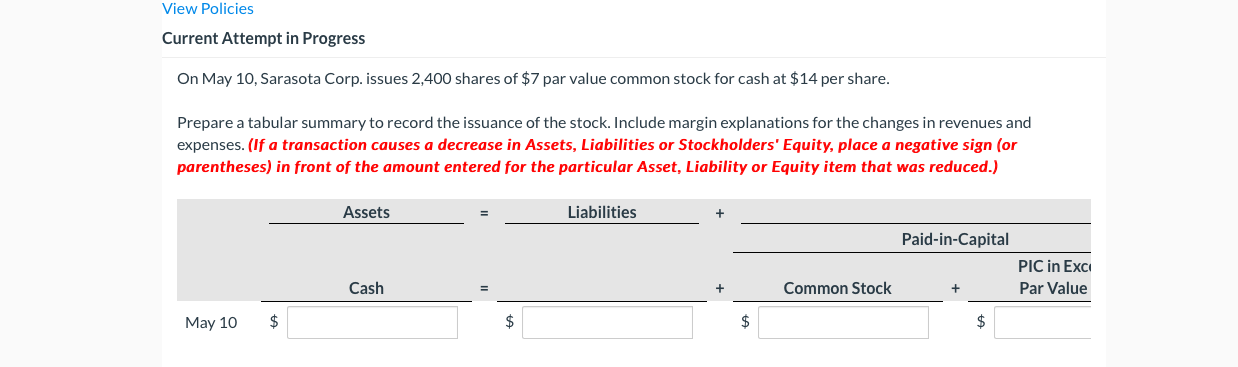

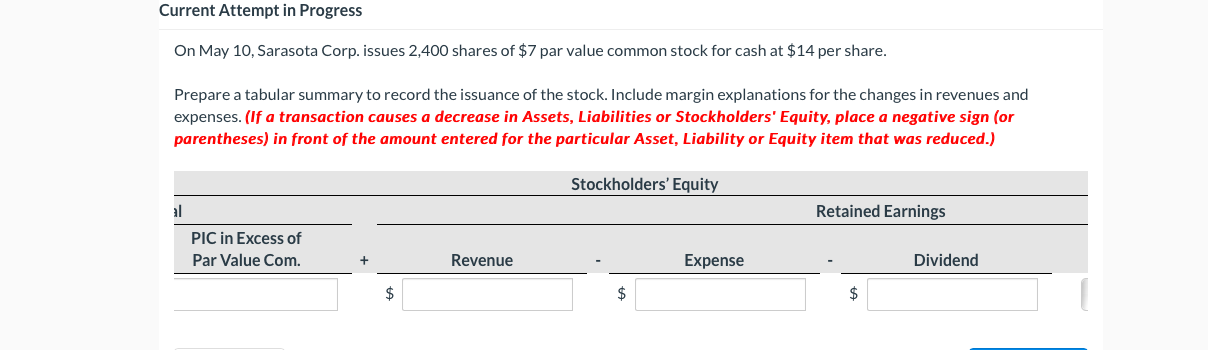

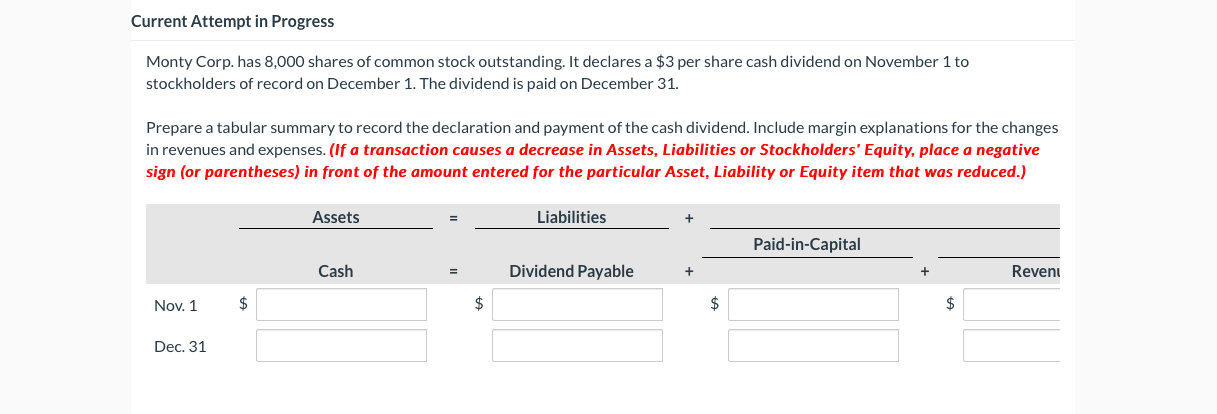

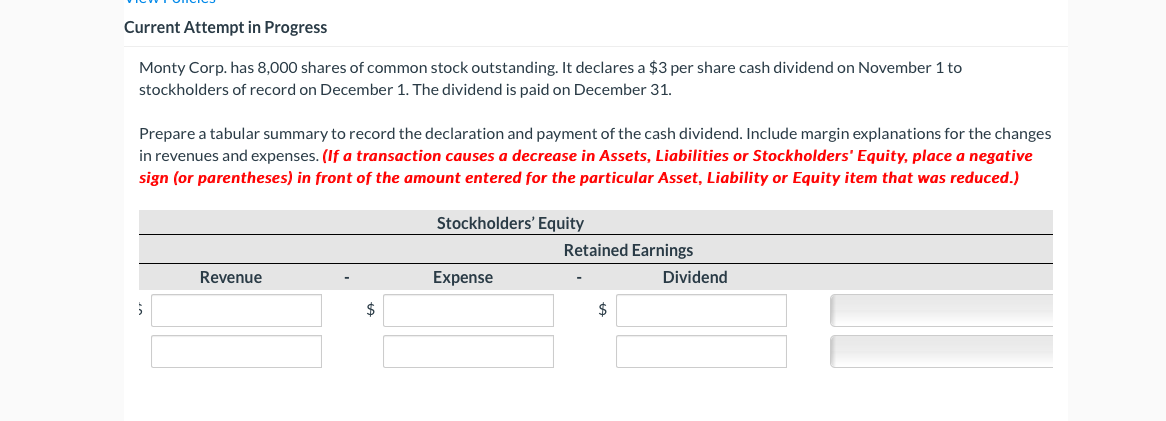

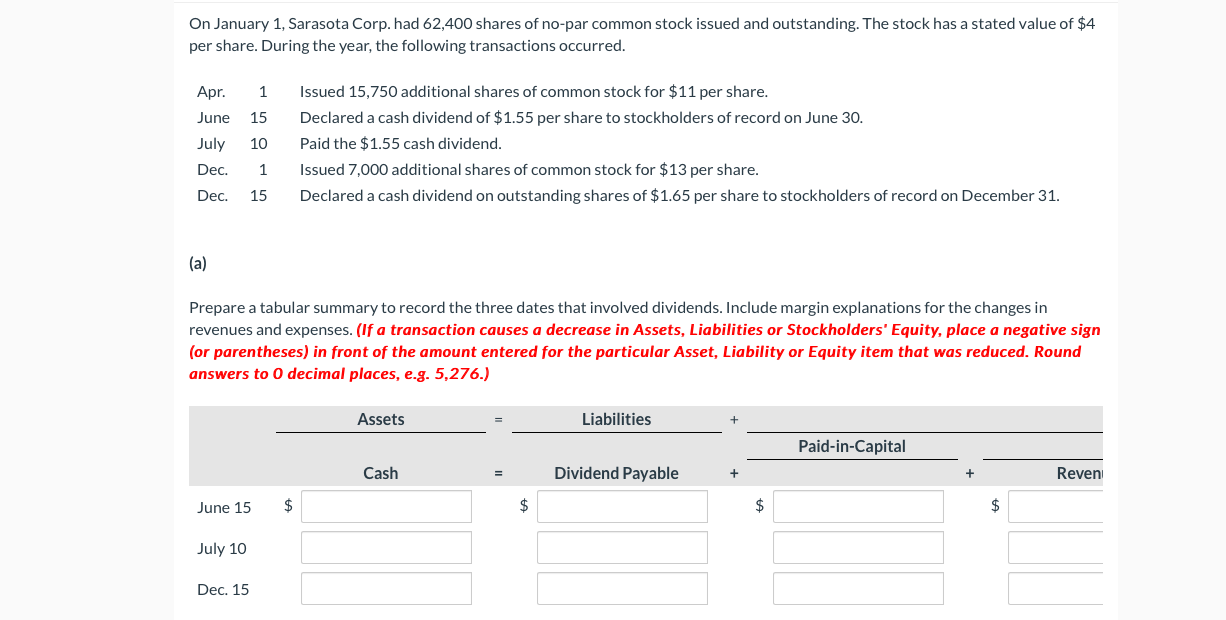

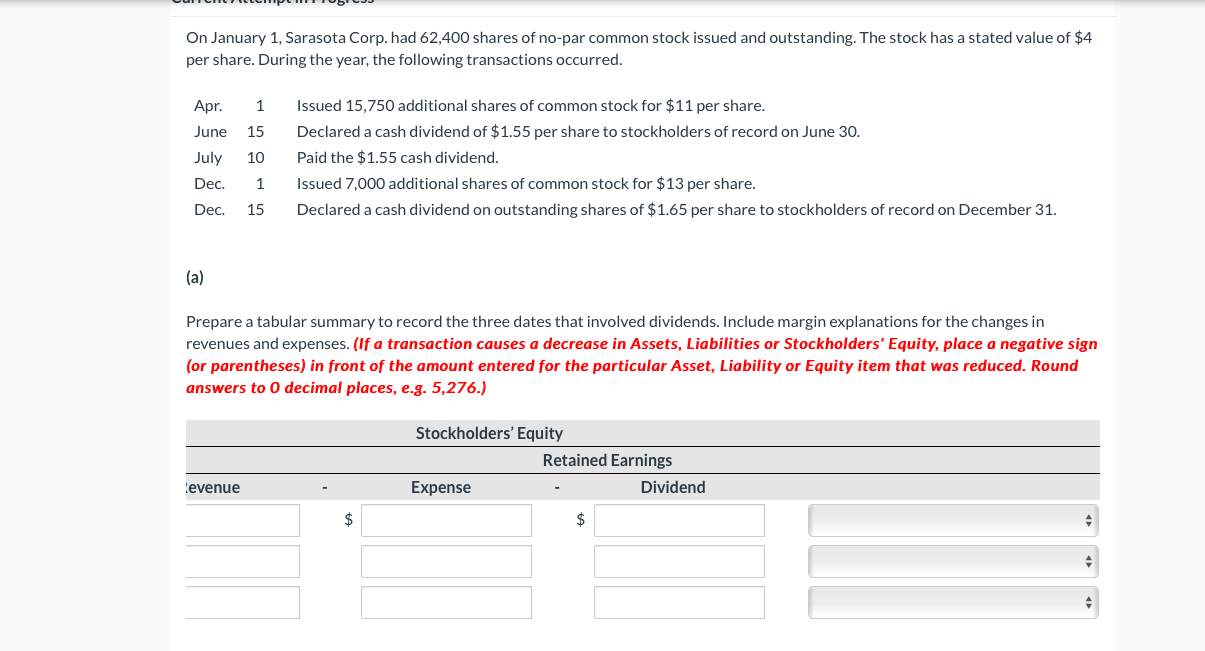

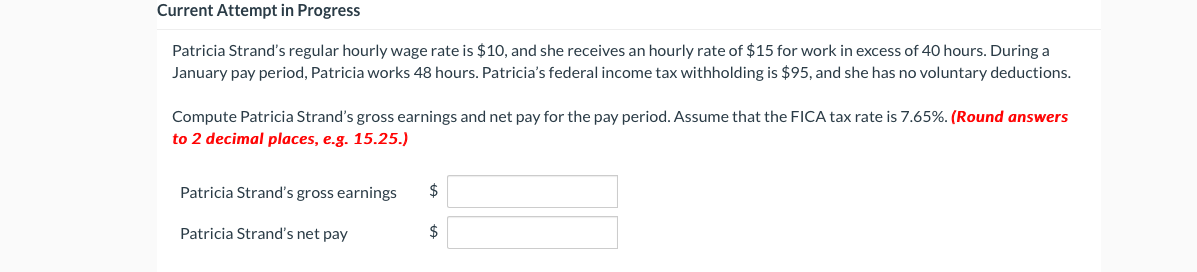

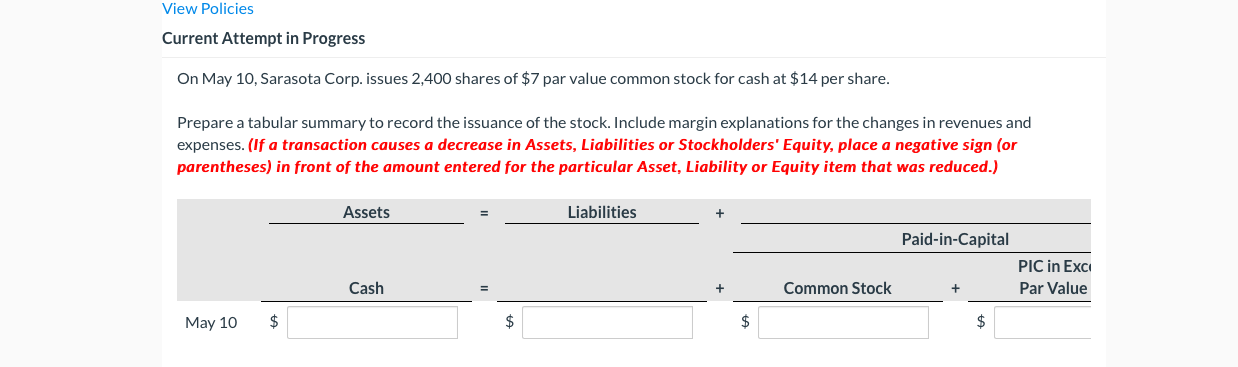

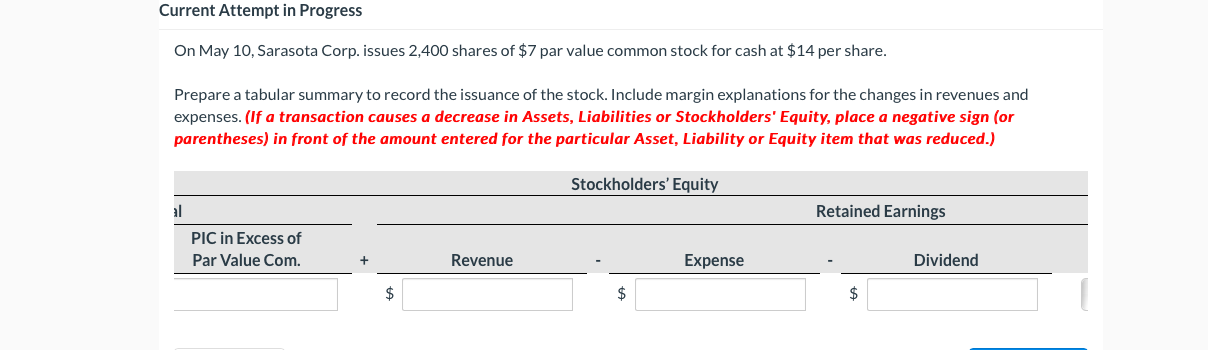

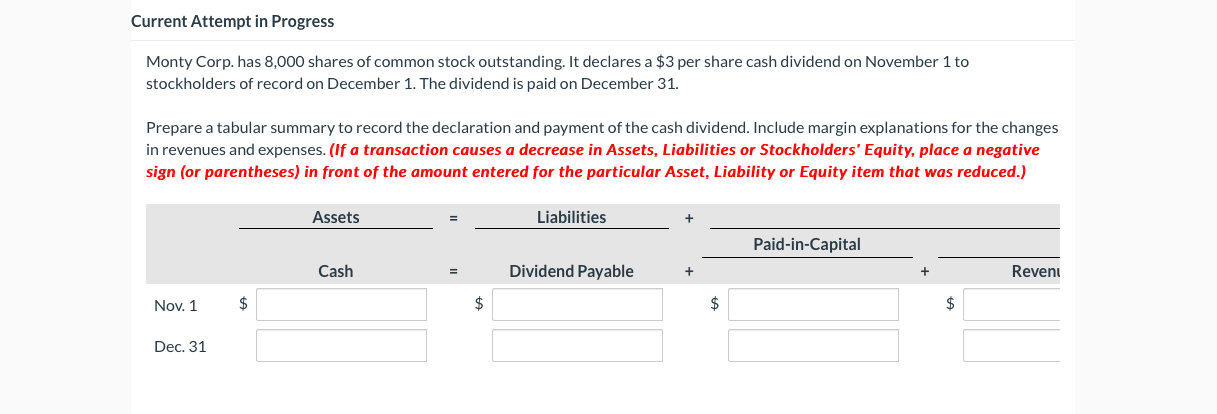

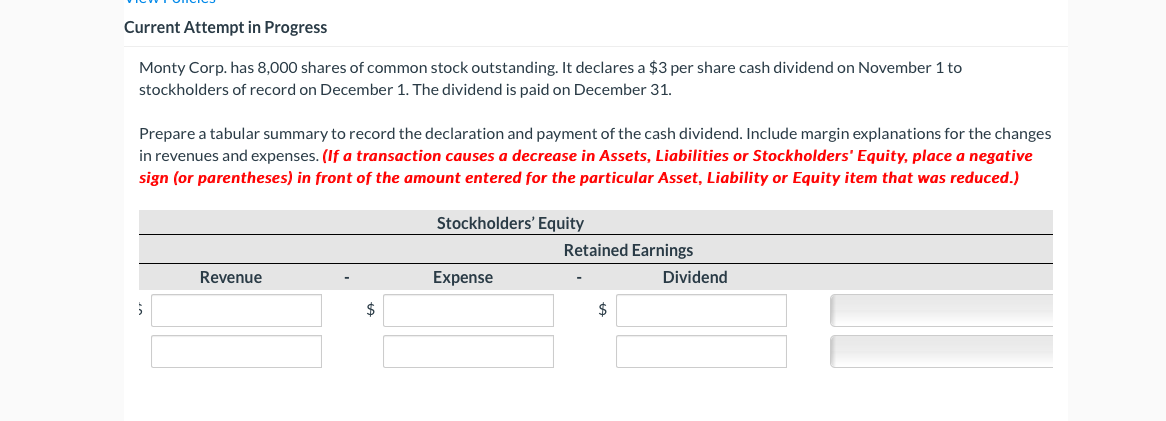

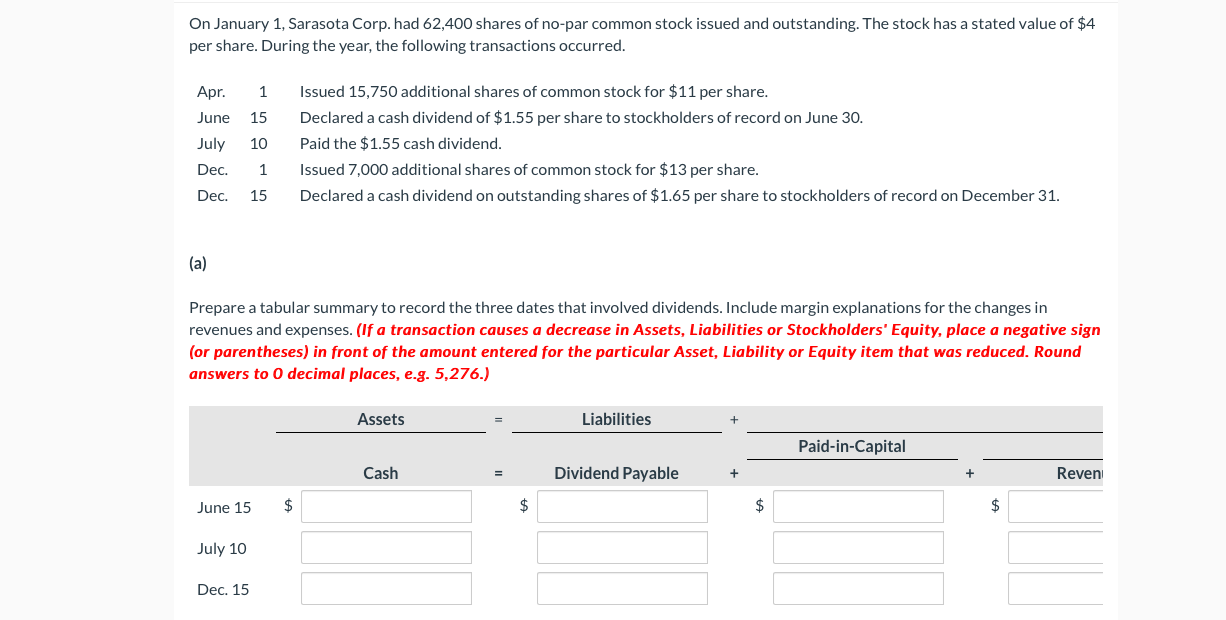

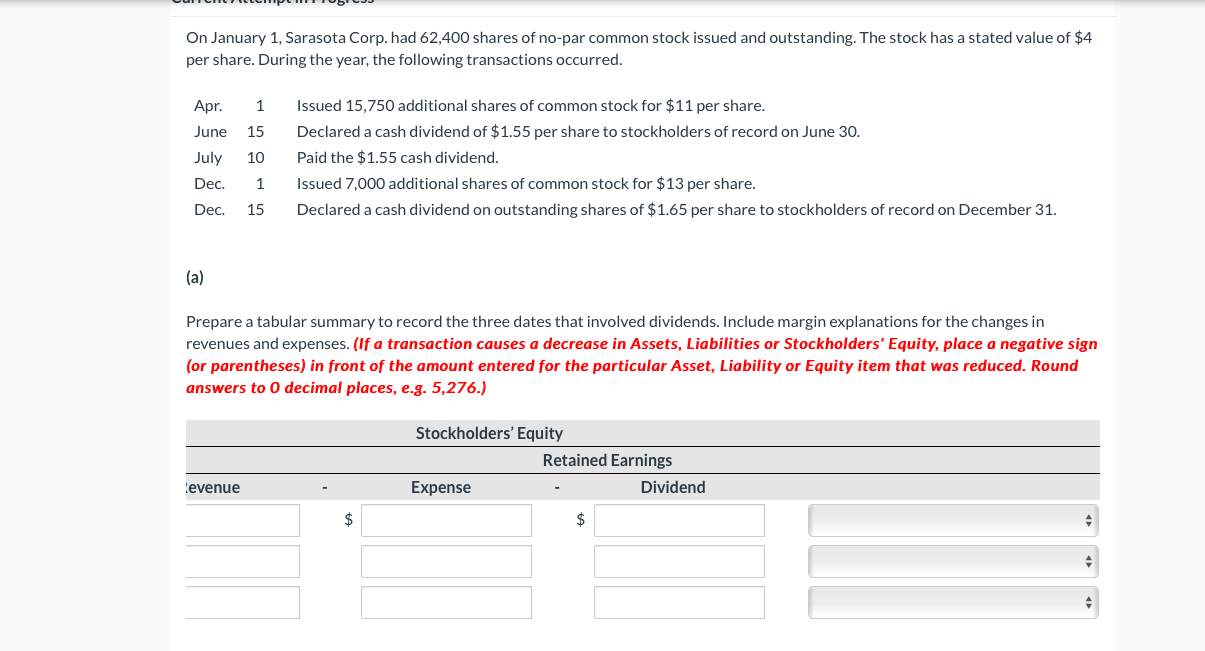

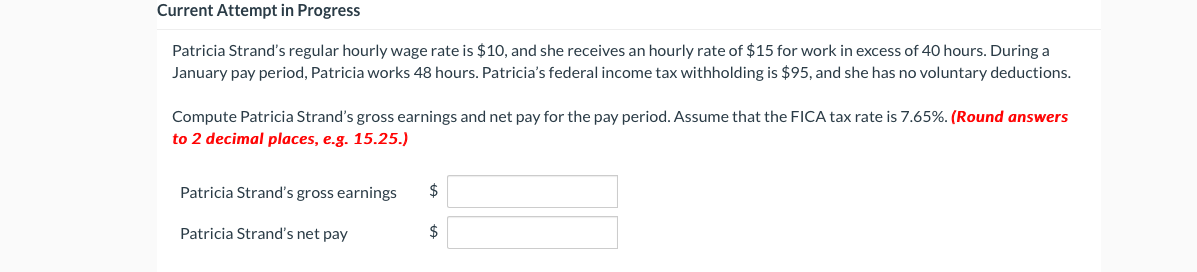

View Policies Current Attempt in Progress On May 10, Sarasota Corp. issues 2,400 shares of $7 par value common stock for cash at $14 per share. Prepare a tabular summary to record the issuance of the stock. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Paid-in-Capital PIC in Exci Par Value Cash Common Stock May 10 $ $ $ Current Attempt in Progress On May 