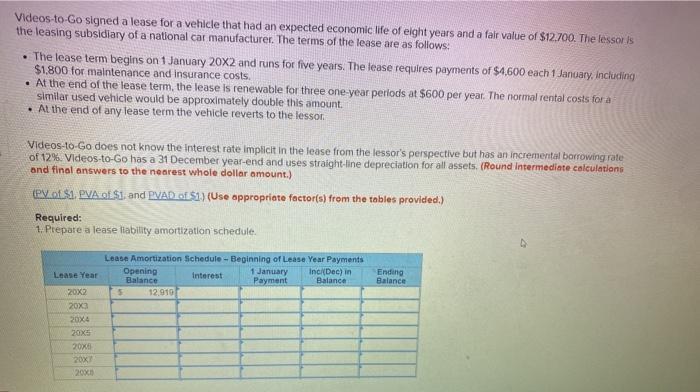

Videos-to-Go signed a lease for a vehicle that had an expected economic life of eight years and a fair value of $12,700. The lessor is the leasing subsidiary of a national car manufacturer. The terms of the lease are as follows: The lease term begins on 1 January 20X2 and runs for five years. The lease requires payments of $4,600 each 1 January, including $1,800 for maintenance and insurance costs. . At the end of the lease term, the lease is renewable for three one-year periods at $600 per year. The normal rental costs for a similar used vehicle would be approximately double this amount. . At the end of any lease term the vehicle reverts to the lessor. Videos-to-Go does not know the interest rate implicit in the lease from the lessor's perspective but has an incremental borrowing rate of 12%. Videos-to-Go has a 31 December year-end and uses straight-line depreciation for all assets. (Round intermediate calculations and final answers to the nearest whole dollar amount.) (PV of $1. PVA of $1. and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare a lease liability amortization schedule. Lease Year 20x2 20x3 20X4 20x5 20x6 20x7 20x8 Lease Amortization Schedule - Beginning of Lease Year Payments 1 January Interest Inc/(Dec) in Balance Payment Opening Balance 5 12,910 Ending Balance

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The Leased Asset and liability both are recorded in the books of the lessee at the value of Present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started