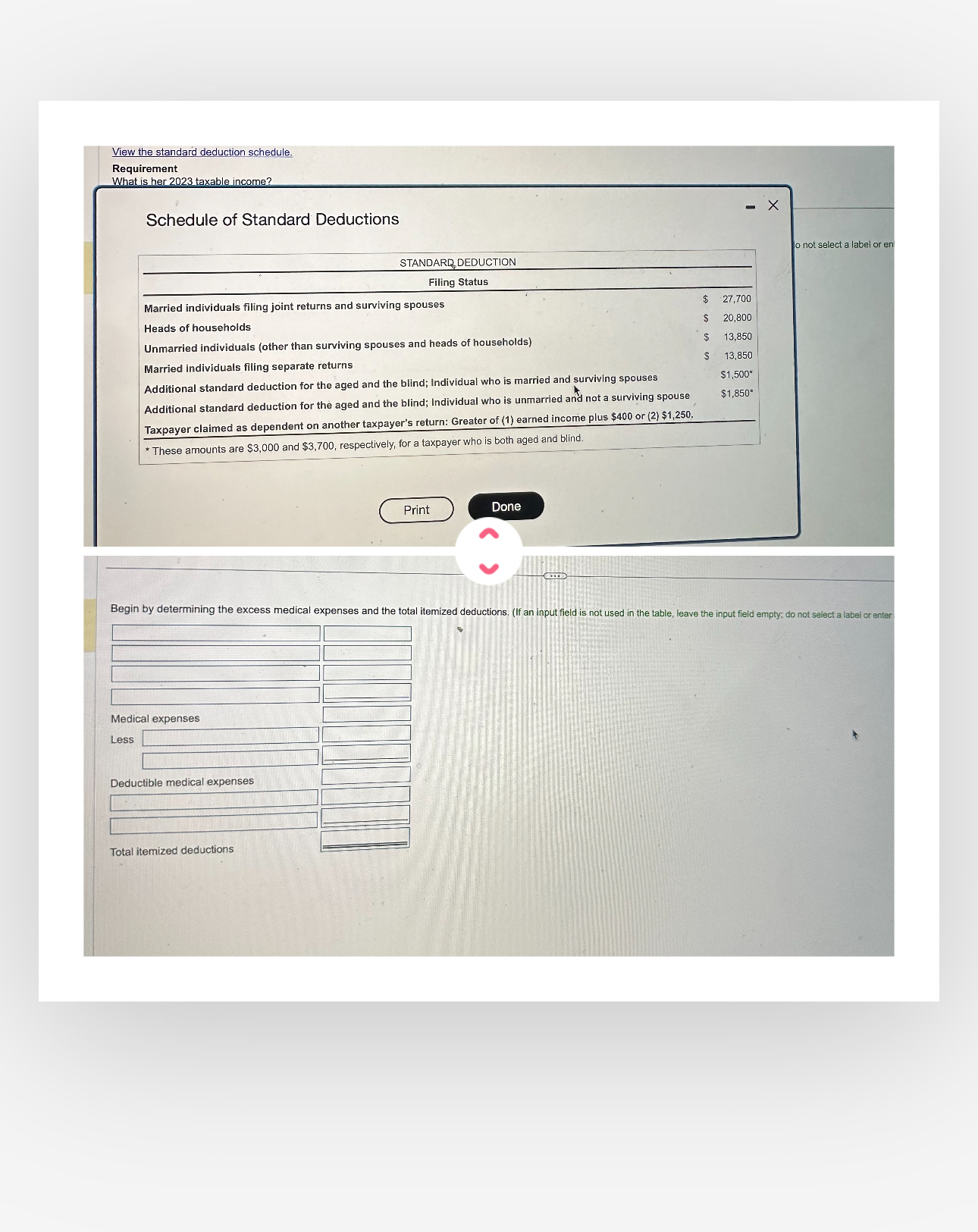

View the standard deduction schedule. Requirement What is her 2023 taxable income? Schedule of Standard Deductions...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

View the standard deduction schedule. Requirement What is her 2023 taxable income? Schedule of Standard Deductions STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $400 or (2) $1,250. *These amounts are $3,000 and $3,700, respectively, for a taxpayer who is both aged and blind. $ 27,700 S 20,800 $ 13,850 $ 13,850 $1,500 $1,850 Print Done o not select a label or en Begin by determining the excess medical expenses and the total itemized deductions. (If an input field is not used in the table, leave the input field empty; do not select a label or enter Medical expenses Less Deductible medical expenses Total itemized deductions View the standard deduction schedule. Requirement What is her 2023 taxable income? Schedule of Standard Deductions STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $400 or (2) $1,250. *These amounts are $3,000 and $3,700, respectively, for a taxpayer who is both aged and blind. $ 27,700 S 20,800 $ 13,850 $ 13,850 $1,500 $1,850 Print Done o not select a label or en Begin by determining the excess medical expenses and the total itemized deductions. (If an input field is not used in the table, leave the input field empty; do not select a label or enter Medical expenses Less Deductible medical expenses Total itemized deductions

Expert Answer:

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date:

Students also viewed these accounting questions

-

What similarities exist between the style and spirit of the Bayeux Tapestry and the Song of Roland?

