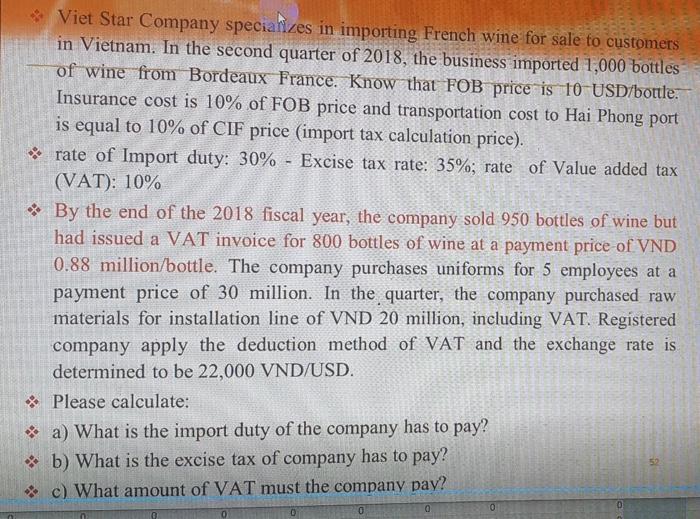

Viet Star Company specializes in importing French wine for sale to customers in Vietnam. In the second quarter of 2018, the business imported 1,000 bottles of wine from Bordeaux France. Know that FOB price is 10-USD/bottle. Insurance cost is 10% of FOB price and transportation cost to Hai Phong port is equal to 10% of CIF price (import tax calculation price). rate of Import duty: 30% - Excise tax rate: 35%; rate of Value added tax (VAT): 10% By the end of the 2018 fiscal year, the company sold 950 bottles of wine but had issued a VAT invoice for 800 bottles of wine at a payment price of VND 0.88 million/bottle. The company purchases uniforms for 5 employees at a payment price of 30 million. In the quarter, the company purchased raw materials for installation line of VND 20 million, including VAT. Registered company apply the deduction method of VAT and the exchange rate is determined to be 22,000 VND/USD. Please calculate: a) What is the import duty of the company has to pay? b) What is the excise tax of company has to pay? c) What amount of VAT must the company pay? 52 0 0 0 Viet Star Company specializes in importing French wine for sale to customers in Vietnam. In the second quarter of 2018, the business imported 1,000 bottles of wine from Bordeaux France. Know that FOB price is 10-USD/bottle. Insurance cost is 10% of FOB price and transportation cost to Hai Phong port is equal to 10% of CIF price (import tax calculation price). rate of Import duty: 30% - Excise tax rate: 35%; rate of Value added tax (VAT): 10% By the end of the 2018 fiscal year, the company sold 950 bottles of wine but had issued a VAT invoice for 800 bottles of wine at a payment price of VND 0.88 million/bottle. The company purchases uniforms for 5 employees at a payment price of 30 million. In the quarter, the company purchased raw materials for installation line of VND 20 million, including VAT. Registered company apply the deduction method of VAT and the exchange rate is determined to be 22,000 VND/USD. Please calculate: a) What is the import duty of the company has to pay? b) What is the excise tax of company has to pay? c) What amount of VAT must the company pay? 52 0 0 0