10, Sarasota Corp. issues 2,400 shares of $7 par value common stock for cash at $14 per share. Prepare a tabular summary to record the issuance of the stock. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity al Retained Earnings PIC in Excess of Par Value Com. Revenue Expense Dividend $ $ $ Current Attempt in Progress Monty Corp. has 8,000 shares of common stock outstanding. It declares a $3 per share cash dividend on November 1 to stockholders of record on December 1. The dividend is paid on December 31. Prepare a tabular summary to record the declaration and payment of the cash dividend. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Paid-in-Capital Cash Dividend Payable Reveni Nov. 1 $ $ $ $ Dec. 31 Current Attempt in Progress Monty Corp. has 8,000 shares of common stock outstanding. It declares a $3 per share cash dividend on November 1 to stockholders of record on December 1. The dividend is paid on December 31. Prepare a tabular summary to record the declaration and payment of the cash dividend. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings Expense Dividend Revenue $ $ $ On January 1, Sarasota Corp. had 62,400 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following transactions occurred. Apr. 1 June 15 July 10 Issued 15,750 additional shares of common stock for $11 per share. Declared a cash dividend of $1.55 per share to stockholders of record on June 30. Paid the $1.55 cash dividend. Issued 7,000 additional shares of common stock for $13 per share. Declared a cash dividend on outstanding shares of $1.65 per share to stockholders of record on December 31. Dec. 1 Dec. 15 (a) Prepare a tabular summary to record the three dates that involved dividends. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to 0 decimal places, e.g. 5,276.) Assets Liabilities Paid-in-Capital Cash Dividend Payable Reven June 15 $ $ $ $ July 10 Dec. 15 On January 1, Sarasota