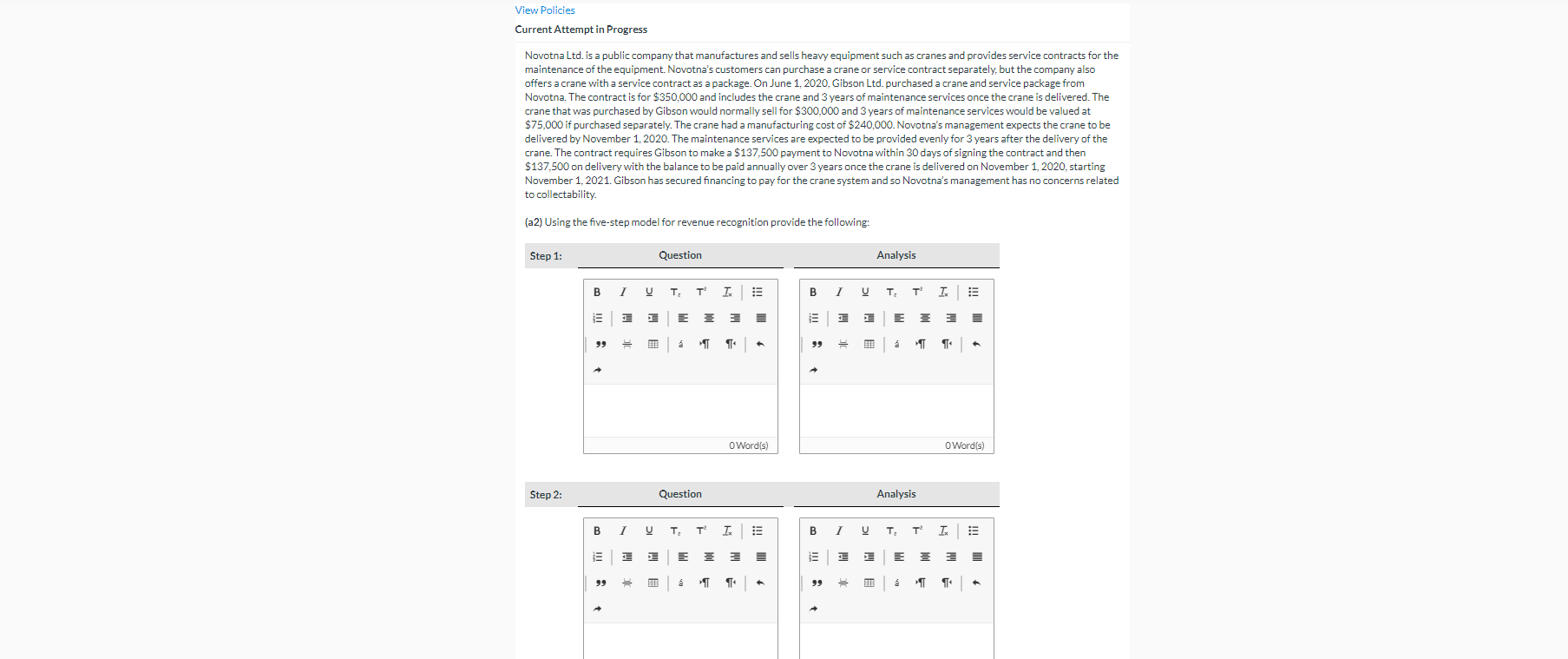

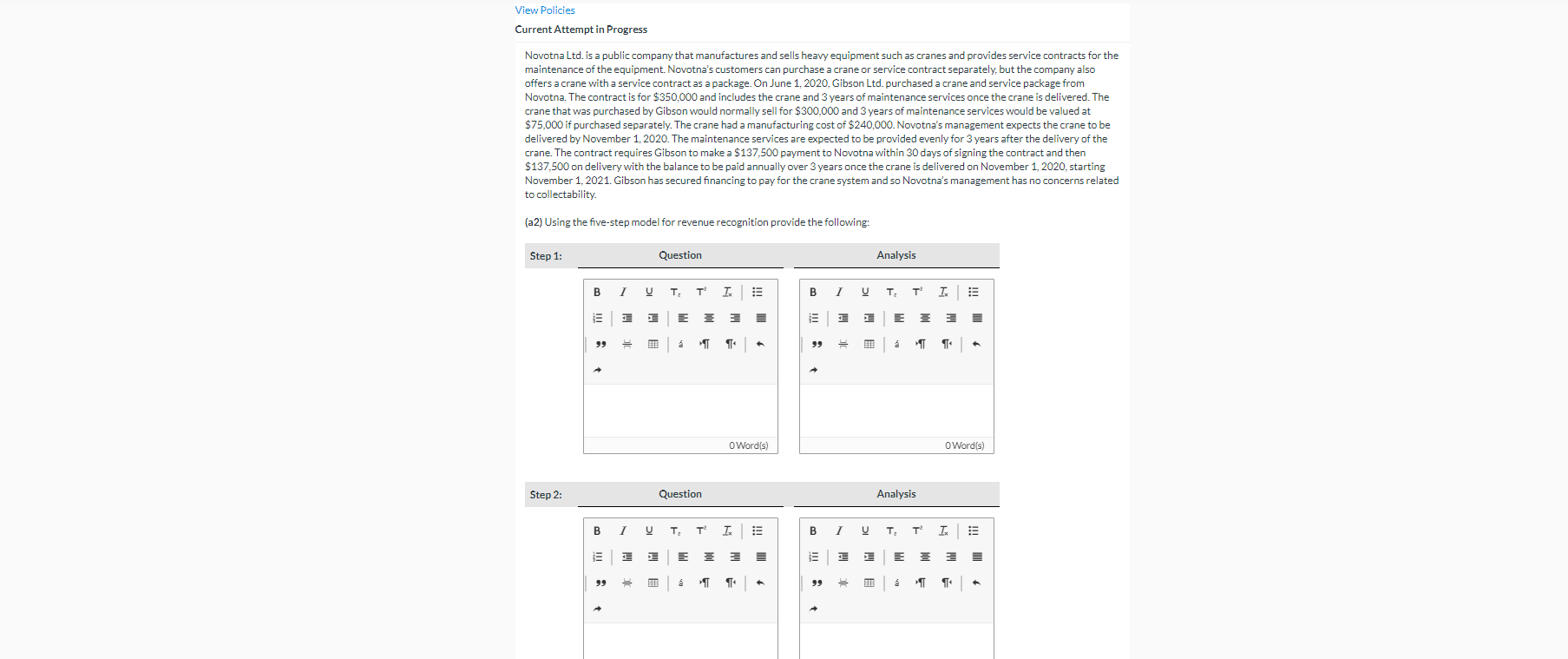

View Policies Current Attempt in Progress Novotna Ltd. is a public company that manufactures and sells heavy equipment such as cranes and provides service contracts for the maintenance of the equipment. Novotna's customers can purchase a crane or service contract separately, but the company also offers a crane with a service contract as a package. On June 1, 2020, Gibson Ltd. purchased a crane and service package from Novotna. The contract is for $350,000 and includes the crane and 3 years of maintenance services once the crane is delivered. The crane that was purchased by Gibson would normally sell for $300,000 and 3 years of maintenance services would be valued at $75,000 if purchased separately. The crane had a manufacturing cost of $240,000. Novotna's management expects the crane to be delivered by November 1, 2020. The maintenance services are expected to be provided evenly for 3 years after the delivery of the crane. The contract requires Gibson to make a $137,500 payment to Novotna within 30 days of signing the contract and then $137.500 on delivery with the balance to be paid annually over 3 years once the crane is delivered on November 1, 2020, starting November 1, 2021. Gibson has secured financing to pay for the crane system and so Novotna's management has no concerns related to collectability (a2) Using the five-step model for revenue recognition provide the following: Step 1: Question Analysis B 1 T, T I. B 1 V . I! JP I III W E fil 99 = 99 T | O Word(s) O Word(s) Step 2: Question Analysis