Answered step by step

Verified Expert Solution

Question

1 Approved Answer

View Policies Current Attempt in Progress Larkspur Department Store Inc., a private company following ASPE, is located near a shopping mall. At the end

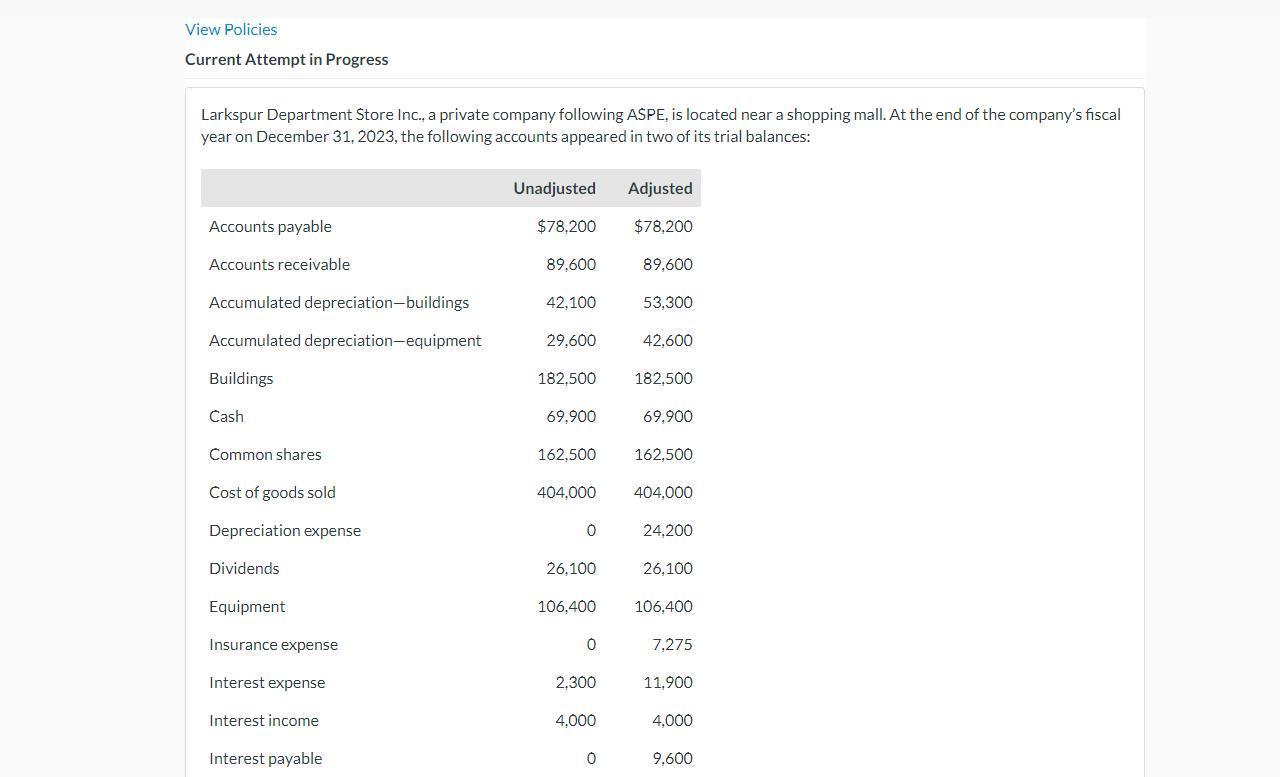

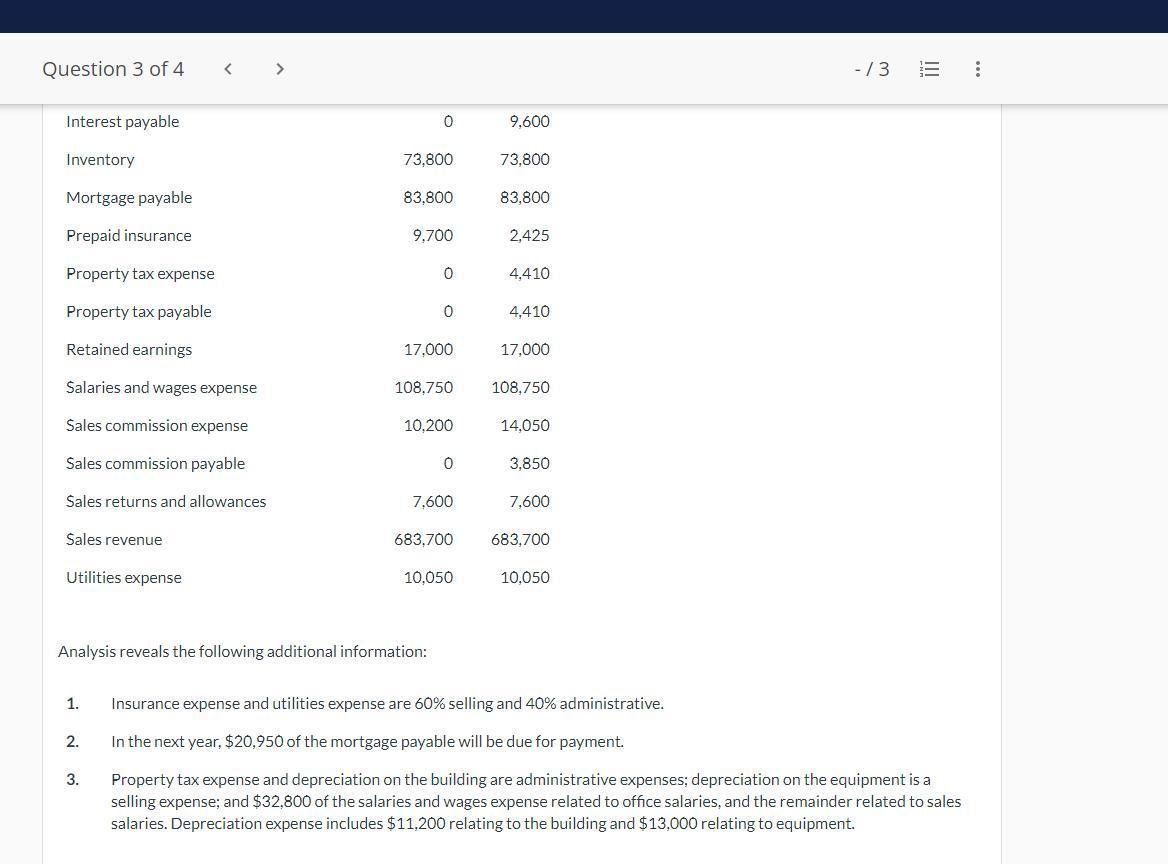

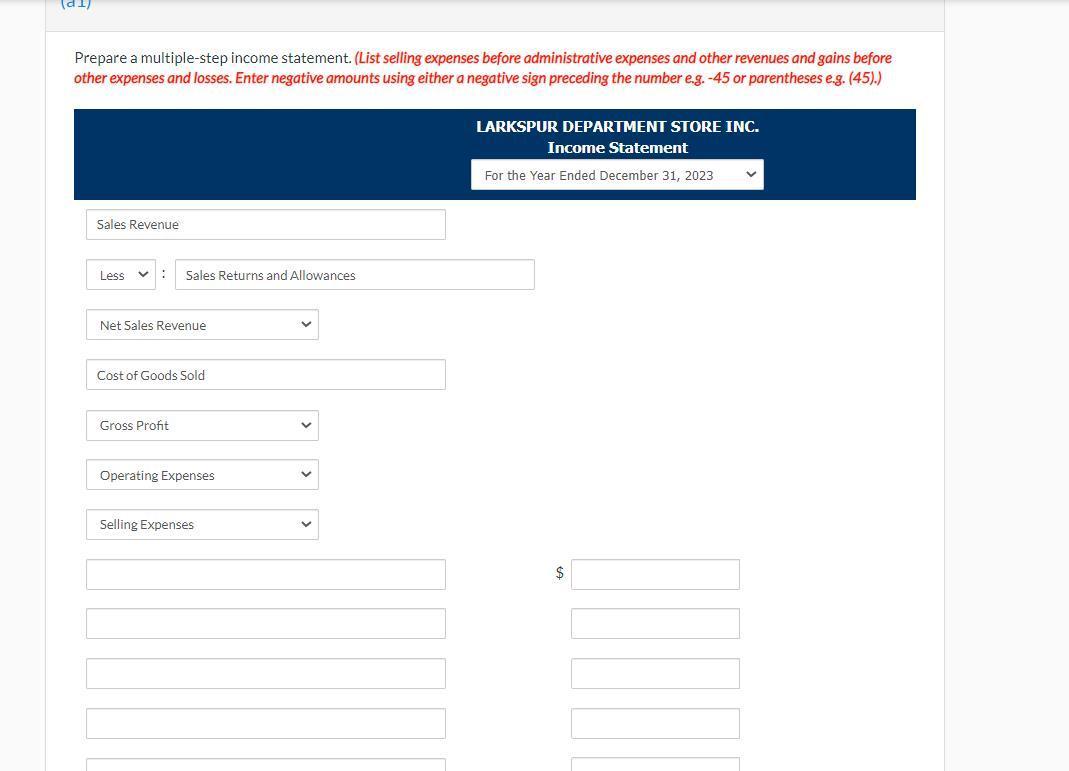

View Policies Current Attempt in Progress Larkspur Department Store Inc., a private company following ASPE, is located near a shopping mall. At the end of the company's fiscal year on December 31, 2023, the following accounts appeared in two of its trial balances: Accounts payable Accounts receivable Accumulated depreciation-buildings Accumulated depreciation-equipment Buildings Cash Common shares Cost of goods sold Depreciation expense Dividends Equipment Insurance expense Interest expense Interest income Interest payable Unadjusted $78,200 89,600 42,100 29,600 182,500 69,900 162,500 404,000 0 26,100 106,400 0 2,300 4.000 0 Adjusted $78,200 89,600 53,300 42,600 182,500 69,900 162,500 404,000 24,200 26,100 106,400 7,275 