Corp. had 62,400 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following transactions occurred. Apr. 1 15 June July 10 Issued 15,750 additional shares of common stock for $11 per share. Declared a cash dividend of $1.55 per share to stockholders of record on June 30. Paid the $1.55 cash dividend. Issued 7,000 additional shares of common stock for $13 per share. Declared a cash dividend on outstanding shares of $1.65 per share to stockholders of record on December 31. Dec. 1 15 Dec. (a) Prepare a tabular summary to record the three dates that involved dividends. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to 0 decimal places, e.g. 5,276.) Stockholders' Equity Retained Earnings Expense Dividend evenue $ $ Current Attempt in Progress Patricia Strand's regular hourly wage rate is $10, and she receives an hourly rate of $15 for work in excess of 40 hours. During a January pay period, Patricia works 48 hours. Patricia's federal income tax withholding is $95, and she has no voluntary deductions. Compute Patricia Strand's gross earnings and net pay for the pay period. Assume that the FICA tax rate is 7.65%. (Round answers to 2 decimal places, e.g. 15.25.) Patricia Strand's gross earnings $ Patricia Strand's net pay $ View Policies Current Attempt in Progress On May 10, Sarasota Corp. issues 2,400 shares of $7 par value common stock for cash at $14 per share. Prepare a tabular summary to record the issuance of the stock. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Paid-in-Capital PIC in Exci Par Value Cash Common Stock May 10 $ $ $ Current Attempt in Progress On May 10, Sarasota Corp. issues 2,400 shares of $7 par value common stock for cash at $14 per share. Prepare a tabular summary to record the issuance of the stock. