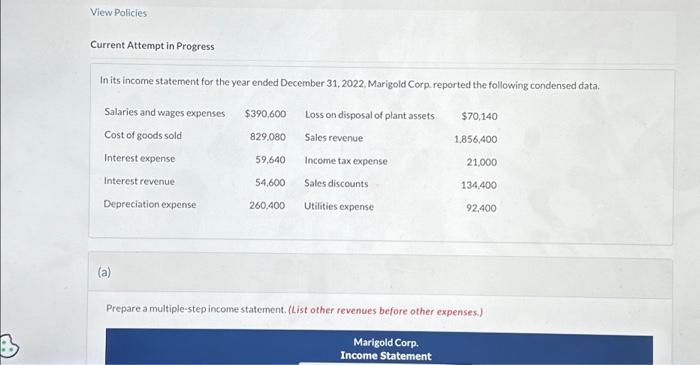

Question: View Policies Current Attempt in Progress In its income statement for the year ended December 31, 2022, Marigold Corp. reported the following condensed data. Salaries

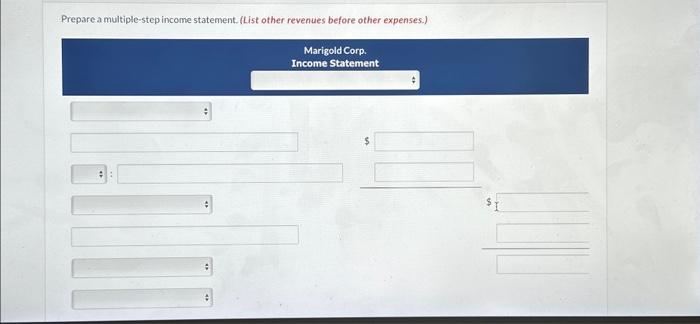

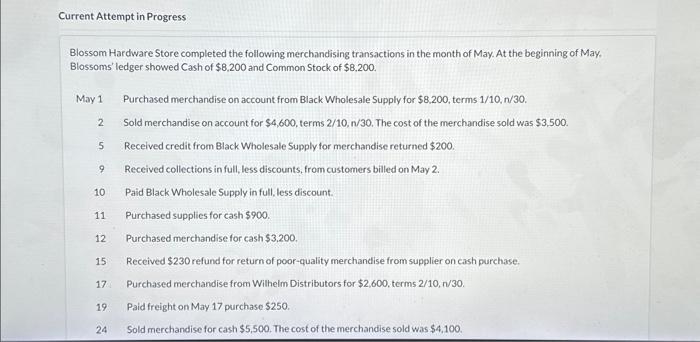

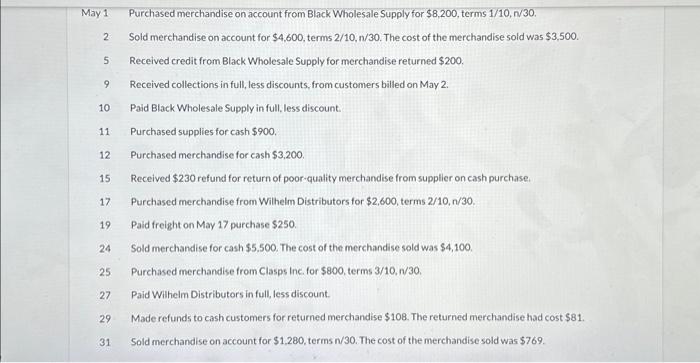

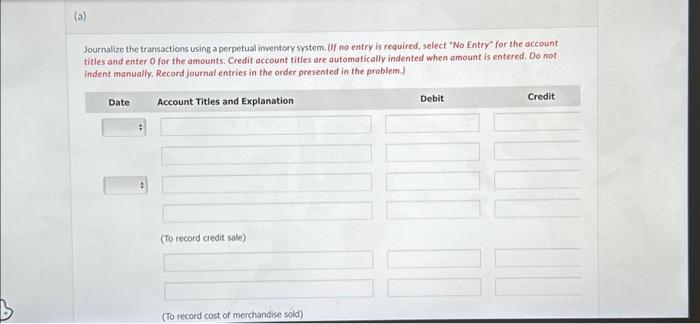

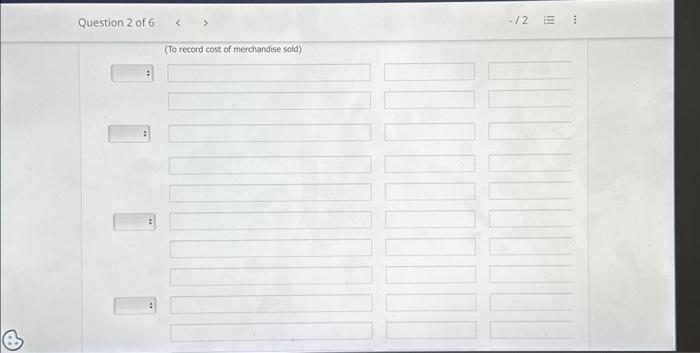

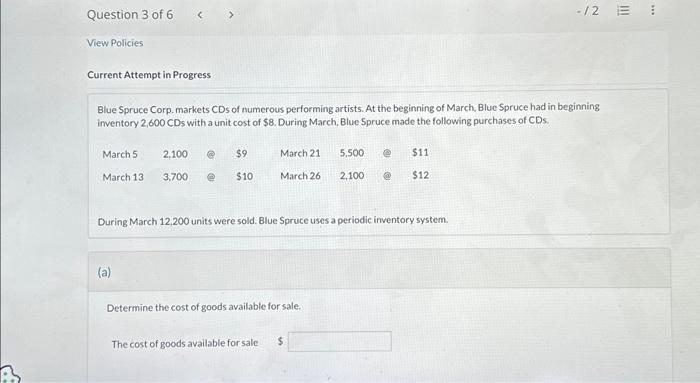

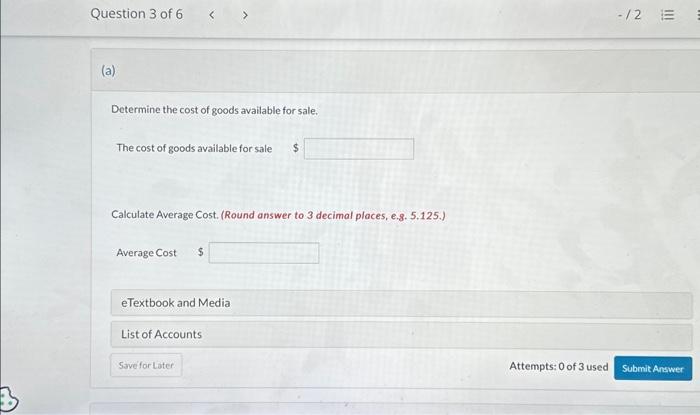

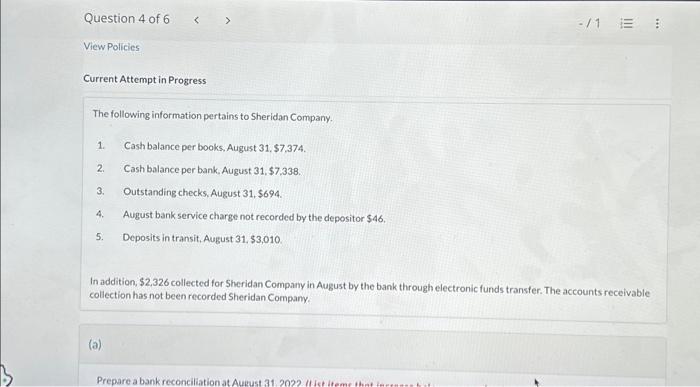

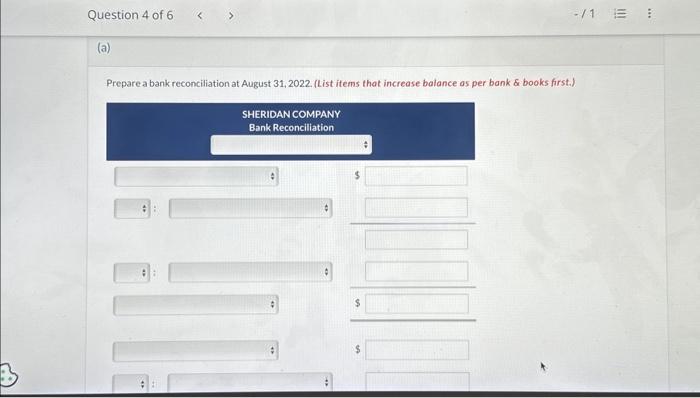

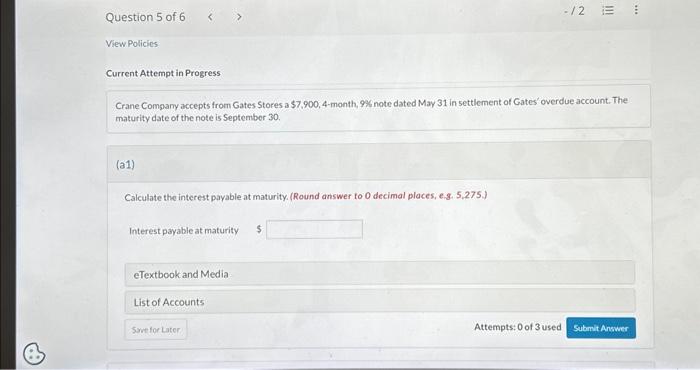

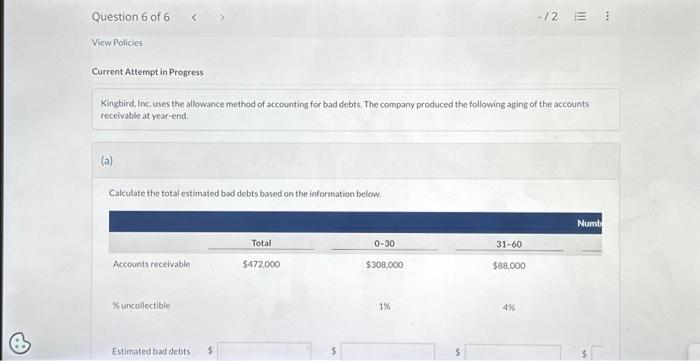

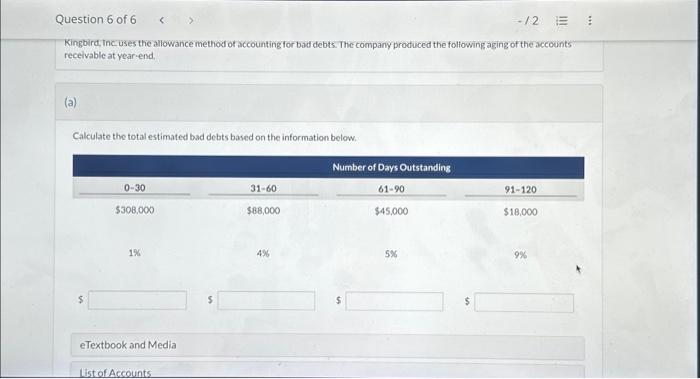

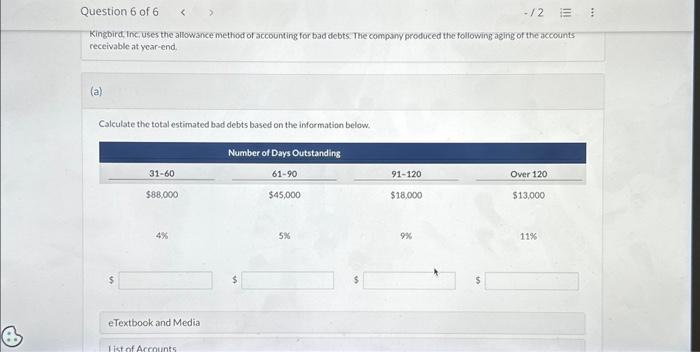

Current Attempt in Progress In its income statement for the year ended December 31, 2022, Marigold Corp. reported the following condensed data. (a) Prepare a multiple-step income statement. (List other revenues before other expenses.) (To record sales) (To record cost of merchandise sold) The following information pertains to Sheridan Company. 1. Cash balance per books, August 31,$7,374. 2. Cash balance per bank, August 31,$7,338. 3. Outstanding checks, August 31, $694. 4. August bank service charge not recorded by the depositor $46. 