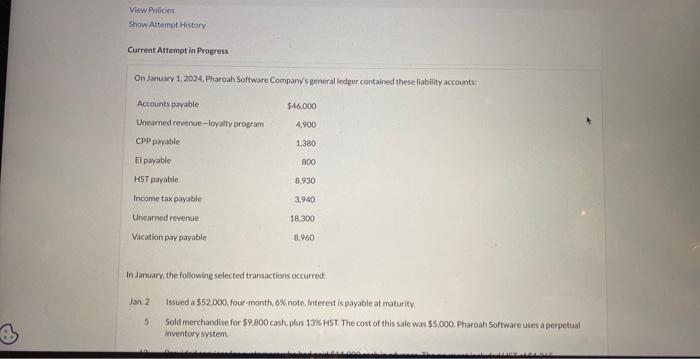

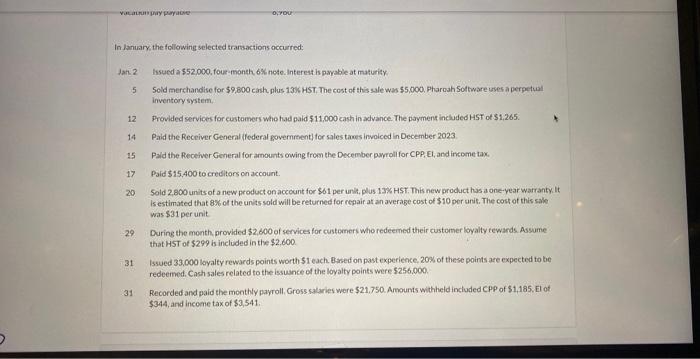

View Policies Show Alterett History Current Attempt in Progress On Januery 1, 2024, Pharoah Software Compam's general ledger contained these liability accounts: In January the following selected transactions occurred: Jan. 2 Issued a $52,000, four-month, 6 note, interest is payable at maturity. 5. Sold merchandise for $9.800 cash, plas 13% HST. The cost of this sale was $5,000, Pharoah Software uses a perpetual inventary system. In January the following selected transactions occurred: Jan.2 fsued a $52.000, four-month. 6S nete. Interest is payable at maturity. 5 Sold merchandise for $9800 cash, plus 13 HST. The cost of this sale was $5,000. Fharoah Soltware uses a pergetuat inventory system, 12 Provided services for custamers who had paid $11,000 cash in advance. The payment included HST of $1,265. 14 Paid the Receiver General (federal povemrtent) for sales tawes invoiced in December 2023. 15 Pald the Recehver General for amounts owing trom the December payrolif for CPP, El, and income tax. 17 Paid $15,400 to creditors on account. 20. Sold 2,800 units of a new product on account for $61 per unit, plus 13$6 HST. This new product has a one-year warranty it is estimated that 8% of the units sold will be returned for regair at an average cost of $10 per unit. The cost of this sale. was $31 per unit. 29. During the month, provided $2,800 of services for custemers who redeened their customer loyalty rewards. Assume that HST of $299 is included in the $2,800. 31 Issued 33,000 koyalty rewards points worth 51 each. Bssed on past experience, 20% of these points are expected to be redeemed. Cach sales related to the issuance of the loyalty points were $256.000. 31 Recorded and paid the monthly payroll, Gross salaries were $21.750. Amounts withheid included CP of $1,185, El of $344, and income tax of \$3,541. View Policies Show Alterett History Current Attempt in Progress On Januery 1, 2024, Pharoah Software Compam's general ledger contained these liability accounts: In January the following selected transactions occurred: Jan. 2 Issued a $52,000, four-month, 6 note, interest is payable at maturity. 5. Sold merchandise for $9.800 cash, plas 13% HST. The cost of this sale was $5,000, Pharoah Software uses a perpetual inventary system. In January the following selected transactions occurred: Jan.2 fsued a $52.000, four-month. 6S nete. Interest is payable at maturity. 5 Sold merchandise for $9800 cash, plus 13 HST. The cost of this sale was $5,000. Fharoah Soltware uses a pergetuat inventory system, 12 Provided services for custamers who had paid $11,000 cash in advance. The payment included HST of $1,265. 14 Paid the Receiver General (federal povemrtent) for sales tawes invoiced in December 2023. 15 Pald the Recehver General for amounts owing trom the December payrolif for CPP, El, and income tax. 17 Paid $15,400 to creditors on account. 20. Sold 2,800 units of a new product on account for $61 per unit, plus 13$6 HST. This new product has a one-year warranty it is estimated that 8% of the units sold will be returned for regair at an average cost of $10 per unit. The cost of this sale. was $31 per unit. 29. During the month, provided $2,800 of services for custemers who redeened their customer loyalty rewards. Assume that HST of $299 is included in the $2,800. 31 Issued 33,000 koyalty rewards points worth 51 each. Bssed on past experience, 20% of these points are expected to be redeemed. Cach sales related to the issuance of the loyalty points were $256.000. 31 Recorded and paid the monthly payroll, Gross salaries were $21.750. Amounts withheid included CP of $1,185, El of $344, and income tax of \$3,541