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity al Retained Earnings PIC in Excess of Par Value Com. Revenue Expense Dividend $ $ $ Current Attempt in Progress Monty Corp. has 8,000 shares of common stock outstanding. It declares a $3 per share cash dividend on November 1 to stockholders of record on December 1. The dividend is paid on December 31. Prepare a tabular summary to record the declaration and payment of the cash dividend. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Paid-in-Capital Cash Dividend Payable Reveni Nov. 1 $ $ $ $ Dec. 31 Current Attempt in Progress Monty Corp. has 8,000 shares of common stock outstanding. It declares a $3 per share cash dividend on November 1 to stockholders of record on December 1. The dividend is paid on December 31. Prepare a tabular summary to record the declaration and payment of the cash dividend. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings Expense Dividend Revenue $ $ $ On January 1, Sarasota Corp. had 62,400 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following transactions occurred. Apr. 1 June 15 July 10 Issued 15,750 additional shares of common stock for $11 per share. Declared a cash dividend of $1.55 per share to stockholders of record on June 30. Paid the $1.55 cash dividend. Issued 7,000 additional shares of common stock for $13 per share. Declared a cash dividend on outstanding shares of $1.65 per share to stockholders of record on December 31. Dec. 1 Dec. 15 (a) Prepare a tabular summary to record the three dates that involved dividends. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to 0 decimal places, e.g. 5,276.) Assets Liabilities Paid-in-Capital Cash Dividend Payable Reven June 15 $ $ $ $ July 10 Dec. 15 On January 1, Sarasota Corp. had 62,400 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following transactions occurred. Apr. 1 15 June July 10 Issued 15,750 additional shares of common stock for $11 per share. Declared a cash dividend of $1.55 per share to stockholders of record on June 30. Paid the $1.55 cash dividend. Issued 7,000 additional shares of common stock for $13 per share. Declared a cash dividend on outstanding shares of $1.65 per share to stockholders of record on December 31. Dec. 1 15 Dec. (a) Prepare a tabular summary to record the three dates that involved dividends. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to 0 decimal places, e.g. 5,276.) Stockholders' Equity Retained Earnings Expense Dividend evenue $ $ Current Attempt in Progress Patricia Strand's regular hourly wage rate is $10, and she receives an hourly rate of $15 for work in excess of 40 hours. During a January pay period, Patricia works 48 hours. Patricia's federal income tax withholding is $95, and she has no voluntary deductions. Compute Patricia Strand's gross earnings and net pay for the pay period. Assume that the FICA tax rate is 7.65%. (Round answers to 2 decimal places, e.g. 15.25.) Patricia Strand's gross earnings $ Patricia Strand's net pay $