5. Deposits in transit, August 31,$3,010. In addition, \$2,326 collected for Sheridan Company in August by the bank through electronic funds transfer. The accounts receivable collection has not been recorded Sheridan Company. Prepare a multiple-step income statement. (List other revenues before other expenses.) May 1 Purchased merchandise on account from Black Wholesale Supply for $8,200, terms 1/10,n/30. 2. Sold merchandise on account for $4,600, terms 2/10,n/30. The cost of the merchandise sold was $3,500. 5 Received credit from Black Wholesale Supply for merchandise returned $200. 9 Received collections in full, less discounts, from customers billed on May 2. 10 Paid Black Wholesale Supply in full, less discount. 11 Purchased supplies for cash $900. 12 Purchased merchandise for cash $3,200. 15 Received $230 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Wilhelm Distributors for $2,600, terms 2/10,n/30. 19 Paid freight on May 17 purchase $250. 24 Sold merchandise for cash \$5.500. The cost of the merchandise sold was $4,100. 25 Purchased merchandise from Clasps Inc. for $800, terms 3/10,n/30. 27 Paid Wilhelm Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $108. The returned merchandise had cost $81. 31 Sold merchandise on account for $1,280, terms n/30. The cost of the merchandise sold was $769. Determine the cost of goods available for sale. The cost of goods available for sale Calculate Average Cost. (Round answer to 3 decimal places, e.8. 