11,900 4.000 9,600 Question 3 of 4 Interest payable Inventory. Mortgage payable Prepaid insurance Property tax expense Property tax payable Retained earnings Salaries and wages expense Sales commission expense Sales commission payable Sales returns and allowances Sales revenue Utilities expense 1. < 2. 3. > 0 73,800 83,800 9,700 0 0 17,000 Analysis reveals the following additional information: 108,750 10,200 0 7,600 683,700 10,050 9,600 73,800 83,800 2,425 4,410 4,410 17,000 108,750 14,050 3,850 7,600 683.700 10,050 -/3 ||| Insurance expense and utilities expense are 60% selling and 40% administrative. In the next year, $20,950 of the mortgage payable will be due for payment. Property tax expense and depreciation on the building are administrative expenses; depreciation on the equipment is a selling expense; and $32,800 of the salaries and wages expense related to office salaries, and the remainder related to sales salaries. Depreciation expense includes $11,200 relating to the building and $13,000 relating to equipment. : (di) Prepare a multiple-step income statement. (List selling expenses before administrative expenses and other revenues and gains before other expenses and losses. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sales Revenue Less V : Sales Returns and Allowances Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses LARKSPUR DEPARTMENT STORE INC. Income Statement For the Year Ended December 31, 2023 $ V Question 3 of 4 Sales Revenue Less V : Sales Returns and Allowances Net Sales Revenue Administrative Expenses Dividends Expenses Gross Profit Income before Income Taxes Income from Operations Net Income /(Loss) Net Sales Revenue Operating Expenses Other Expenses and Losses Other Revenues and Gains Retained Earnings, December 31 Retained Earnings, January 1 Sales Revenue Selling Expenses Total Administrative Expenses Total Expenses Total Operating Expenses Total Revenues Total Selling Expenses Income Statement For the Year Ended December 31, 2023 $ -/3 E :

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Income Statement Particular Amount Amount Sales Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started