-

detects and corrects the error. /*The Expected Output*/ Enter the scheme of code 11 Write a Java program that computes the Hamming Code which 7 The Scheme of hamming code is (11,7) Enter the 7-bit...

-

A group of three friends, Eric, Dave, and Bob, have an idea to start a new wine bar, KurniWines, Co., located in a small but wealthy town in Ohio. Their goal is to stock the bar with many types of...

-

A rectangular field will have one side made of a brick wall and the other three sides made of wooden fence. Brick wall costs 20 dollars per meter and wooden fence costs 30 dollars for 3 meters. The...

-

In Problems, sketch the region bounded by the graphs of the given equations, show a typical slice, approximate its area, set up an integral, and calculate the area of the region. Make an estimate of...

-

Calculate net profit for managerial remuneration from the following information: Particulars Salaries and wages Repairs Miscellaneous expenses Workmen compensation (including 1,000 legal...

-

On December 31, 2020, for GAAP purposes, Clubs Inc. reported a balance of \(\$ 40,000\) in a warranty liability for anticipated costs to satisfy future warranty claims. No claims were paid in 2020....

-

Activity-based costing, merchandising Pharmacare, Inc., a distributor of special pharmaceutical products, operates at capacity and has three main market segments: a. General supermarket chains b....

-

Comparative income statements for Boggs Sports Equipment Companyfor the last two months are presented below:JulyAugustSales in Units11,00010,000Sales Revenue$165,000$150,000Less Co 2 answers

-

Angus Walker, CFA, is reviewing the defined benefit pension plan of Acme Industries. Based in London, Acme has operations in North America, Japan, and several European countries. Next month, the...

-

Question: How Long Will It Take For Ordinary Annuity Of $150 To Be $ 335,000 With The Interest Rate Is 8%?* 70 Years O 68 Years 66 Years O How long will it take for ordinary annuity of $150 to be...

-

The manager at Rainbow International prepares a Cost of Quality report to report the following expenses: Inspection of raw material costs Warranty costs warranty claims Cost to dispose of rejected...

-

Explains briefly 1- What are the requirements and incentives in Puerto Rico for international and domestic trade 2- What are the advantages and disadvantages 3- includes references

-

Analyze the attractiveness of the computer industry based on the threats of new entrants and the power of buyers .

-

Exercise 8-24 (Algorithmic) (LO. 5) The Parent consolidated group reports the following results for the tax year. Entity Income or Loss $13,600 Parent Sub1 (1,360) Sub2 Sub3 5,440 2,720 Do not round...

-

Based on the graph below, notice there are cost lines and four different price levels. Answer the following A- D questions: $ ATC AVC P-MR-D P-MR-D Quantity (A)Which point (a-g) on the graph is the...

-

A rocket is departing Earth towards Mars. The following function represents the rocket's vertical velocity for the first 3 hours: +3 v(t) = t e 13t 13' in km/h. (a) Approximate the distance travelled...

-

Suppose the government bond described in problem 1 above is held for five years and then the savings institution acquiring the bond decides to sell it at a price of $940. Can you figure out the...

-

Bea Jones (age 32) moved from Texas to Florida in December 2011. She lives at 654 Ocean Way, Gulfport, FL 33707. Bea's Social Security number is 466-78-7359 and she is single. Her earnings and income...

-

Yolanda earns $112,000 in 2012. Calculate the FICA tax that must be paid by: Yolanda:.....................Soc.Sec..................$__________...

-

For each of the following situations, indicate whether the taxpayer(s) is (are) required to file a tax return for 2012. Explain your answer. a. Helen is a single taxpayer with interest income in 2012...

-

Blue S.A., a French telecommunications company, acquired a 45 percent interest in E-Minus for 65,000,000. Blue consolidates E-Minus because it has special voting rights that allow it to control...

-

Consider the following data: Required Use the above data to prepare the operating cash flow section of a consolidated statement of cash flows, using the indirect method. Consolidated net income.......

-

At the date of acquisition, consolidation eliminating entry (R) credits the noncontrolling interest in Starfruit Company in the amount of On January 1, 2015, Pomegranate Company acquired 90% of the...

Study smarter with the SolutionInn App