5.125.) (To record payment for returned merchandise) (To record cost of goods returned) (To record credit sale) (To record cost of goods sold on account) eTextbook and Media Crane Company accepts from Gates Stores a \$7,900, 4-month, 9% note dated May 31 in settlement of Gates overdue account. The maturity date of the note is September 30 . (a1) Calculate the interest payable at maturity. (Round answer to 0 decimal places, e.g. 5,275) Interest payable at maturity Current Attempt in Progress Blue Spruce Corp. markets CDs of numerous performing artists. At the beginning of March, Blue Spruce had in beginning inventory 2,600 CDs with a unit cost of \$8. During March. Blue Spruce made the following purchases of CDS. During March 12,200 units were sold. Blue Spruce uses a periodic inventory system. (a) Determine the cost of goods available for sale. The cost of goods available for sale Blossom Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May. Blossoms' ledger showed Cash of $8,200 and Common Stock of $8,200. May 1 Purchased merchandise on account from Black Wholesale Supply for $8,200, terms 1/10,n/30. 2 Sold merchandise on account for $4,600, terms 2/10,n/30. The cost of the merchandise sold was $3,500. 5 Received credit from Black Wholesale Supply for merchandise returned $200. 9. Received collections in full, less discounts, from customers billed on May 2. 10 Paid Black Wholesale Supply in full, less discount. 11 Purchased supplies for cash $900. 12 Purchased merchandise for cash $3,200. 15 Received $230 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Wilhelm Distributors for $2,600, terms 2/10,n/30. 19. Paid freight on May 17 purchase $250. 24 Sold merchandise for cash $5,500. The cost of the merchandise sold was $4,100. Kingbird, Inc uses the allowance method of accounting for bad debts. The company produced the following aging of the accounts receivable at year end. (a) Calculate the total estimated bad debts based on the information below. Journalize the transactions using a perpetual inventory system. (If no entry is required, select "No Entry" for the occount tilles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Question 2 of 6 12 (To record cost of merchandise sold) Prepare a bank reconciliation at August 31, 2022. (List items that increase balance os per bank \& books first.) Kingbird, Inc. uses the allowance method of accounting for bad debts. The company produced the following aging of the accounts receivable at year-end. (a) Calculate the total estimated bad debts based on the information below. Question 4 of 6 /1 Kingbird, Inc, uses the allowance method of accounting for bad debts. The company produced the following aging of the accounts receivable at year-end. (a) Calculate the total estimated bad debts based on the information below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts