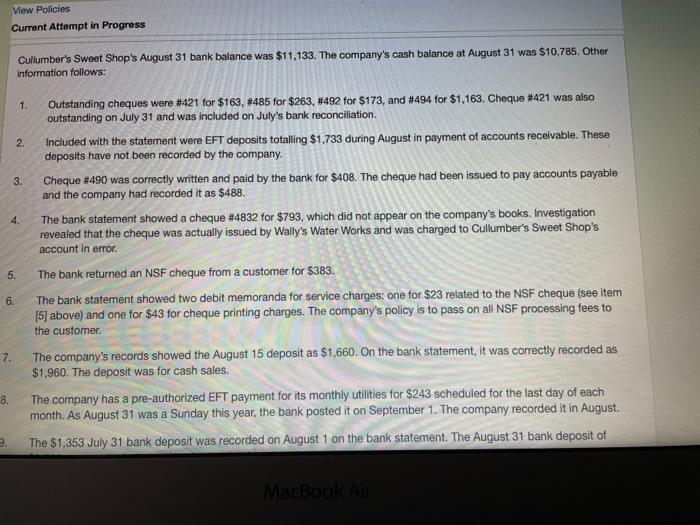

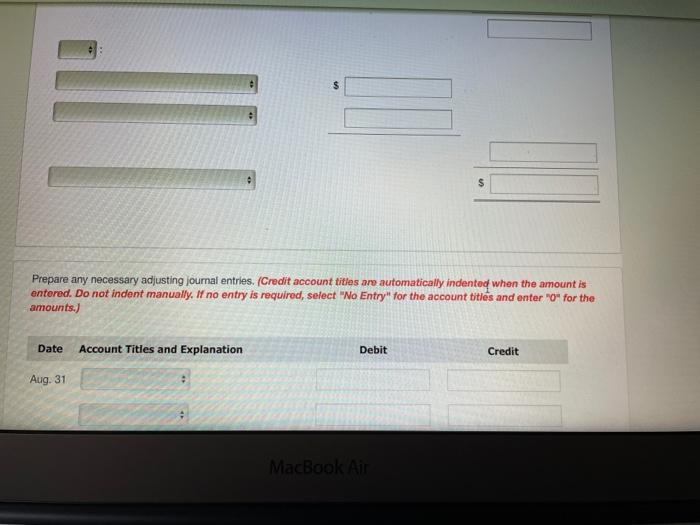

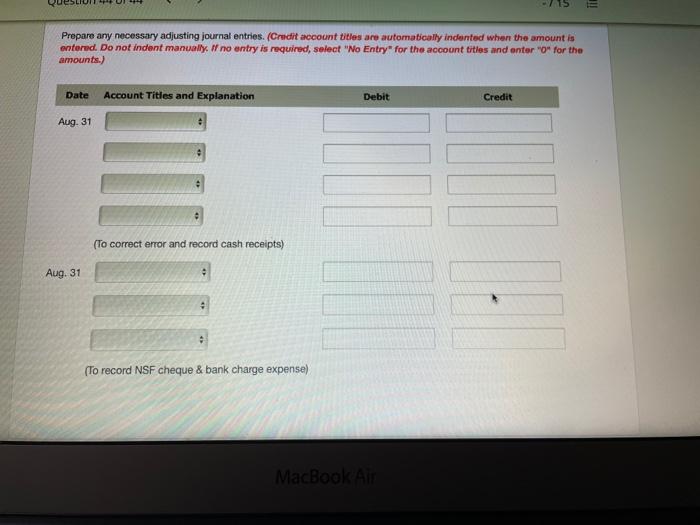

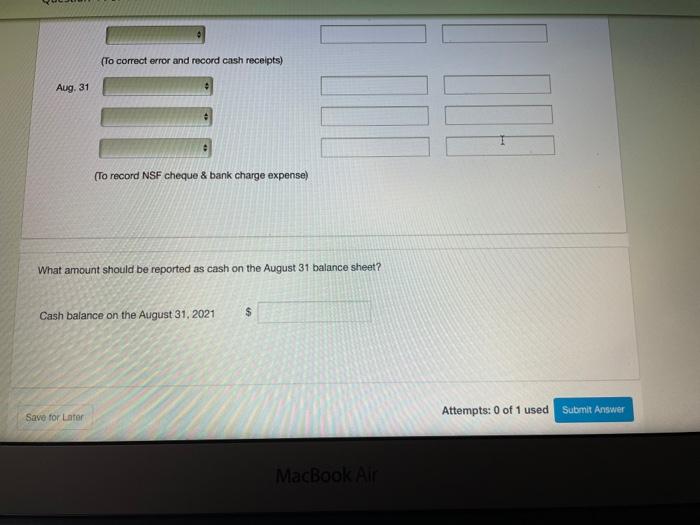

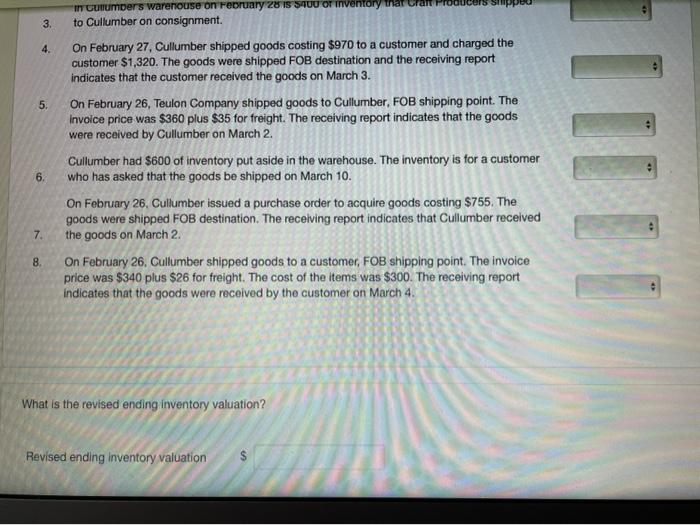

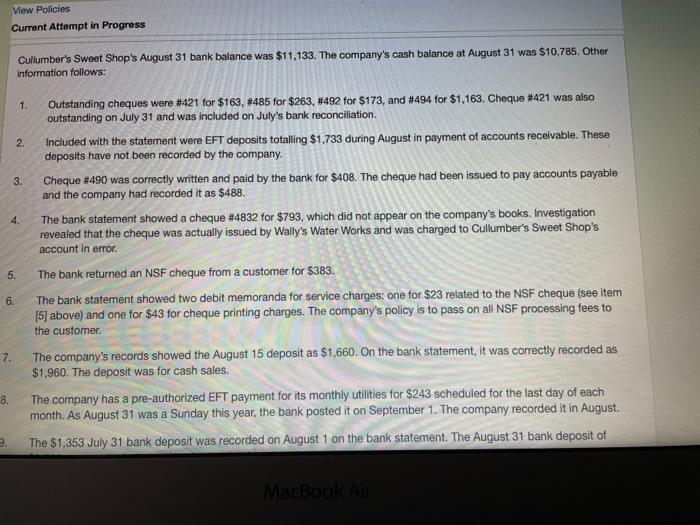

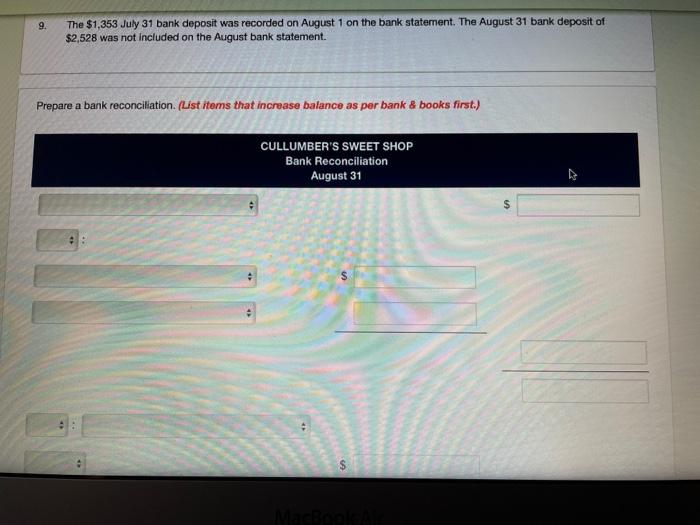

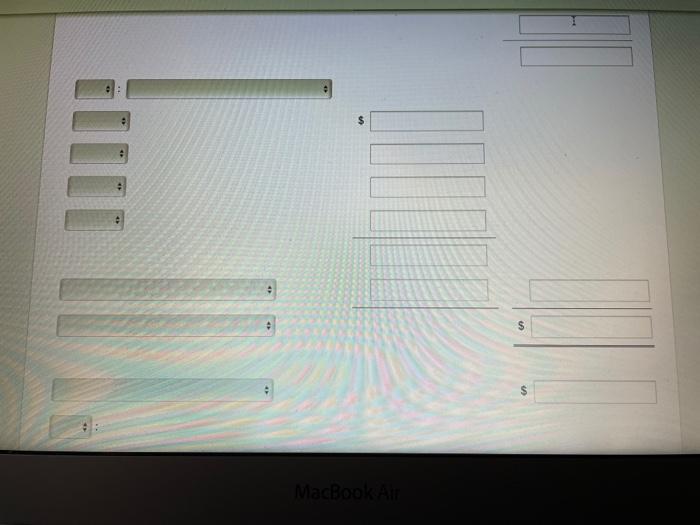

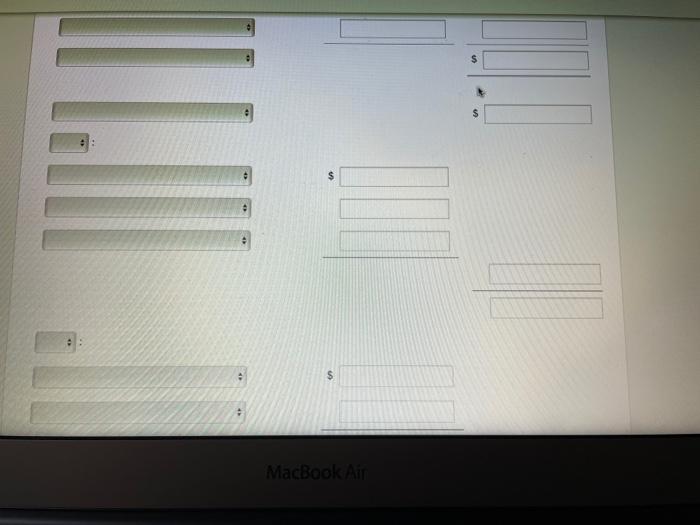

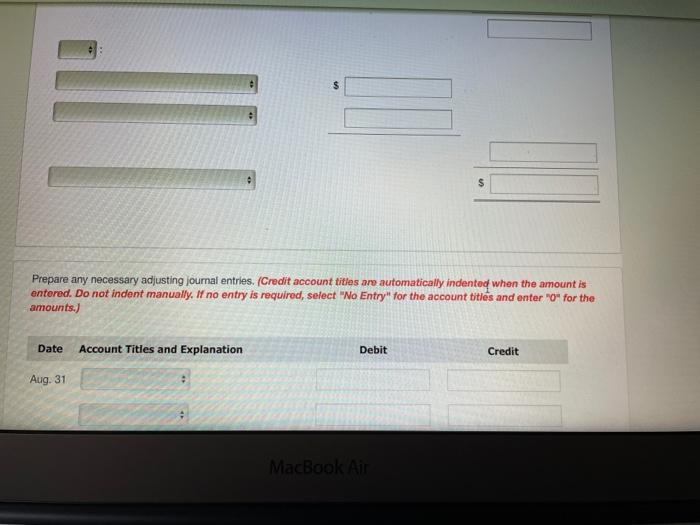

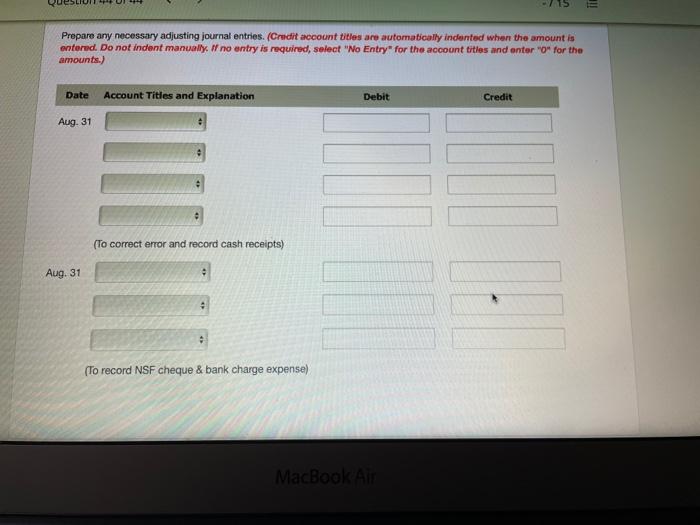

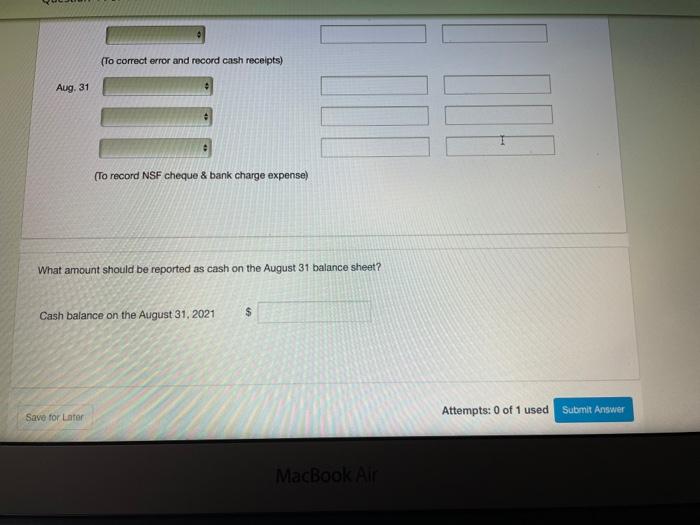

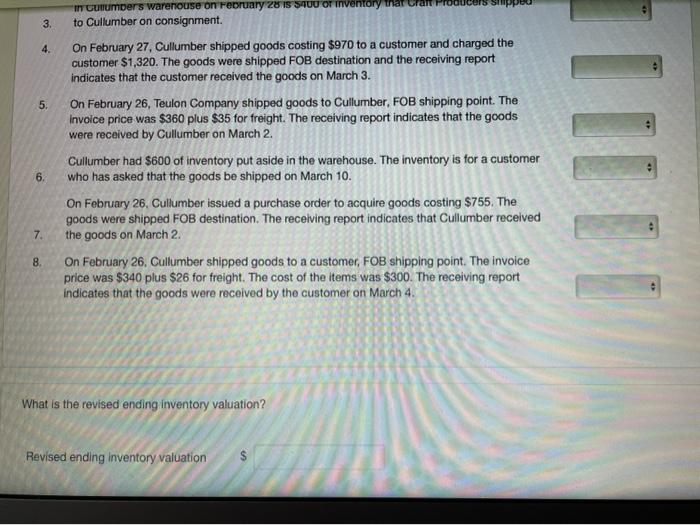

View Policies Current Attempt in Progress Cullumber's Sweet Shop's August 31 bank balance was $11,133. The company's cash balance at August 31 was $10,785. Other information follows: 1. 2. 3. 4. 5. Outstanding cheques were #421 for $163, #485 for $263, #492 for $173, and #494 for $1,163. Cheque #421 was also outstanding on July 31 and was included on July's bank reconciliation Included with the statement were EFT deposits totalling $1,733 during August in payment of accounts receivable. These deposits have not been recorded by the company. Cheque #490 was correctly written and paid by the bank for $408. The cheque had