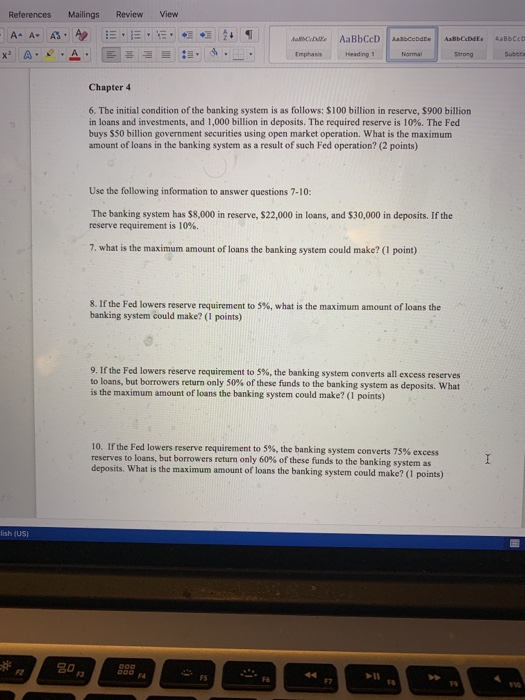

View References Mailings A- A A A ? A...A Review E.E. AaBbCcD Maced ABCDE. Bbce Chapter 4 6. The initial condition of the banking system is as follows: $100 billion in reserve, 5900 billion in loans and investments, and 1,000 billion in deposits. The required reserve is 10%. The Fed buys 550 billion government securities using open market operation. What is the maximum amount of loans in the banking system as a result of such Fed operation? (2 points) Use the following information to answer questions 7-10: The banking system has $8.000 in reserve, $22,000 in loans, and $30,000 in deposits. If the reserve requirement is 10% 7. what is the maximum amount of loans the banking system could make? (1 point) 8. If the Fed lowers reserve requirement to 5%, what is the maximum amount of loans the banking system could make? (1 points) 9. If the Fed lowers reserve requirement to 5%, the banking system converts all excess reserves to loans, but borrowers return only 50% of these funds to the banking system as deposits. What is the maximum amount of loans the banking system could make? (1 points) 10. If the Fed lowers reserve requirement to 5%, the banking system converts 75% excess reserves to loans, but borrowers return only 60% of these funds to the banking system as deposits. What is the maximum amount of loans the banking system could make? (1 points) Ish (USI View References Mailings A- A A A ? A...A Review E.E. AaBbCcD Maced ABCDE. Bbce Chapter 4 6. The initial condition of the banking system is as follows: $100 billion in reserve, 5900 billion in loans and investments, and 1,000 billion in deposits. The required reserve is 10%. The Fed buys 550 billion government securities using open market operation. What is the maximum amount of loans in the banking system as a result of such Fed operation? (2 points) Use the following information to answer questions 7-10: The banking system has $8.000 in reserve, $22,000 in loans, and $30,000 in deposits. If the reserve requirement is 10% 7. what is the maximum amount of loans the banking system could make? (1 point) 8. If the Fed lowers reserve requirement to 5%, what is the maximum amount of loans the banking system could make? (1 points) 9. If the Fed lowers reserve requirement to 5%, the banking system converts all excess reserves to loans, but borrowers return only 50% of these funds to the banking system as deposits. What is the maximum amount of loans the banking system could make? (1 points) 10. If the Fed lowers reserve requirement to 5%, the banking system converts 75% excess reserves to loans, but borrowers return only 60% of these funds to the banking system as deposits. What is the maximum amount of loans the banking system could make? (1 points) Ish (USI