Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vigor - max is considering buying a new water treatment system for its plant in Austin, Texas. The investment proposal passed the initial screening

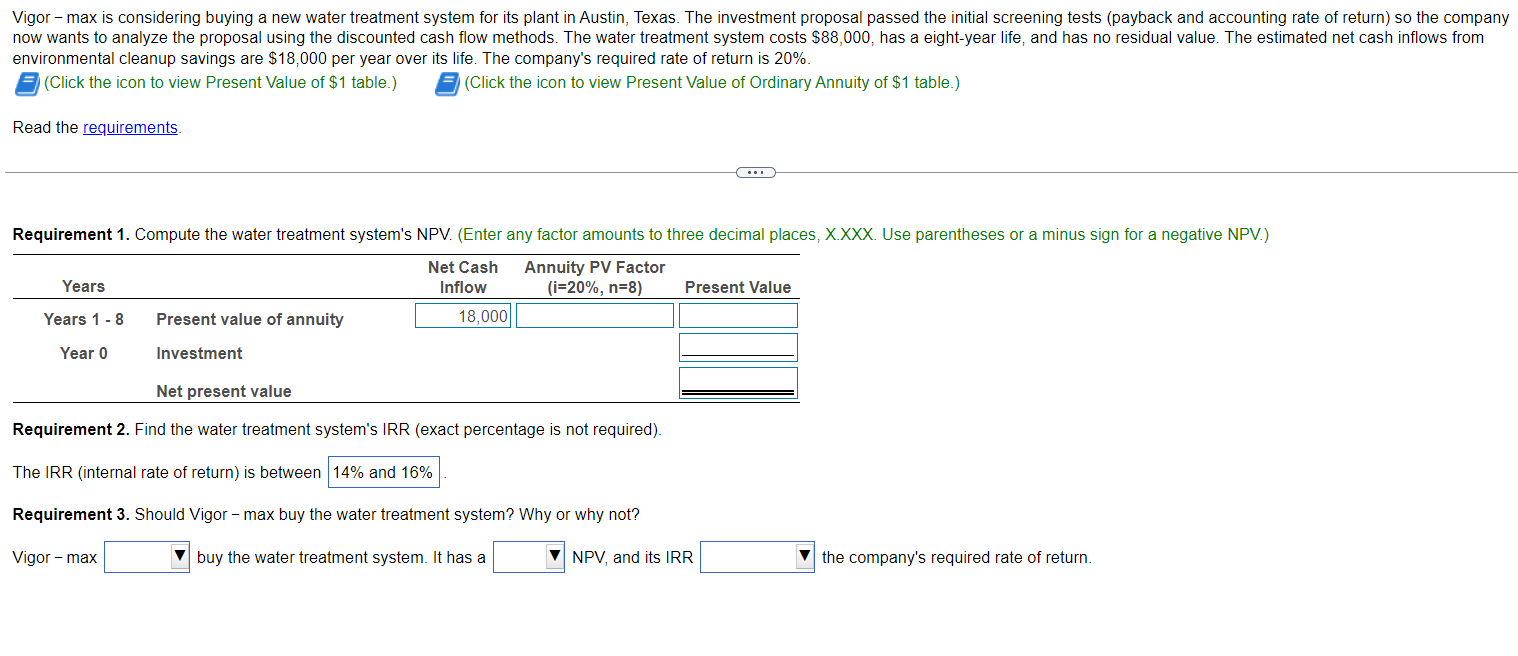

Vigor - max is considering buying a new water treatment system for its plant in Austin, Texas. The investment proposal passed the initial screening tests (payback and accounting rate of return) so the company now wants to analyze the proposal using the discounted cash flow methods. The water treatment system costs $88,000, has a eight-year life, and has no residual value. The estimated net cash inflows from environmental cleanup savings are $18,000 per year over its life. The company's required rate of return is 20%. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. Compute the water treatment system's NPV. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative NPV.) Years Years 1 - 8 Present value of annuity Year 0 Investment Net Cash Inflow Annuity PV Factor (i=20%, n=8) Present Value 18,000 Net present value Requirement 2. Find the water treatment system's IRR (exact percentage is not required). The IRR (internal rate of return) is between 14% and 16% Requirement 3. Should Vigor - max buy the water treatment system? Why or why not? Vigor - max buy the water treatment system. It has a NPV, and its IRR the company's required rate of return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started