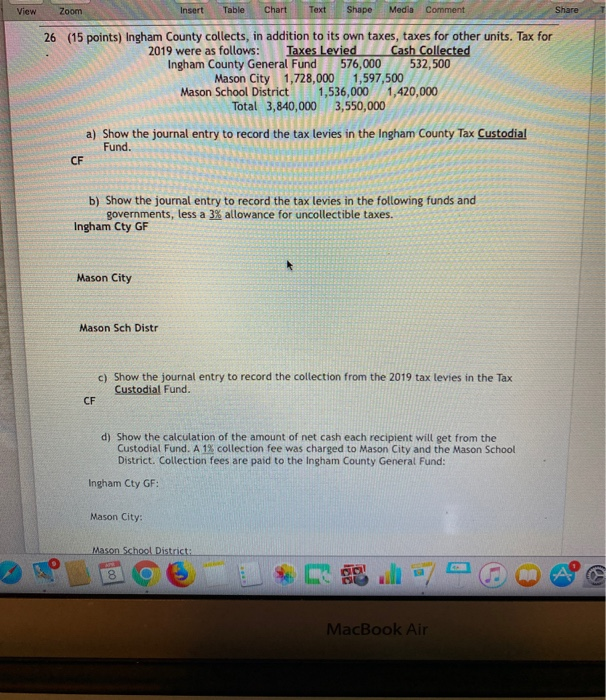

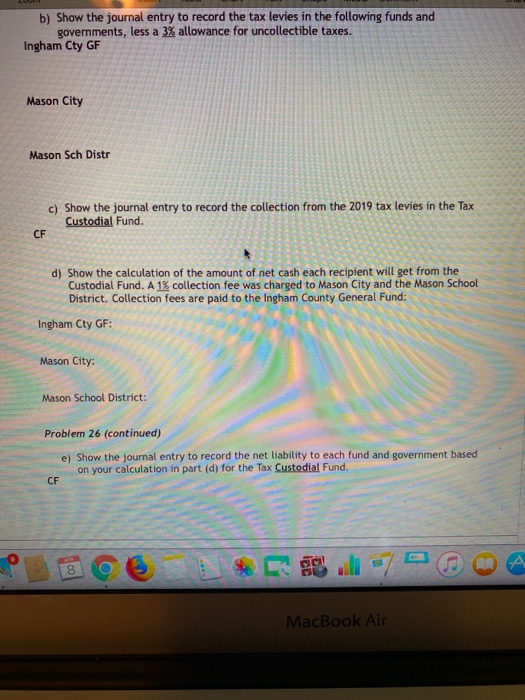

View Zoom 26 Insert Table Chart Text Shape Media Comment Share (15 points) Ingham County collects, in addition to its own taxes, taxes for other units. Tax for 2019 were as follows: Taxes Levied Cash Collected Ingham County General Fund 576,000 532,500 Mason City 1,728,000 1,597,500 Mason School District 1,536,000 1,420,000 Total 3,840,000 3,550,000 it ! a) Show the journal entry to record the tax levies in the Ingham County Tax Custodial 4,500 Mason City 0. 1,536 1.597,500 526 000 1.420,000 Fund. CF b) Show the journal entry to record the tax levies in the following funds and governments, less a 3% allowance for uncollectible taxes. Ingham Cty GF Mason City Mason Sch Distr c) Show the journal entry to record the collection from the 2019 tax levies in the Tax Custodial Fund. CF d) Show the calculation of the amount of net cash each recipient will get from the Custodial Fund. A 1% collection fee was charged to Mason City and the Mason School District. Collection fees are paid to the Ingham County General Fund: Ingham Cty GF: Mason City: Mason School District: MacBook Air b) Show the journal entry to record the tax levies in the following funds and governments, less a 3% allowance for uncollectible taxes. Ingham Cty GF Mason City Mason Sch Distr c) Show the journal entry to record the collection from the 2019 tax levies in the Tax Custodial Fund. CF d) Show the calculation of the amount of net cash each recipient will get from the Custodial Fund. A 1% collection fee was charged to Mason City and the Mason School District. Collection fees are paid to the Ingham County General Fund: Ingham Cty GF: Mason City: Mason School District: Problem 26 (continued) e) Show the journal entry to record the net liability to each fund and government based on your calculation in part (d) for the Tax Custodial Fund. MacBook Air View Zoom 26 Insert Table Chart Text Shape Media Comment Share (15 points) Ingham County collects, in addition to its own taxes, taxes for other units. Tax for 2019 were as follows: Taxes Levied Cash Collected Ingham County General Fund 576,000 532,500 Mason City 1,728,000 1,597,500 Mason School District 1,536,000 1,420,000 Total 3,840,000 3,550,000 it ! a) Show the journal entry to record the tax levies in the Ingham County Tax Custodial 4,500 Mason City 0. 1,536 1.597,500 526 000 1.420,000 Fund. CF b) Show the journal entry to record the tax levies in the following funds and governments, less a 3% allowance for uncollectible taxes. Ingham Cty GF Mason City Mason Sch Distr c) Show the journal entry to record the collection from the 2019 tax levies in the Tax Custodial Fund. CF d) Show the calculation of the amount of net cash each recipient will get from the Custodial Fund. A 1% collection fee was charged to Mason City and the Mason School District. Collection fees are paid to the Ingham County General Fund: Ingham Cty GF: Mason City: Mason School District: MacBook Air b) Show the journal entry to record the tax levies in the following funds and governments, less a 3% allowance for uncollectible taxes. Ingham Cty GF Mason City Mason Sch Distr c) Show the journal entry to record the collection from the 2019 tax levies in the Tax Custodial Fund. CF d) Show the calculation of the amount of net cash each recipient will get from the Custodial Fund. A 1% collection fee was charged to Mason City and the Mason School District. Collection fees are paid to the Ingham County General Fund: Ingham Cty GF: Mason City: Mason School District: Problem 26 (continued) e) Show the journal entry to record the net liability to each fund and government based on your calculation in part (d) for the Tax Custodial Fund. MacBook Air