B 1 U T, ' . B I , ? IK DE 1 99 = HE 99 = View Policies Current Attempt in Progress Novotna Ltd. is a public company that manufactures and sells heavy equipment such as cranes and provides service contracts for the maintenance of the equipment. Novotna's customers can purchase a crane or service contract separately, but the company also offers a crane with a service contract as a package. On June 1, 2020, Gibson Ltd. purchased a crane and service package from Novotna. The contract is for $350,000 and includes the crane and 3 years of maintenance services once the crane is delivered. The crane that was purchased by Gibson would normally sell for $300,000 and 3 years of maintenance services would be valued at $75,000 if purchased separately. The crane had a manufacturing cost of $240,000. Novotna's management expects the crane to be delivered by November 1, 2020. The maintenance services are expected to be provided evenly for 3 years after the delivery of the crane. The contract requires Gibson to make a $137,500 payment to Novotna within 30 days of signing the contract and then $137.500 on delivery with the balance to be paid annually over 3 years once the crane is delivered on November 1, 2020, starting November 1, 2021. Gibson has secured financing to pay for the crane system and so Novotna's management has no concerns related to collectability (a2) Using the five-step model for revenue recognition provide the following: Step 1: Question Analysis B 1 T, T I. B 1 V . I! JP I III W E fil 99 = 99 T | O Word(s) O Word(s) Step 2: Question Analysis B 1 U T, ' . B I , ? IK DE 1 99 = HE 99 =