Answered step by step

Verified Expert Solution

Question

1 Approved Answer

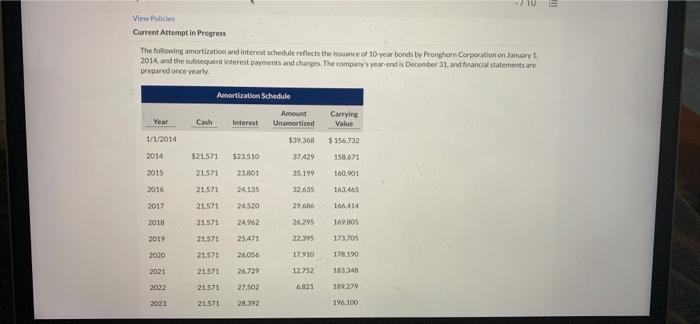

View Policies Current Attempt in Progress The following amortization and interest schedule reflects the issuance of 10-year bonds by Pronghorn Corporation on January 1

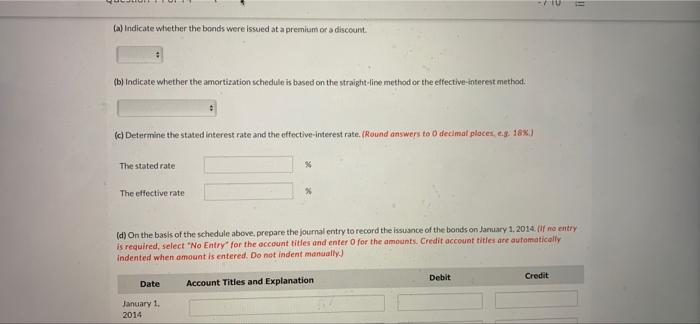

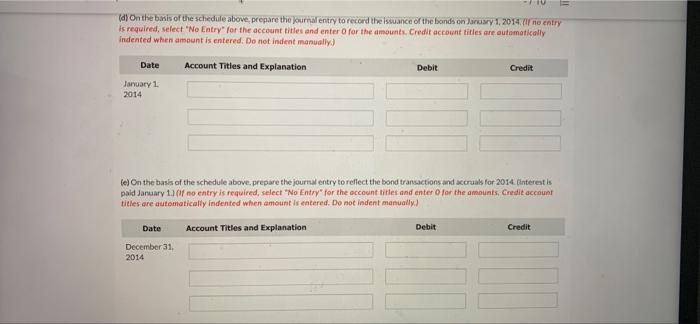

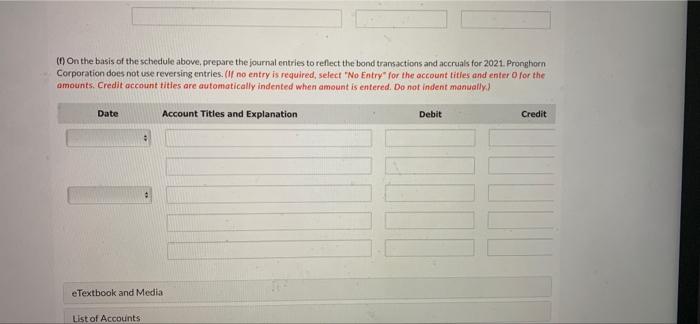

View Policies Current Attempt in Progress The following amortization and interest schedule reflects the issuance of 10-year bonds by Pronghorn Corporation on January 1 2014, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly Amortization Schedule Year Cash 1/1/2014 Amount Interest Unamortized $39.368 $156.732 Carrying Value 2014 $21.571 $23.510 37429 158.671 2015 21.571 23.801 35.199 160.901 2016 21.571 24.135 32.635 163.465 2017 21,571 24.520 29.686 166.414 2018 21,571 24,962 26.295 169.805 2019 21,571 25471 22.395 173.705 2020 21.571 26.056 17.910 178.190 2021 21571 26,729 12.752 183,348 2022 21.571 27.502 6.821 189.279 2023 21,571 28.392 196,100 (a) Indicate whether the bonds were issued at a premium or a discount. (b) Indicate whether the amortization schedule is based on the straight-line method or the effective-interest method. e (c) Determine the stated interest rate and the effective-interest rate. (Round answers to O decimal places, e.g. 18%) The stated rate The effective rate (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2014. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation January 1. 2014 Debit Credit (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2014. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation January 1 2014 Debit Credit (e) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2014. (interest is paid January 1.3 (If no entry is required, select "No Entry" for the account titles and enter O for the amounts, Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date December 31, 2014 Account Titles and Explanation Debit Credit (f) On the basis of the schedule above, prepare the journal entries to reflect the bond transactions and accruals for 2021. Pronghorn Corporation does not use reversing entries. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date eTextbook and Media List of Accounts Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started