been issued to pay accounts payable and the company had recorded it as $488. The bank statement showed a cheque #4832 for $793, which did not appear on the company's books. Investigation revealed that the cheque was actually issued by Wally's Water Works and was charged to Cullumber's Sweet Shop's account in error The bank returned an NSF cheque from a customer for $383. The bank statement showed two debit memoranda for service charges: one for $23 related to the NSF cheque (see item (5) above) and one for $43 for cheque printing charges. The company's policy is to pass on all NSF processing fees to the customer. The company's records showed the August 15 deposit as $1.660. On the bank statement, it was correctly recorded as $1,960. The deposit was for cash sales. The company has a pre-authorized EFT payment for its monthly utilities for $243 scheduled for the last day of each month. As August 31 was a Sunday this year, the bank posted it on September 1. The company recorded it in August. The $1,353 July 31 bank deposit was recorded on August 1 on the bank statement. The August 31 bank deposit of 6. 7. 8. 2. MacBook Air 9. The $1,353 July 31 bank deposit was recorded on August 1 on the bank statement. The August 31 bank deposit of $2,528 was not included on the August bank statement. Prepare a bank reconciliation. (List items that increase balance as per bank & books first.) CULLUMBER'S SWEET SHOP Bank Reconciliation August 31 $ S $ MacBook AS s $ $ MacBook Air $ e S Prepare any necessary adjusting journal entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter "O" for the amounts.) Date Account Titles and Explanation Debit Credit Aug. 31 MacBook Air = Prepare any necessary adjusting journal entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. W no entry is required, select "No Entry" for the account titles and enter "O for the amounts.) Date Account Titles and Explanation Debit Credit Aug. 31 (To correct error and record cash receipts) Aug. 31 . . (To record NSF cheque & bank charge expense) MacBook Air (To correct error and record cash receipts) Aug. 31 (To record NSF cheque & bank charge expense) What amount should be reported as cash on the August 31 balance sheet? Cash balance on the August 31, 2021 $ Attempts: 0 of 1 used Submit Answer Save for Lator MacBook Air 3 4. 5. munumbers warenouse on February 2018 SAU O inventory to Cullumber on consignment. On February 27, Cullumber shipped goods costing $970 to a customer and charged the customer $1,320. The goods were shipped FOB destination and the receiving report indicates that the customer received the goods on March 3. On February 26, Teulon Company shipped goods to Cullumber, FOB shipping point. The Invoice price was $360 plus $35 for freight. The receiving report indicates that the goods were received by Cullumber on March 2 Cullumber had $600 of inventory put aside in the warehouse. The inventory is for a customer who has asked that the goods be shipped on March 10. On February 26, Cullumber issued a purchase order to acquire goods costing $755. The goods were shipped FOB destination. The receiving report indicates that Cullumber received the goods on March 2 On February 26, Cullumber shipped goods to a customer, FOB shipping point. The invoice price was $340 plus $26 for freight. The cost of the items was $300. The receiving report indicates that the goods were received by the customer on March 4. LILLE 6. 7. 8. What is the revised ending inventory valuation? Revised ending inventory valuation